Is Now The Right Time To Buy Nio Stock? A Current Market Perspective

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Now the Right Time to Buy Nio Stock? A Current Market Perspective

The electric vehicle (EV) market is booming, and Nio (NIO) is one of the leading players in China, a crucial market for EV adoption. But with market volatility and global economic uncertainty, many investors are asking: is now the right time to buy Nio stock? This article delves into the current market conditions, analyzing Nio's performance and future prospects to help you make an informed decision.

Nio's Recent Performance: A Rollercoaster Ride

Nio's stock price has been on a volatile journey in recent months. While the company has demonstrated significant growth in vehicle deliveries and revenue, external factors like supply chain disruptions, competition from established automakers and emerging EV startups, and macroeconomic headwinds have influenced its performance. Understanding these factors is crucial before considering an investment.

Key Factors Influencing Nio's Stock Price:

- Delivery Numbers: Consistent and increasing vehicle deliveries are a key indicator of Nio's success. Strong delivery figures often translate to positive market sentiment and a rise in stock price. Regularly monitoring Nio's delivery reports is essential for any potential investor.

- New Product Launches: Nio's pipeline of new vehicles and innovative technologies significantly impacts investor confidence. The introduction of new models and advancements in battery technology can boost investor enthusiasm.

- Government Policies and Subsidies: China's government policies regarding EV adoption and the availability of subsidies heavily influence the EV market, impacting Nio's profitability and growth. Changes in these policies can significantly affect the stock price.

- Global Economic Conditions: Global economic uncertainty, inflation, and interest rate hikes can affect investor risk appetite, leading to fluctuations in Nio's stock price, regardless of the company's performance.

- Competition: The EV market is becoming increasingly competitive, with both established automakers and new EV companies vying for market share. Nio's ability to maintain its competitive edge is a key factor in its long-term success.

Analyzing the Current Market Landscape:

The current market presents both opportunities and challenges for Nio. While the long-term outlook for the EV sector remains positive, short-term volatility is to be expected. Several factors need careful consideration:

- China's Economic Recovery: The pace of China's economic recovery will directly influence consumer spending and demand for EVs, impacting Nio's sales.

- Supply Chain Resilience: Nio's ability to navigate potential future supply chain disruptions will be crucial for maintaining production and meeting demand.

- Technological Innovation: Continuous technological advancements and innovation are key for Nio to stay competitive and attract customers.

Should You Buy Now? A Cautious Approach

Determining whether now is the right time to buy Nio stock requires a thorough risk assessment. While the long-term prospects for Nio and the EV market appear promising, the current market volatility presents significant risks.

Before investing, consider:

- Your Risk Tolerance: Nio stock is considered a high-growth, high-risk investment. Only invest what you can afford to lose.

- Long-Term Perspective: Investing in Nio requires a long-term outlook, as short-term fluctuations are likely.

- Diversification: Diversifying your portfolio is crucial to mitigate risk. Don't put all your eggs in one basket.

Conclusion:

The decision of whether to buy Nio stock is ultimately a personal one, dependent on your individual investment goals and risk tolerance. Thorough research, understanding the current market conditions, and a long-term perspective are crucial for making an informed decision. Consult with a financial advisor before making any investment decisions. Stay updated on Nio's performance, industry trends, and economic conditions to make the best possible choice for your investment portfolio. Remember to always do your due diligence before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Now The Right Time To Buy Nio Stock? A Current Market Perspective. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

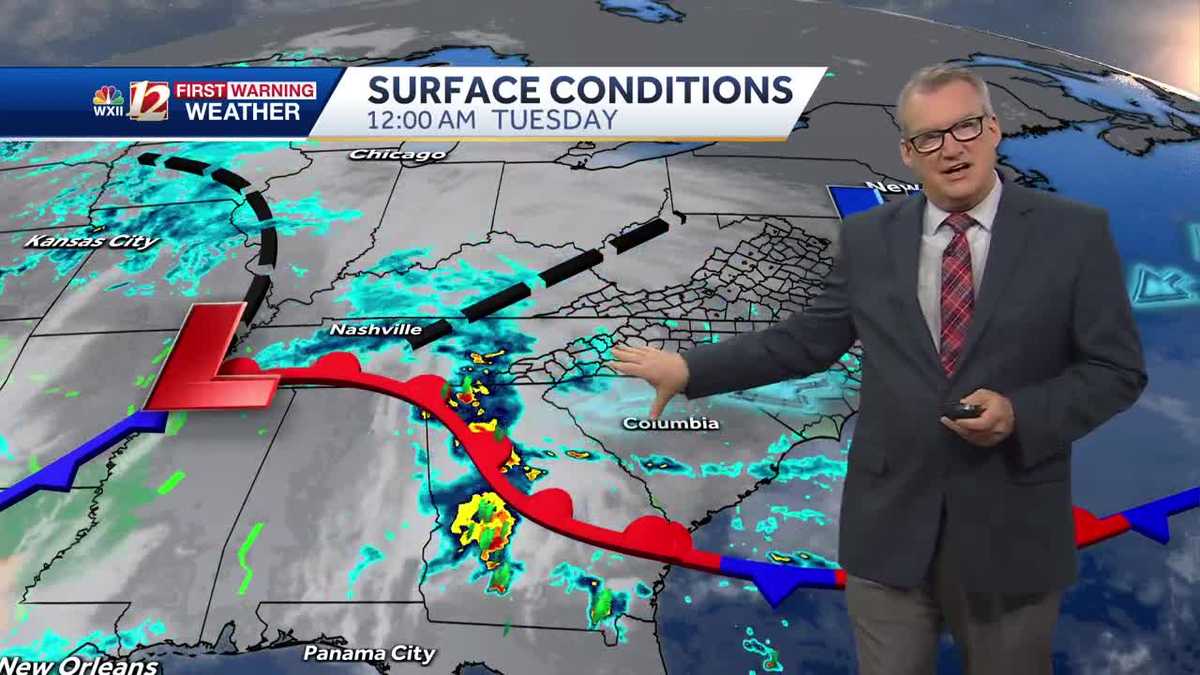

Cool Wet Tuesday Impacts On Transportation And Outdoor Activities

May 28, 2025

Cool Wet Tuesday Impacts On Transportation And Outdoor Activities

May 28, 2025 -

From Dead Last To Victory Lane Ross Chastains Coca Cola 600 Triumph

May 28, 2025

From Dead Last To Victory Lane Ross Chastains Coca Cola 600 Triumph

May 28, 2025 -

Nascar Coca Cola 600 Chastain Secures Victory Defeats Byron

May 28, 2025

Nascar Coca Cola 600 Chastain Secures Victory Defeats Byron

May 28, 2025 -

From Wreckage To Victory Stunning Images From The 109th Indy 500

May 28, 2025

From Wreckage To Victory Stunning Images From The 109th Indy 500

May 28, 2025 -

Nio Stock Price Prediction Is Now The Time To Invest

May 28, 2025

Nio Stock Price Prediction Is Now The Time To Invest

May 28, 2025