Investment Analysis: Morgan Stanley's Choice Between Apple And AMD Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investment Analysis: Morgan Stanley Weighs Apple vs. AMD – Which Tech Giant Reigns Supreme?

Wall Street is buzzing about Morgan Stanley's recent assessment of two tech titans, Apple (AAPL) and Advanced Micro Devices (AMD). This in-depth analysis explores the investment bank's perspective, comparing the strengths and weaknesses of each company and ultimately offering insights for potential investors navigating the complex landscape of the tech sector. The choice between these two industry leaders presents a compelling dilemma, forcing investors to consider diverse factors ranging from market dominance to future growth potential.

Morgan Stanley's Take: A Closer Look

Morgan Stanley's analysts have recently made headlines with their contrasting views on Apple and AMD. While acknowledging Apple's consistent performance and robust ecosystem, they've highlighted AMD's significant growth trajectory, particularly within the data center and high-performance computing (HPC) markets. This divergence in opinion underscores the complexities inherent in choosing between established giants and rapidly expanding disruptors.

Apple (AAPL): The Steady Hand

Apple's position in the market is undeniable. Its vast ecosystem, encompassing iPhones, iPads, Macs, and wearables, generates consistently strong revenue. The company's loyal customer base and premium pricing strategy contribute to substantial profitability. However, Morgan Stanley's analysis subtly points towards a potential plateau in growth, particularly in its flagship iPhone segment. This concern stems from market saturation and increasing competition from Android manufacturers.

- Strengths: Strong brand loyalty, diversified product portfolio, robust ecosystem, consistent profitability.

- Weaknesses: Potential for slower growth in mature markets, increasing competition, dependence on iPhone sales.

AMD (AMD): The Rising Star

AMD, on the other hand, presents a compelling narrative of rapid growth. The company's strong performance in the CPU and GPU markets, particularly its inroads into the data center sector, fuels optimistic projections. This aggressive expansion, coupled with increasing demand for high-performance computing, positions AMD for substantial future growth. However, increased competition from Intel and Nvidia, along with potential supply chain challenges, pose significant risks.

- Strengths: Rapid growth in data center and HPC markets, innovative product development, strong competitive positioning.

- Weaknesses: Intense competition, potential supply chain disruptions, dependence on specific market segments.

The Investor's Dilemma: Apple's Stability vs. AMD's Potential

The crux of the investment decision lies in balancing risk and reward. Apple offers stability and consistent returns, appealing to investors seeking lower volatility. However, its growth potential may be more limited compared to AMD. AMD, while presenting higher growth potential and significant upside, carries a higher degree of risk due to its dependence on specific market segments and intense competition.

Beyond the Headlines: Factors to Consider

Before making any investment decisions, potential investors should conduct thorough due diligence. Consider consulting with a qualified financial advisor and analyzing factors beyond Morgan Stanley's report, including:

- Market trends: Stay informed about the broader trends affecting the technology sector.

- Financial statements: Review the financial health of both companies.

- Competitive landscape: Analyze the competitive dynamics and potential disruptions.

- Your risk tolerance: Align your investment choices with your individual risk profile.

Conclusion: A nuanced approach

Morgan Stanley's comparison of Apple and AMD highlights the importance of diversification and a thoughtful investment strategy. The choice ultimately depends on individual investment goals and risk tolerance. Both companies represent significant players in the tech industry, but their trajectories differ significantly. Carefully weigh the pros and cons before investing in either AAPL or AMD. This detailed analysis serves as a starting point for further research and informed decision-making. Remember, this information is for educational purposes only and not financial advice. Consult with a qualified financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investment Analysis: Morgan Stanley's Choice Between Apple And AMD Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Palous Indiana Double Indy 500 Win Followed By Knicks Pacers Game Attendance

May 27, 2025

Palous Indiana Double Indy 500 Win Followed By Knicks Pacers Game Attendance

May 27, 2025 -

Assessing The 2025 French Open From Alcaraz To Gauff A Ranking Of Potential Winners

