Investor Concerns Grow As Experian (LON:EXPN) Shows Unattractive Returns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investor Concerns Grow as Experian (LON:EXPN) Shows Unattractive Returns

Experian's recent performance sparks debate among analysts and investors. The credit reporting agency, Experian (LON:EXPN), has seen its share price falter, prompting growing concerns among investors regarding its future prospects. While the company remains a significant player in the global credit information market, unattractive returns compared to market benchmarks are fueling anxieties about its long-term growth potential.

This article delves into the reasons behind the declining investor confidence, exploring Experian's recent financial performance, competitive landscape, and the broader economic factors impacting its trajectory.

Sluggish Growth and Market Underperformance:

Experian's recent financial reports have revealed slower-than-expected growth, falling short of market expectations. This underperformance, compared to other companies in the financial technology (FinTech) sector, is a key factor contributing to investor apprehension. While Experian continues to generate revenue, the rate of growth appears insufficient to satisfy investor demands for significant returns, leading to a dip in share price. [Link to Experian's latest financial report]

Competitive Pressures in the FinTech Arena:

The FinTech landscape is increasingly competitive, with numerous startups and established players vying for market share. Experian faces pressure from both emerging technologies and established competitors offering innovative solutions in credit scoring, fraud detection, and data analytics. This intense competition is forcing Experian to adapt and innovate more rapidly, potentially impacting short-term profitability.

Macroeconomic Headwinds and Uncertain Global Outlook:

The global economic outlook remains uncertain, with inflation and recessionary fears impacting consumer spending and business investment. These macroeconomic headwinds can significantly affect Experian's performance, as its business is closely tied to consumer credit and business activity. A potential downturn could lead to increased loan defaults and reduced demand for Experian's services.

Analyst Opinions and Future Outlook:

Several analysts have expressed concerns regarding Experian's current trajectory. Some point to the need for bolder strategic initiatives to drive growth and enhance shareholder value. Others suggest that the company may need to reconsider its pricing strategies or explore strategic acquisitions to maintain its competitive edge. [Link to a relevant financial news article discussing analyst opinions]

What's Next for Experian Investors?

The situation highlights the challenges faced by even established players in navigating a dynamic and competitive market. Investors are now closely watching Experian's strategic response to these challenges. Key areas to monitor include:

- New product and service launches: Innovation is crucial for maintaining competitiveness.

- Strategic acquisitions: Acquisitions could broaden Experian's reach and capabilities.

- Cost-cutting measures: Efficiency improvements could boost profitability.

- Management's response to investor concerns: Clear communication and strategic direction are essential.

Conclusion:

While Experian remains a significant player, its recent performance has raised legitimate concerns among investors. The company faces a challenging environment, requiring swift and effective action to regain investor confidence and deliver attractive returns. The coming months will be critical in determining Experian's future trajectory and whether it can successfully navigate the headwinds it currently faces. Further analysis and monitoring of its strategic moves are essential for investors seeking clarity on the company's long-term prospects.

Keywords: Experian, LON:EXPN, investor concerns, unattractive returns, credit reporting agency, FinTech, competitive landscape, macroeconomic headwinds, financial performance, share price, stock market, growth potential, analyst opinions, future outlook, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investor Concerns Grow As Experian (LON:EXPN) Shows Unattractive Returns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indy 500 Champion Alex Palou Balancing Racing Business And Rest

