Is SMCI Stock Overvalued? Evaluating Its 14.62 P/E Multiple

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is SMCI Stock Overvalued? Evaluating its 14.62 P/E Multiple

Is the seemingly attractive price-to-earnings (P/E) ratio of 14.62 for SMCI stock hiding a potential overvaluation? Many investors are currently eyeing SMCI (Smith Micro Software, Inc.) with interest, drawn in by its relatively low P/E multiple. However, a simple P/E ratio alone doesn't tell the whole story. This article delves deeper into SMCI's valuation, considering factors beyond just the headline number to determine if the stock is truly a bargain or a potential risk.

Understanding SMCI's Business and Recent Performance:

SMCI, a provider of software solutions for mobile carriers and enterprises, has experienced a period of both growth and challenges. Recent financial reports show [cite specific reports and data, including links to official sources like SEC filings]. Analyzing these results is crucial to understanding the context of the 14.62 P/E ratio. Is this relatively low P/E a reflection of undervalued potential or a warning sign of future underperformance?

Deconstructing the P/E Ratio: Beyond the Surface:

While a P/E ratio of 14.62 might seem low compared to market averages, several factors need consideration:

-

Growth Prospects: A low P/E can be justified if a company is expected to experience significant future growth. What are SMCI's projected growth rates? Are analysts bullish or bearish on its future prospects? [Cite analyst reports and forecasts with links.] A low P/E coupled with high growth potential could indicate undervaluation. Conversely, slow or stagnant growth might suggest the low P/E accurately reflects the company's limited future earnings.

-

Debt Levels: High debt can significantly impact a company's valuation. SMCI's debt-to-equity ratio should be analyzed to understand its financial leverage. [Include SMCI's debt-to-equity ratio and link to the source of this data]. A high debt burden could negate the apparent attractiveness of a low P/E ratio.

-

Industry Comparisons: How does SMCI's P/E ratio compare to its competitors in the software industry? [Include a table comparing SMCI's P/E ratio to its competitors, citing sources]. Benchmarking against similar companies provides crucial context. A lower P/E than competitors might suggest undervaluation, but a higher P/E could signal overvaluation, even with the seemingly low 14.62 figure.

-

Profit Margins: Examine SMCI's profit margins (gross, operating, and net). Are these margins healthy and improving, or are they declining? Strong and improving margins support a higher valuation, while shrinking margins may justify a lower P/E. [Include data on SMCI's profit margins and link to the source].

Qualitative Factors to Consider:

Beyond quantitative data, consider these qualitative factors:

- Management Team: The experience and competence of SMCI's management team play a crucial role in future performance.

- Competitive Landscape: How intense is the competition in SMCI's market? A highly competitive environment can limit profitability.

- Technological Innovation: Is SMCI investing in and adapting to technological advancements? Failing to innovate could severely hinder future growth.

Conclusion: Is SMCI Stock Overvalued?

Ultimately, determining whether SMCI stock is overvalued at its current P/E ratio requires a comprehensive analysis that goes beyond a single metric. While the 14.62 P/E might initially seem attractive, a thorough examination of growth prospects, debt levels, industry comparisons, profit margins, and qualitative factors is necessary. Investors should conduct their own due diligence before making any investment decisions. Remember to consult with a qualified financial advisor for personalized advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and seek professional guidance before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is SMCI Stock Overvalued? Evaluating Its 14.62 P/E Multiple. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Cfp Analyzing The Odds After The New Playoff Format

