Investors Pour $200 Million Into Ethereum Following Pectra Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investors Pour $200 Million into Ethereum Following Shanghai Upgrade: A Bullish Signal?

The Ethereum network has witnessed a significant surge in investment following the highly anticipated Shanghai upgrade, with over $200 million flowing into the second-largest cryptocurrency in just the first few days. This massive influx of capital is fueling speculation of a bullish trend for ETH, sending ripples through the crypto market. But is this just short-term excitement, or a sign of things to come?

The Shanghai upgrade, also known as the Shapella upgrade, marked a pivotal moment for Ethereum. This long-awaited update finally enabled the withdrawal of staked ETH, unlocking millions of coins previously locked in the network's staking contract. This unlocking event was a major catalyst for the recent investment surge. Before Shapella, many investors were hesitant to stake their ETH due to the inability to access their funds. Now, with withdrawals enabled, the perceived risk has lessened, making Ethereum a more attractive investment for both institutional and retail investors.

What Drove the $200 Million Investment?

Several factors contributed to the significant investment influx following the Shanghai upgrade:

- Unlocking of Staked ETH: This was undoubtedly the primary driver. The ability to withdraw staked ETH removed a significant barrier to entry and increased liquidity within the market.

- Increased Confidence in Ethereum's Scalability: The upgrade also included improvements to Ethereum's scalability and efficiency, further boosting investor confidence. This is crucial for the long-term adoption of Ethereum as a platform for decentralized applications (dApps).

- Positive Market Sentiment: The overall crypto market has shown signs of recovery in recent weeks, contributing to the positive sentiment surrounding Ethereum. This broader market trend has undoubtedly amplified the impact of the Shanghai upgrade.

- Institutional Adoption: While anecdotal evidence is prevalent, it's reasonable to assume institutional investors, looking for stable and scalable blockchain platforms, played a significant role in this investment wave. The enhanced security and improved functionality of the Ethereum network make it an increasingly attractive investment for large-scale players.

Is This a Sustainable Trend?

While the immediate influx of $200 million is impressive, it remains crucial to view this within a broader context. The long-term sustainability of this bullish trend depends on several factors, including:

- Continued Development and Innovation: Ethereum's ongoing development and the implementation of future upgrades will be crucial in maintaining its competitive edge and attracting further investment.

- Regulatory Clarity: The regulatory landscape for cryptocurrencies continues to evolve, and clarity from regulatory bodies is essential for fostering sustainable growth.

- Market Volatility: The cryptocurrency market is inherently volatile, and external factors can significantly influence investment trends.

The Future of Ethereum

The Shanghai upgrade represents a significant milestone in Ethereum's journey. The unlocking of staked ETH and the improvements in scalability have removed key obstacles to wider adoption. The $200 million investment surge is a strong indication of market confidence, but whether this translates into a sustained bullish trend remains to be seen. Continued development, regulatory clarity, and overall market sentiment will be key determinants of Ethereum's future trajectory.

Learn more: For deeper insights into the Ethereum Shanghai upgrade, check out the official Ethereum Foundation website: (replace with actual link). Stay tuned for further updates as the market evolves.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investors Pour $200 Million Into Ethereum Following Pectra Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Juego De Voces 2025 El Inolvidable Dueto De Yahir Y Victor Garcia

