Is Boeing's Stock Market Outperformance In 2025 Sustainable?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Boeing's Stock Market Outperformance in 2025 Sustainable? A Deep Dive into the Aerospace Giant

Boeing. The name alone conjures images of soaring jets and groundbreaking aerospace innovation. But can the company's potential stock market success in 2025 be sustained? Recent performance has been promising, prompting investors to consider its long-term viability. This in-depth analysis explores the factors influencing Boeing's stock and whether its upward trajectory is a temporary surge or a sign of enduring strength.

Boeing's 2025 Projections: A Balancing Act

Several factors contribute to the optimistic (and perhaps cautious) outlook for Boeing's stock in 2025. The company is heavily reliant on several key areas:

-

737 MAX Recovery: The grounding and subsequent recertification of the 737 MAX significantly impacted Boeing's reputation and financial performance. A full recovery in production and delivery is crucial for sustained growth. Any further setbacks or lingering safety concerns could derail the positive momentum.

-

787 Dreamliner Production: The 787 Dreamliner program has faced its own set of challenges, including production delays and quality control issues. Resolving these issues and maintaining a steady production rate is vital for revenue generation and investor confidence.

-

Defense and Space Segment: Boeing's defense and space division provides a significant portion of its revenue stream. Government contracts and technological advancements in this sector are critical to long-term stability. However, competition in this market is fierce, and securing lucrative contracts is essential for continued success.

-

Supply Chain Resilience: The global aerospace industry has been grappling with supply chain disruptions in recent years. Boeing's ability to navigate these challenges efficiently and secure a reliable supply of parts and materials will be a key determinant of its future performance.

Analyzing the Risks:

While the future looks promising, significant risks remain:

-

Geopolitical Instability: Global events, such as the ongoing war in Ukraine and escalating trade tensions, can significantly impact the aerospace industry. Uncertainty in the global market can negatively affect demand for Boeing's products.

-

Competition: Boeing faces stiff competition from Airbus, particularly in the commercial aircraft market. Maintaining a competitive edge in terms of technology, pricing, and efficiency is paramount.

-

Inflationary Pressures: Rising costs of raw materials, labor, and energy can squeeze profit margins, affecting Boeing's profitability and potentially dampening investor enthusiasm.

Sustainable Growth or Fleeting Success?

The sustainability of Boeing's stock market performance in 2025 and beyond hinges on several interwoven factors. Successful navigation of the 737 MAX and 787 Dreamliner challenges, securing significant defense contracts, mitigating supply chain disruptions, and adapting to a volatile geopolitical landscape are all critical components.

Investors should conduct thorough due diligence before making any investment decisions. Considering the complexities of the aerospace industry and the numerous external factors at play, predicting the long-term trajectory of Boeing's stock remains a challenging task. While the potential for growth is certainly there, the journey to sustained market outperformance is likely to be bumpy.

Looking Ahead:

Ultimately, whether Boeing's 2025 success is sustainable depends on its ability to execute its strategic plans effectively, adapt to unforeseen challenges, and maintain investor confidence. Consistent innovation, improved operational efficiency, and a focus on risk mitigation will be essential for long-term growth and a sustainable stock market position. Further analysis and ongoing monitoring of the company’s performance are vital for informed investment decisions. Stay informed by following industry news and financial reports to gauge Boeing’s progress and make well-informed choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Boeing's Stock Market Outperformance In 2025 Sustainable?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Second Hurdle In Sight For Keys Project