May 27, 2025

2025 Cfp Analyzing The Odds After The New Playoff Format

May 27, 2025 -

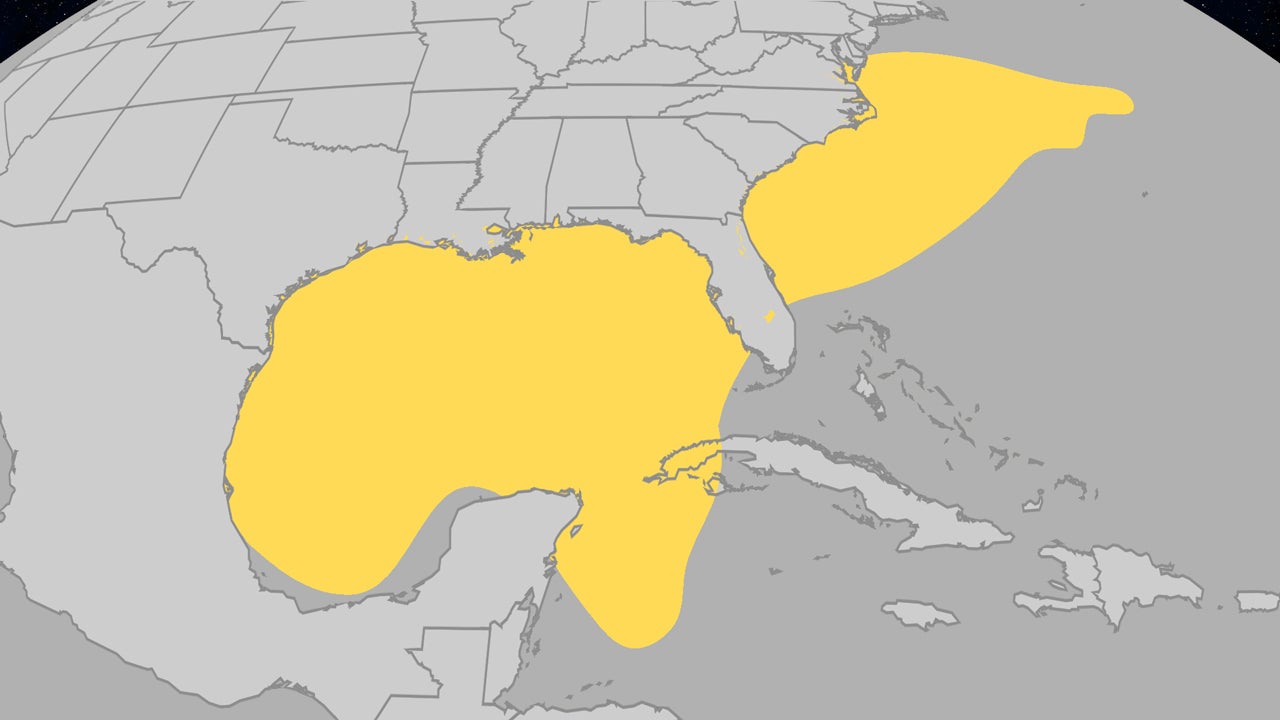

Where Do Atlantic Hurricanes Form In June A Look At Recent Trends

May 27, 2025

Where Do Atlantic Hurricanes Form In June A Look At Recent Trends

May 27, 2025 -

French Open Womens Matches Day 2 Predictions And Key Matchups To Watch

May 27, 2025

French Open Womens Matches Day 2 Predictions And Key Matchups To Watch

May 27, 2025 -

Wedbush Predicts Teslas Golden Age Autonomous Driving And The Robotaxi Revolution

May 27, 2025

Wedbush Predicts Teslas Golden Age Autonomous Driving And The Robotaxi Revolution

May 27, 2025 -

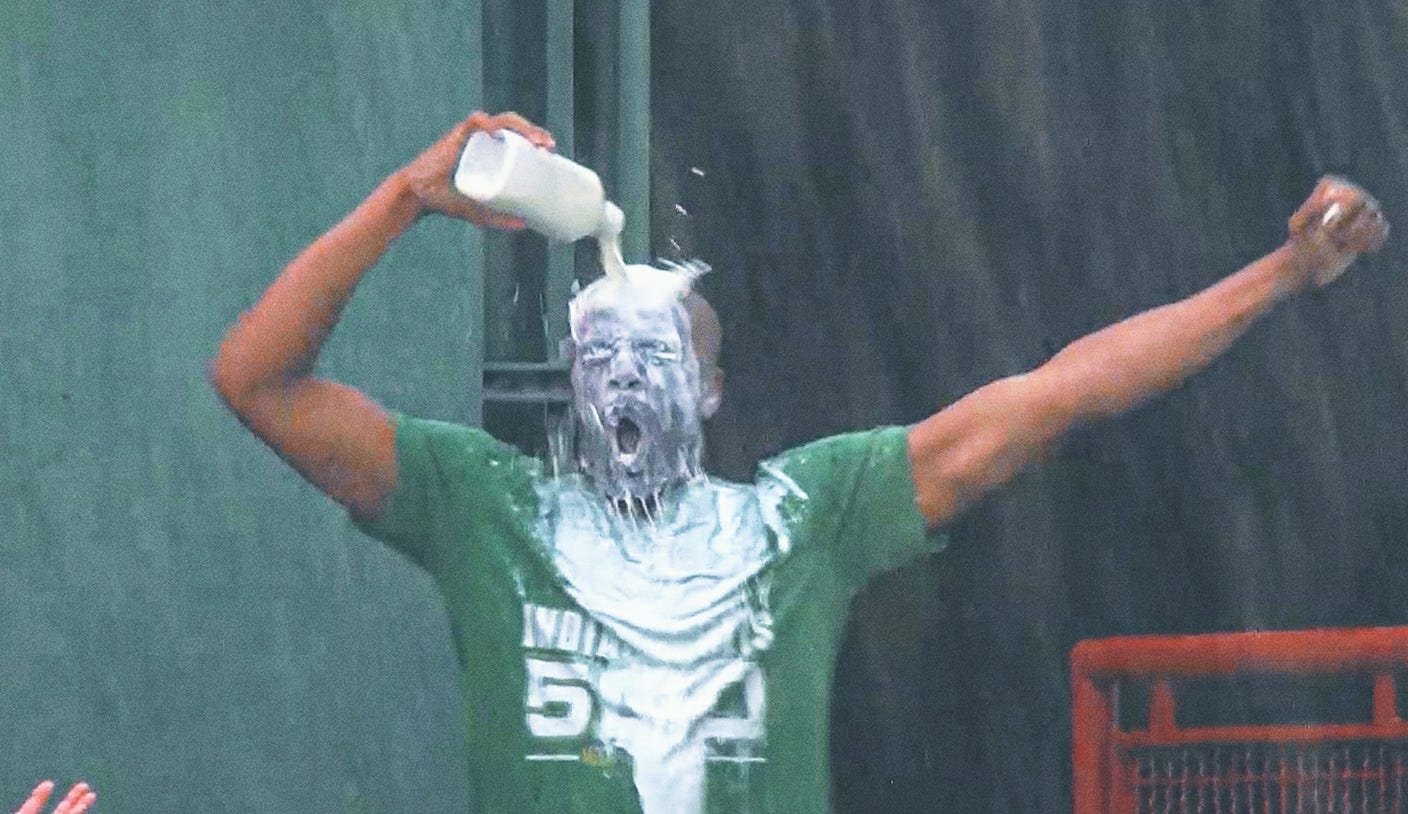

Is This The Next Big Thing Baseball Fans Celebrate With Milk Baths

May 27, 2025

Is This The Next Big Thing Baseball Fans Celebrate With Milk Baths

May 27, 2025