May 27, 2025

Assessing The 2025 French Open From Alcaraz To Gauff A Ranking Of Potential Winners

May 27, 2025 -

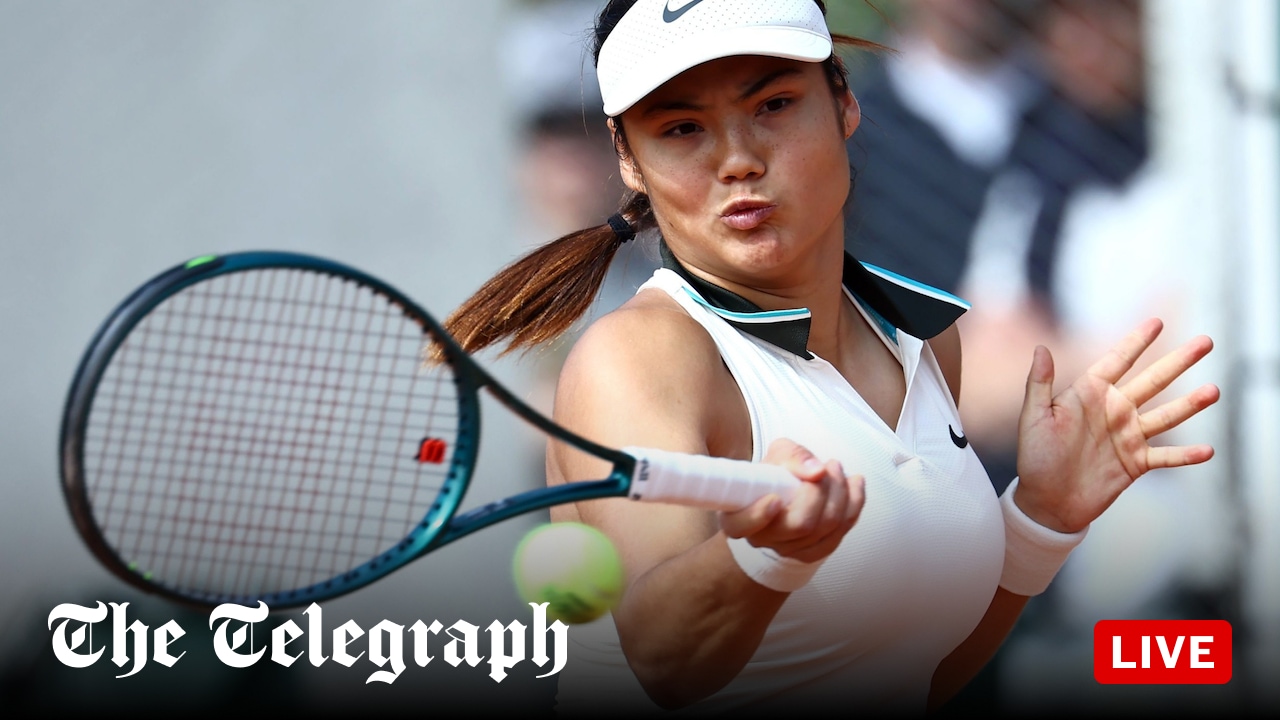

Roland Garros Get The Latest Scores And Updates On Raducanu Vs Wang Xinyu

May 27, 2025

Roland Garros Get The Latest Scores And Updates On Raducanu Vs Wang Xinyu

May 27, 2025 -

Nba Playoffs Thunder Exploits Wolves Weakness In Dominant Game 3 Win

May 27, 2025

Nba Playoffs Thunder Exploits Wolves Weakness In Dominant Game 3 Win

May 27, 2025 -

Indy 500 Photos Celebrating The 109th Races Best And Worst Moments

May 27, 2025

Indy 500 Photos Celebrating The 109th Races Best And Worst Moments

May 27, 2025