Investor Sounds Alarm: Assessing The Risks In Super Micro Computer Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investor Sounds Alarm: Assessing the Risks in Super Micro Computer Stock

Super Micro Computer (SMCI) has been a darling of the tech market, experiencing significant growth in recent years. However, a recent investor alert is causing ripples, urging caution and a thorough risk assessment before investing in the company. This article delves into the concerns raised, examining the potential pitfalls and helping investors make informed decisions.

The Investor Warning: A Closer Look

The alarm bells were sounded by [Name of Investor Group/Analyst – if available, otherwise remove this sentence and the next], who cited [Specific concerns raised, e.g., high valuation compared to competitors, dependence on specific clients, supply chain vulnerabilities, etc.]. These concerns highlight potential risks that investors should carefully consider before committing capital. While Super Micro boasts impressive technological advancements and a strong presence in the server market, it's crucial to understand the potential downsides.

Key Risks to Consider:

-

Valuation Concerns: SMCI's stock price has seen substantial growth. Some analysts believe this growth is unsustainable and that the current valuation doesn't fully reflect the inherent risks. A thorough comparison with competitors' price-to-earnings ratios (P/E) and other key financial metrics is essential. [Link to a reputable financial analysis website comparing SMCI to competitors].

-

Client Concentration: Over-reliance on a small number of key clients can expose the company to significant financial vulnerability. If a major client reduces orders or shifts to a competitor, SMCI's revenue could suffer dramatically. Diversification of its client base is crucial for long-term stability.

-

Supply Chain Disruptions: The global semiconductor industry is notoriously susceptible to supply chain disruptions. Any delays or shortages in crucial components could severely impact Super Micro's production and profitability. Investors should carefully assess SMCI's strategies for mitigating supply chain risks.

-

Competition: The server market is fiercely competitive. Established players like Dell, HP, and Lenovo, along with emerging competitors, constantly challenge Super Micro's market share. Understanding the competitive landscape and SMCI's competitive advantages is paramount.

-

Technological Advancements: The rapid pace of technological change in the tech industry necessitates continuous innovation. Failure to adapt to new technologies and market demands could negatively affect SMCI's long-term prospects.

Mitigating the Risks: A Balanced Perspective

While the concerns are valid, it's important to acknowledge Super Micro's strengths. The company has a strong reputation for innovation in server technology and enjoys a significant market share. Furthermore, [Mention any positive developments or strategic initiatives taken by the company to address the concerns].

Investing in SMCI: A Call to Due Diligence

Investing in Super Micro Computer, or any stock for that matter, requires thorough due diligence. Before making any investment decisions, investors should:

- Analyze Financial Statements: Scrutinize SMCI's financial statements, including income statements, balance sheets, and cash flow statements, to assess its financial health and performance.

- Research Industry Trends: Stay updated on industry trends and competitive dynamics to gauge SMCI's position in the market.

- Consult Financial Professionals: Seek advice from qualified financial advisors before making any investment decisions.

The investor alert serves as a reminder that even seemingly promising stocks carry inherent risks. By carefully assessing these risks and conducting thorough research, investors can make informed decisions and manage their portfolio effectively. Remember, this article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a financial professional before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investor Sounds Alarm: Assessing The Risks In Super Micro Computer Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Larson To Tackle Indy 500 And Coca Cola 600 Starting Positions Revealed