May 20, 2025

Juego De Voces 2025 El Inolvidable Dueto De Yahir Y Victor Garcia

May 20, 2025 -

Post Pectra Upgrade Investors Pour 200 Million Into Ethereum Funds

May 20, 2025

Post Pectra Upgrade Investors Pour 200 Million Into Ethereum Funds

May 20, 2025 -

2025 Indy 500 Rookie Shwartzmans Pole Changes The Betting Landscape

May 20, 2025

2025 Indy 500 Rookie Shwartzmans Pole Changes The Betting Landscape

May 20, 2025 -

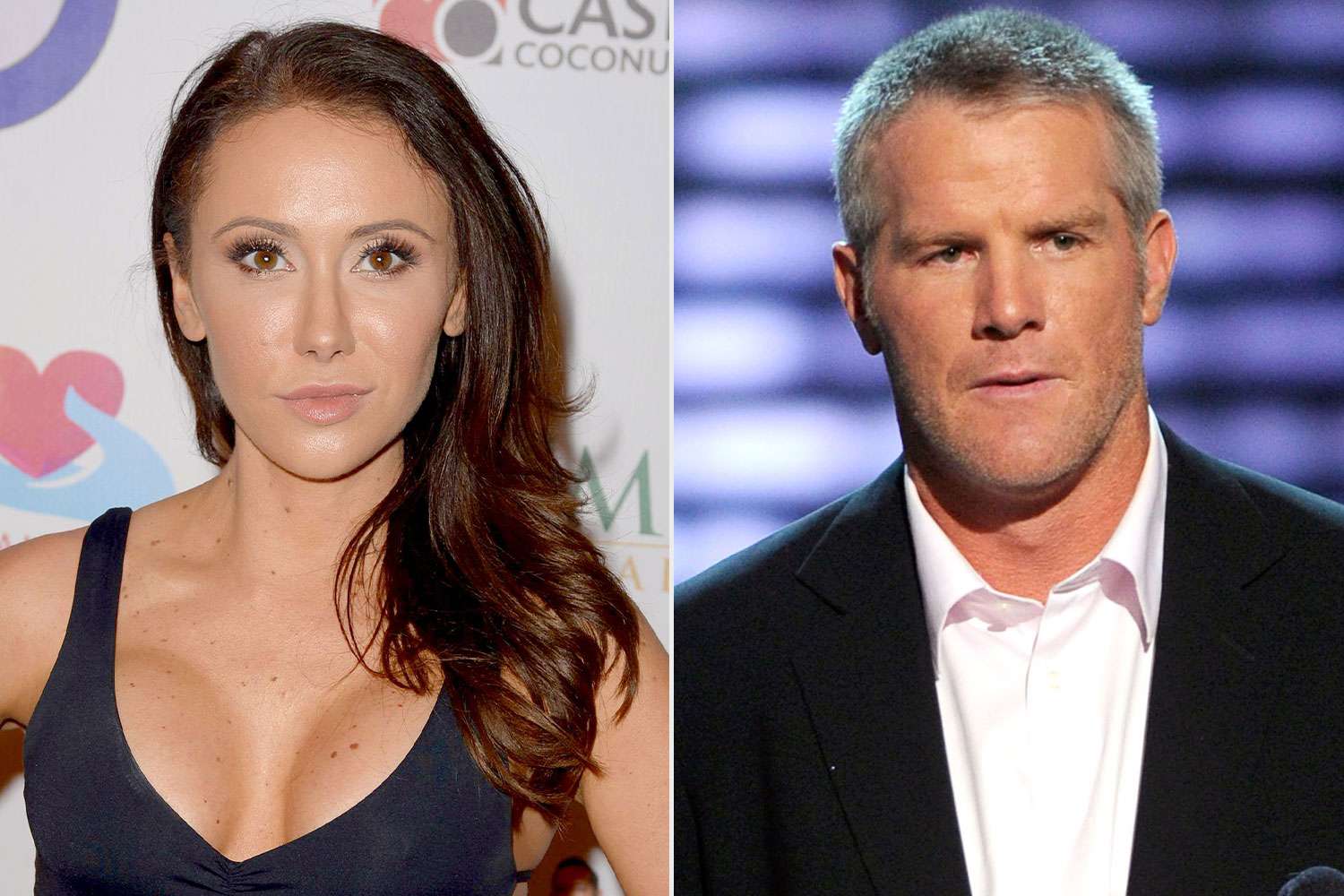

The Brett Favre Scandal Jenn Stergers Account Of Betrayal And Emotional Distress

May 20, 2025

The Brett Favre Scandal Jenn Stergers Account Of Betrayal And Emotional Distress

May 20, 2025 -

Pet Cremation Industry Reform Lawmakers Respond To Scandal

May 20, 2025

Pet Cremation Industry Reform Lawmakers Respond To Scandal

May 20, 2025