Is Robinhood Stock A Smart Investment? Reasons To Consider

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Robinhood Stock a Smart Investment? Reasons to Consider

The meteoric rise and subsequent fall of Robinhood Markets, Inc. (HOOD) has left many investors wondering: is Robinhood stock a smart investment? The answer, as with most financial decisions, is complex and depends heavily on your individual risk tolerance and investment strategy. This article delves into the key reasons to consider—and perhaps reconsider—investing in HOOD stock.

Robinhood's Appeal: Democratizing Investing (or is it?)

Robinhood initially disrupted the brokerage industry by offering commission-free trading, attracting millions of millennial and Gen Z investors. This gamified approach to investing, complete with celebratory confetti animations, made trading accessible to a previously underserved demographic. This innovative approach, coupled with its user-friendly app, fueled impressive growth. However, the initial excitement masked underlying vulnerabilities.

Reasons to Consider Robinhood Stock:

- Potential for Growth: Despite recent struggles, Robinhood retains a substantial user base and continues to innovate with new features and services. Further expansion into new markets and financial products could drive future growth. This potential for future growth is a key argument for bullish investors.

- First-Mover Advantage: Robinhood was a pioneer in commission-free trading, giving it a significant head start in the online brokerage market. Maintaining its brand recognition and user loyalty could be a significant asset in the long term.

- Expanding Product Offerings: Robinhood is not solely reliant on brokerage services. The expansion into crypto trading, options, and other financial products diversifies its revenue streams, reducing reliance on a single source of income. This diversification is a critical factor in assessing the company's long-term stability.

Reasons to Reconsider Robinhood Stock:

- Regulatory Scrutiny: The company has faced significant regulatory scrutiny, including investigations into its practices and accusations of prioritizing profit over customer protection. These legal battles represent a significant financial and reputational risk.

- Volatility and Market Dependence: Robinhood's stock price is notoriously volatile, reflecting the broader market trends and investor sentiment. This high volatility makes it a high-risk investment, unsuitable for risk-averse investors.

- Competition: The online brokerage space is becoming increasingly competitive, with established players and new entrants vying for market share. Robinhood needs to constantly innovate and adapt to maintain its competitive edge. This intense competition puts downward pressure on margins and profitability.

- Financial Performance: Robinhood's recent financial performance has been mixed, with fluctuating revenue and profitability. Investors need to carefully analyze the company's financial statements and future projections before making a decision.

Before Investing in Robinhood Stock:

Before committing to any investment in HOOD, conduct thorough due diligence. This includes:

- Analyzing Financial Statements: Examine Robinhood's financial reports to understand its revenue streams, profitability, and debt levels.

- Researching Market Trends: Stay informed about the overall market conditions and the competitive landscape of the online brokerage industry.

- Considering Your Risk Tolerance: Only invest an amount you are comfortable losing, recognizing the inherent volatility of HOOD stock.

- Seeking Professional Advice: Consider consulting a financial advisor to discuss your investment goals and determine if Robinhood aligns with your risk profile.

Conclusion:

Whether Robinhood stock is a "smart" investment depends entirely on your individual circumstances and investment strategy. While the potential for future growth exists, the significant risks associated with regulatory uncertainty, market volatility, and intense competition should not be overlooked. Thorough research and a cautious approach are crucial before investing in this highly volatile stock. Remember, past performance is not indicative of future results. Always invest wisely and responsibly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Robinhood Stock A Smart Investment? Reasons To Consider. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

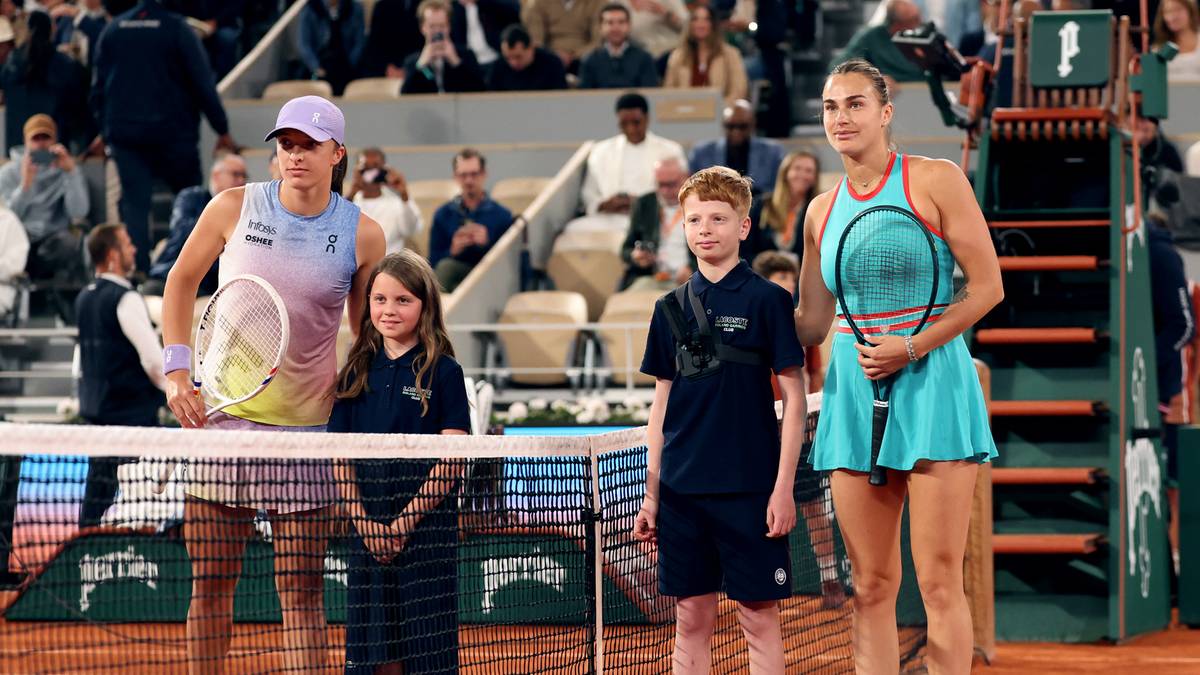

Swiatek Sabalenka Transmisja Live Roland Garros Wynik Online

Jun 06, 2025

Swiatek Sabalenka Transmisja Live Roland Garros Wynik Online

Jun 06, 2025 -

Fringe Nfl Teams Predicting The 2023 Postseason Bound

Jun 06, 2025

Fringe Nfl Teams Predicting The 2023 Postseason Bound

Jun 06, 2025 -

Postponement Of Testimony In Karen Reads Retrial Court Update

Jun 06, 2025

Postponement Of Testimony In Karen Reads Retrial Court Update

Jun 06, 2025 -

Sneaker Frenzy Hundreds Queue At Jd Sports For Highly Anticipated 110s

Jun 06, 2025

Sneaker Frenzy Hundreds Queue At Jd Sports For Highly Anticipated 110s

Jun 06, 2025 -

Nascar Michigan Qualifying 2025 Fire Keepers Casino 400 Starting Lineup

Jun 06, 2025

Nascar Michigan Qualifying 2025 Fire Keepers Casino 400 Starting Lineup

Jun 06, 2025