Aug 12, 2025

Indy 500 Champion Alex Palou Balancing Racing Business And Rest

Aug 12, 2025 -

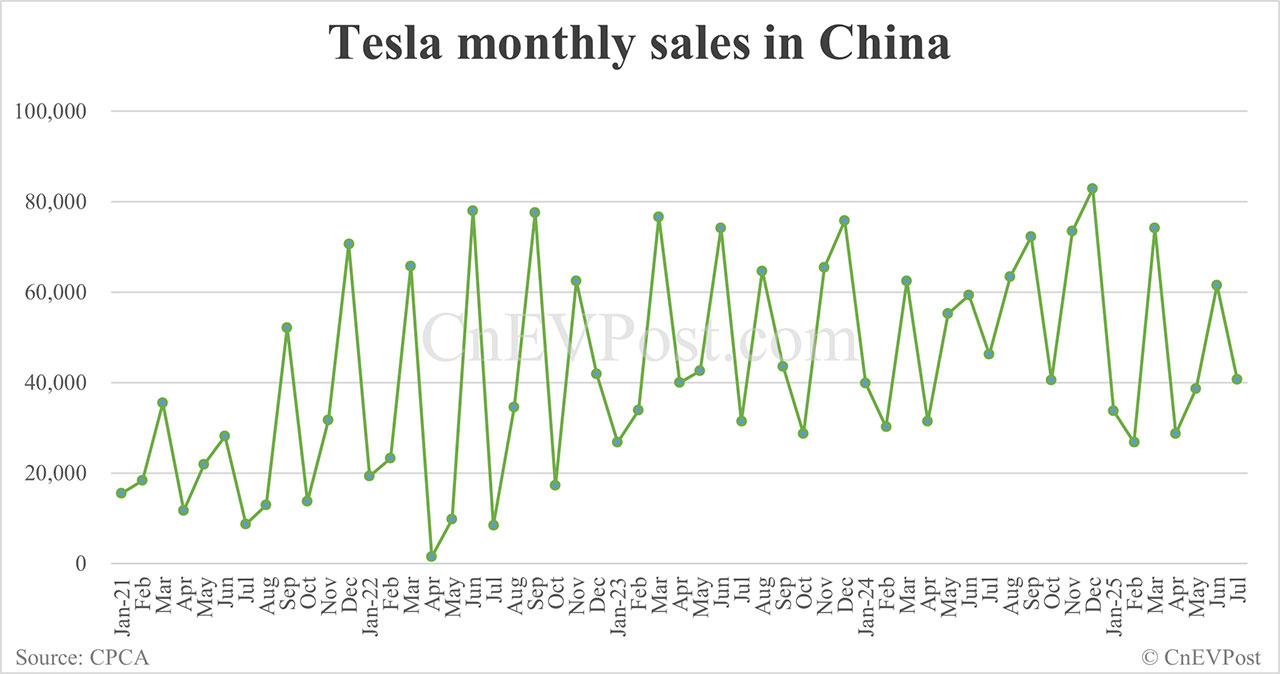

Tesla China Sales Dip July Figures Show 12 Year On Year Decline

Aug 12, 2025

Tesla China Sales Dip July Figures Show 12 Year On Year Decline

Aug 12, 2025 -

Mikolas Vs Rockies Cardinals Opening Pitcher Announced

Aug 12, 2025

Mikolas Vs Rockies Cardinals Opening Pitcher Announced

Aug 12, 2025 -

Indy Car 2024 Alex Palous Historic Championship Win

Aug 12, 2025

Indy Car 2024 Alex Palous Historic Championship Win

Aug 12, 2025 -

Palous Undeniable Dominance Secures Third Consecutive Indycar Title

Aug 12, 2025

Palous Undeniable Dominance Secures Third Consecutive Indycar Title

Aug 12, 2025

Latest Posts

-

49ers Facing Wide Receiver Crisis Aiyuks Potential Week 6 Comeback

Aug 13, 2025

49ers Facing Wide Receiver Crisis Aiyuks Potential Week 6 Comeback

Aug 13, 2025 -

Lluvia De Perseidas 2025 Mejor Momento Y Lugar Para Verlas En Espana

Aug 13, 2025

Lluvia De Perseidas 2025 Mejor Momento Y Lugar Para Verlas En Espana

Aug 13, 2025 -

Cleveland Browns Garrett Cited For Reckless Driving 100 Mph Speed

Aug 13, 2025

Cleveland Browns Garrett Cited For Reckless Driving 100 Mph Speed

Aug 13, 2025 -

2025 Nfl Preseason Week 2 Complete Guide To Betting Lines And Spreads

Aug 13, 2025

2025 Nfl Preseason Week 2 Complete Guide To Betting Lines And Spreads

Aug 13, 2025 -

Get Ready To Rumble Laila Ali Presents Chef Grudge Match A Culinary Throwdown

Aug 13, 2025

Get Ready To Rumble Laila Ali Presents Chef Grudge Match A Culinary Throwdown

Aug 13, 2025