Jun 03, 2025

Second Hurdle In Sight For Keys Project

Jun 03, 2025 -

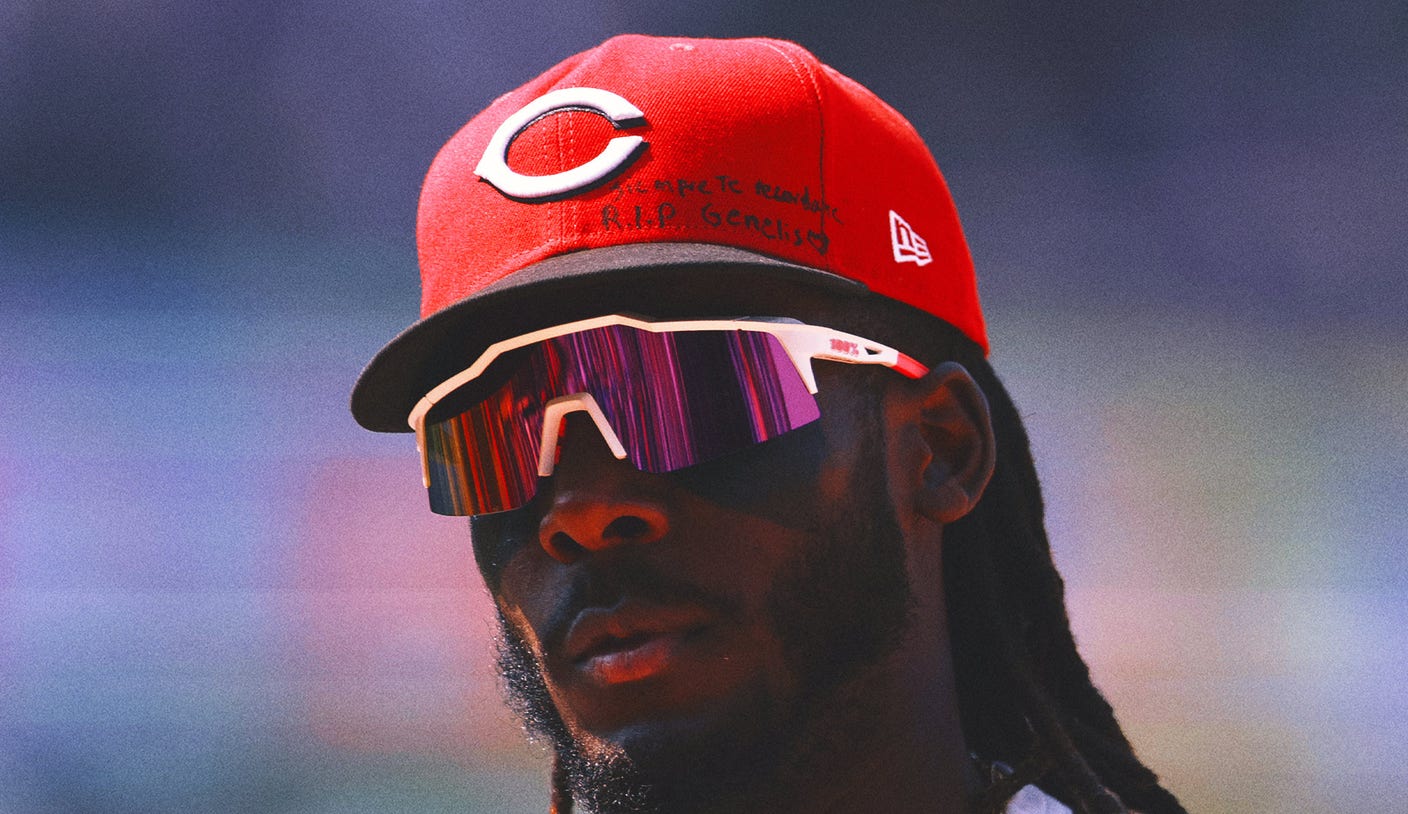

De La Cruzs Powerful Performance Reds Stars Home Run Amidst Family Sorrow

Jun 03, 2025

De La Cruzs Powerful Performance Reds Stars Home Run Amidst Family Sorrow

Jun 03, 2025 -

She The People Founders Lawsuit Against Tyler Perry Over Netflix Series

Jun 03, 2025

She The People Founders Lawsuit Against Tyler Perry Over Netflix Series

Jun 03, 2025 -

Upset Win For Altmaier A Topsy Turvy Match Recap

Jun 03, 2025

Upset Win For Altmaier A Topsy Turvy Match Recap

Jun 03, 2025 -

Despite 33 Point Outburst Injuries Plague Fever Guard In Ncaa Tournament

Jun 03, 2025

Despite 33 Point Outburst Injuries Plague Fever Guard In Ncaa Tournament

Jun 03, 2025