May 27, 2025

Larson To Tackle Indy 500 And Coca Cola 600 Starting Positions Revealed

May 27, 2025 -

Rybakina Vs Bencic French Open 2025 A Detailed Match Prediction

May 27, 2025

Rybakina Vs Bencic French Open 2025 A Detailed Match Prediction

May 27, 2025 -

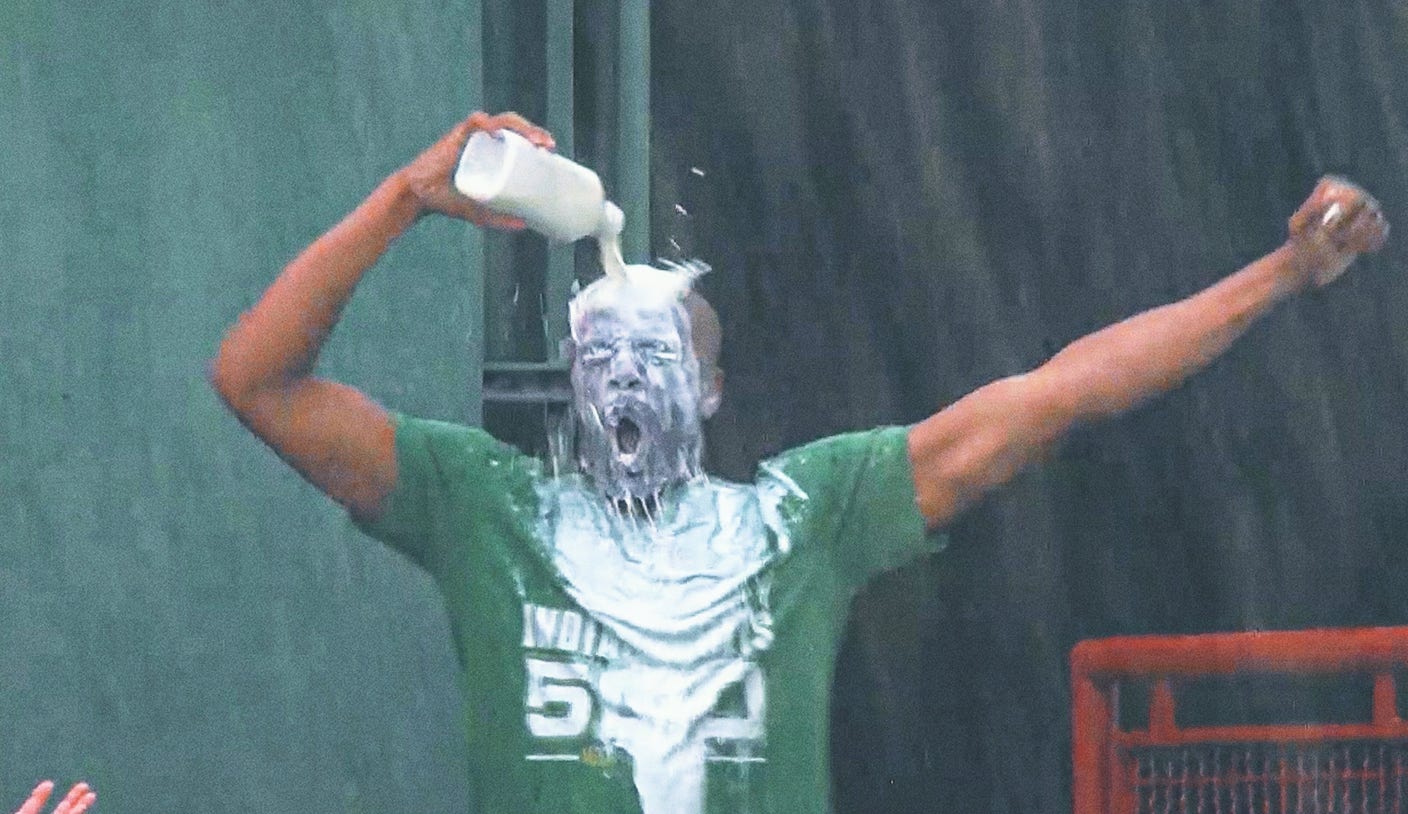

Beyond The Dugout Exploring The Viral Milk Dousing Baseball Trend

May 27, 2025

Beyond The Dugout Exploring The Viral Milk Dousing Baseball Trend

May 27, 2025 -

American Idol Season 24 The Biggest Changes And Updates

May 27, 2025

American Idol Season 24 The Biggest Changes And Updates

May 27, 2025 -

Robert De Niro And Scott Eastwood Confront Jamie Foxx In New Thriller Tin Soldier

May 27, 2025

Robert De Niro And Scott Eastwood Confront Jamie Foxx In New Thriller Tin Soldier

May 27, 2025