Is Robinhood Stock Still A Buy In [Current Year]? A Detailed Analysis.

![Is Robinhood Stock Still A Buy In [Current Year]? A Detailed Analysis. Is Robinhood Stock Still A Buy In [Current Year]? A Detailed Analysis.](https://buiznest.com/image/is-robinhood-stock-still-a-buy-in-current-year-a-detailed-analysis.jpeg)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Robinhood Stock Still a Buy in 2024? A Detailed Analysis

Robinhood's meteoric rise and subsequent fall have captivated investors. Once the darling of the millennial investing crowd, the brokerage app's stock price has experienced significant volatility. So, is Robinhood stock still a buy in 2024? This detailed analysis explores the current state of the company, its challenges, and its potential for future growth to help you make an informed decision.

Robinhood's Recent Performance and Key Challenges:

2023 presented a mixed bag for Robinhood. While the company showed signs of recovery, several key challenges persist, impacting investor confidence and the stock's price.

-

Increased Competition: The online brokerage landscape is fiercely competitive. Established players like Fidelity and Charles Schwab, along with newer entrants, constantly pressure Robinhood's market share. This intense competition necessitates continuous innovation and strategic adjustments to remain relevant.

-

Regulatory Scrutiny: Robinhood has faced increased regulatory scrutiny, particularly concerning its handling of user data and compliance with trading regulations. Navigating this complex regulatory environment adds significant costs and operational challenges.

-

Revenue Diversification: Robinhood's reliance on transaction-based revenue makes it vulnerable to market fluctuations. Diversifying revenue streams through additional financial products and services is crucial for long-term stability. Their efforts in this area are showing some progress, but it's a long-term game.

-

Improving User Experience and Trust: Early criticisms regarding the user interface and platform reliability have impacted user trust. Sustained efforts to enhance user experience and build a more trustworthy platform are essential for attracting and retaining customers.

Positive Indicators and Potential Growth Areas:

Despite the challenges, Robinhood isn't without its strengths and potential for future growth.

-

Expanding Product Offerings: Robinhood is actively expanding its product offerings beyond simple stock trading, including options, crypto trading, and more recently, retirement accounts. This diversification strategy aims to attract a wider customer base and boost revenue streams.

-

Strong User Base: Robinhood still boasts a substantial user base, particularly among younger investors. This represents a significant potential for future growth if the company can successfully retain and engage these users.

-

Technological Innovation: Robinhood's technology platform remains a strength, allowing for a relatively seamless and user-friendly trading experience. Further investment in technological innovation could help maintain a competitive edge.

-

Focus on Financial Literacy: Robinhood's increasing emphasis on providing financial education resources could attract more users and bolster brand loyalty. Educating investors is a smart long-term strategy.

Should You Buy Robinhood Stock in 2024?

The question of whether Robinhood stock is a buy in 2024 is complex and depends heavily on your individual risk tolerance and investment horizon. The company faces significant hurdles, but also possesses considerable potential.

For Conservative Investors: The risks associated with Robinhood stock currently outweigh the potential rewards. The volatile nature of the stock and the ongoing challenges suggest a wait-and-see approach might be prudent.

For Aggressive Investors: If you have a higher risk tolerance and a longer-term investment horizon, Robinhood could represent a potentially lucrative opportunity. However, it's crucial to carefully assess the risks and diversify your portfolio accordingly. Thorough due diligence is paramount.

Conclusion:

Robinhood's future hinges on its ability to navigate the competitive landscape, address regulatory concerns, and successfully diversify its revenue streams. While the potential for growth exists, the inherent risks should not be underestimated. Conduct thorough research and consider consulting a financial advisor before making any investment decisions related to Robinhood stock or any other investment. Remember, past performance is not indicative of future results. Stay informed about the company’s progress and market trends before committing your capital.

![Is Robinhood Stock Still A Buy In [Current Year]? A Detailed Analysis. Is Robinhood Stock Still A Buy In [Current Year]? A Detailed Analysis.](https://buiznest.com/image/is-robinhood-stock-still-a-buy-in-current-year-a-detailed-analysis.jpeg)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Robinhood Stock Still A Buy In [Current Year]? A Detailed Analysis.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

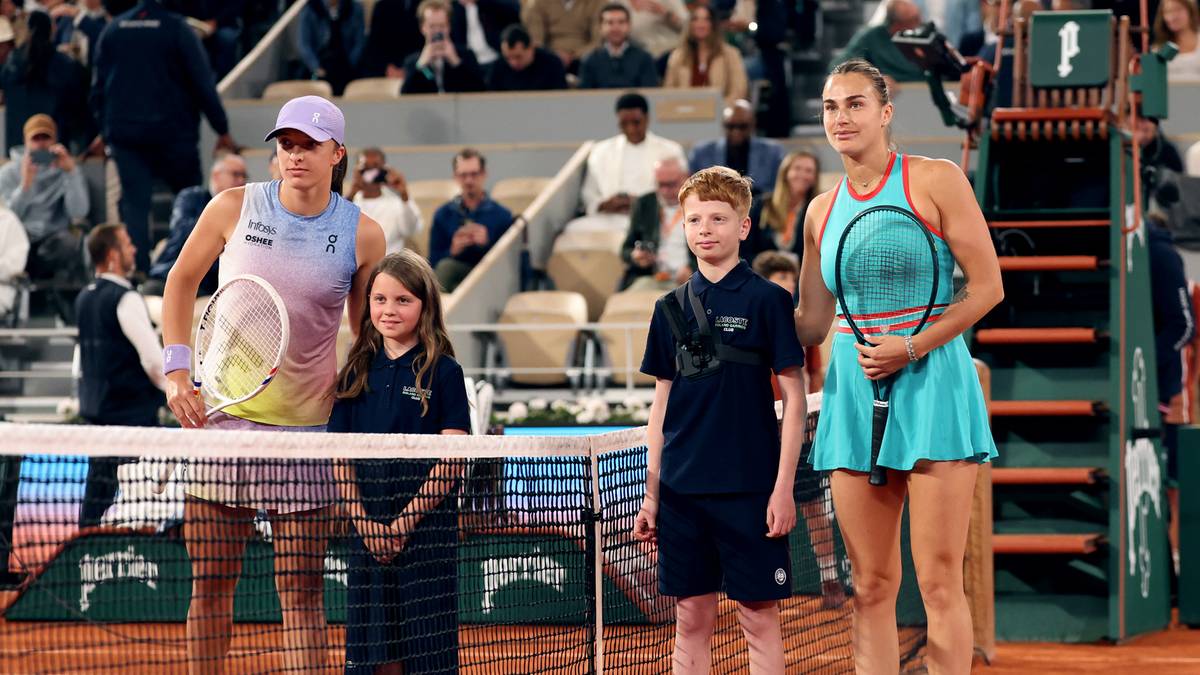

Relacja Na Zywo Swiatek Kontra Sabalenka W Roland Garros Sprawdz Wynik

Jun 06, 2025

Relacja Na Zywo Swiatek Kontra Sabalenka W Roland Garros Sprawdz Wynik

Jun 06, 2025 -

Myles Turner Trade Rumors Potential Landing Spot With The Pistons In 2025

Jun 06, 2025

Myles Turner Trade Rumors Potential Landing Spot With The Pistons In 2025

Jun 06, 2025 -

Spain Vs France How To Watch The Nations League Semifinal Live

Jun 06, 2025

Spain Vs France How To Watch The Nations League Semifinal Live

Jun 06, 2025 -

Watch France Vs Spain Nations League Semifinal Full Tv And Streaming Guide

Jun 06, 2025

Watch France Vs Spain Nations League Semifinal Full Tv And Streaming Guide

Jun 06, 2025 -

Remembering Carrie Fisher Her Honest Words To Mark Hamill About Star Wars

Jun 06, 2025

Remembering Carrie Fisher Her Honest Words To Mark Hamill About Star Wars

Jun 06, 2025