Investment Analysis: Morgan Stanley's Choice Between Apple And AMD

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investment Analysis: Morgan Stanley Weighs Apple vs. AMD – Which Tech Giant Reigns Supreme?

The tech sector is a battlefield of titans, and two giants, Apple and AMD, are currently vying for investor attention. A recent investment analysis from Morgan Stanley has sent ripples through the market, prompting renewed scrutiny of both companies and sparking debate among analysts. This article delves into Morgan Stanley's assessment, exploring the key factors driving their decision and offering insights into the broader implications for investors.

Morgan Stanley's Take: A Tale of Two Tech Leaders

Morgan Stanley's recent report didn't declare a clear winner between Apple (AAPL) and Advanced Micro Devices (AMD), but it did offer a nuanced comparison highlighting the strengths and weaknesses of each. The analysis emphasized different growth trajectories and risk profiles, crucial factors for investors seeking long-term gains.

Apple's Strengths: The report acknowledged Apple's consistent profitability, its robust ecosystem, and the unwavering loyalty of its customer base. Apple's services segment, a significant revenue driver, continues to show impressive growth, further solidifying its position as a stable, high-return investment. The iPhone remains a cash cow, and the expansion into wearables and other services provides a buffer against potential market fluctuations.

Apple's Challenges: However, Morgan Stanley also noted potential headwinds. The premium pricing strategy, while successful, could limit market penetration, especially in emerging markets. Furthermore, increasing competition in the smartphone market and potential regulatory hurdles present ongoing risks.

AMD's Strengths: AMD's rapid growth in the CPU and GPU markets was a significant point of focus. Their innovative technologies and strong partnerships with major players like Microsoft and Sony position them for continued success in the booming gaming and data center sectors. This positions AMD as a potentially higher-growth, albeit higher-risk, investment.

AMD's Challenges: The report highlighted AMD's dependence on a few key clients and the cyclical nature of the semiconductor industry as potential downsides. Increased competition from established players like Intel and Nvidia also presents a significant challenge. The impact of global economic slowdowns on consumer spending in electronics could also negatively affect AMD's performance.

The Investor's Dilemma: Growth vs. Stability

The Morgan Stanley analysis underscores a classic investment dilemma: prioritizing high-growth potential with increased risk (AMD) versus opting for a more stable, albeit potentially slower-growing, investment (Apple). The choice ultimately depends on individual risk tolerance and investment goals.

Factors to Consider:

- Risk Tolerance: Are you comfortable with higher volatility in exchange for potentially higher returns?

- Investment Horizon: Are you investing for the short term or long term? AMD's growth potential might be better suited for longer-term investors.

- Market Sentiment: Keep an eye on broader market trends and how they might impact both companies.

- Diversification: Consider diversifying your portfolio to mitigate risk, regardless of your choice between Apple and AMD.

Conclusion: No Easy Answers, But Informed Choices

Morgan Stanley's comparison of Apple and AMD provides valuable insight for investors navigating the complexities of the tech sector. While the report doesn't offer a definitive "buy" or "sell" recommendation for either company, it emphasizes the importance of understanding the unique risk profiles and growth trajectories before making any investment decisions. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment choices. Further research into individual company financials and market forecasts is crucial for informed decision-making. Stay tuned for further updates and analysis as the tech landscape continues to evolve.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investment Analysis: Morgan Stanley's Choice Between Apple And AMD. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

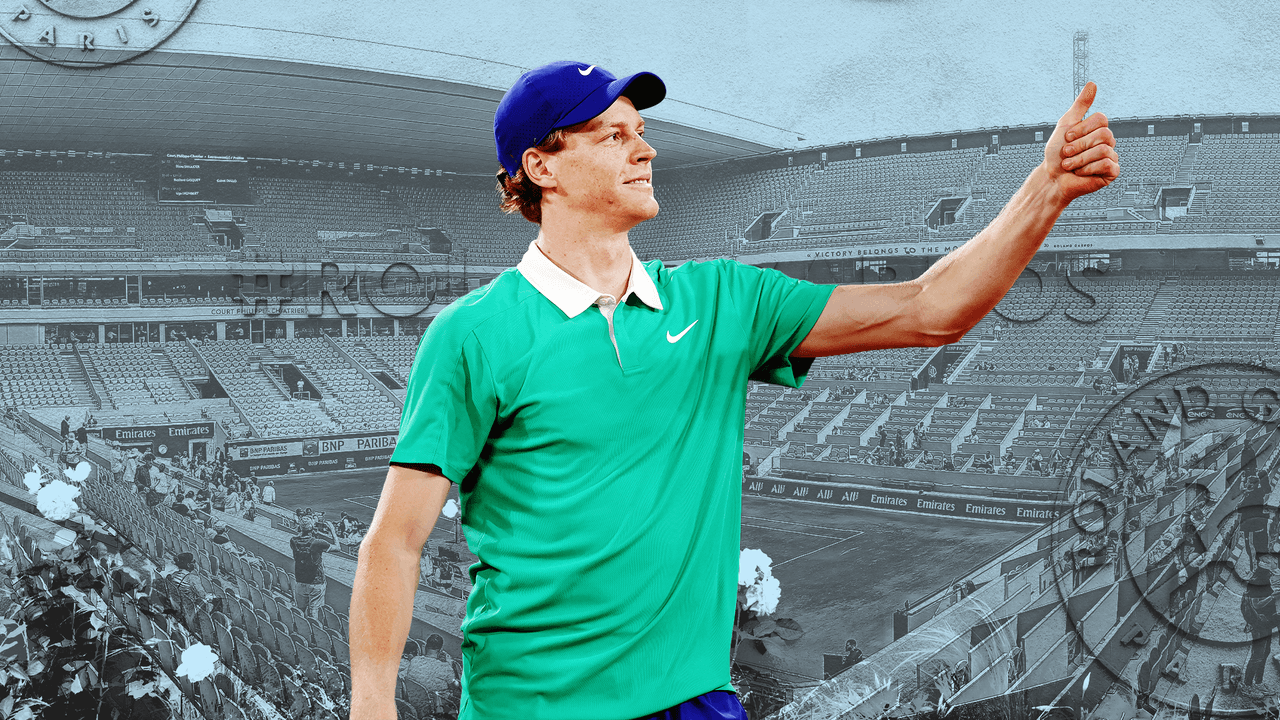

Tutti Gli Incontri Di Sinner Al Roland Garros 2025 Streaming Live

May 28, 2025

Tutti Gli Incontri Di Sinner Al Roland Garros 2025 Streaming Live

May 28, 2025 -

Calciomercato Bayer Leverkusen Ten Hag La Scelta Definitiva Per La Panchina

May 28, 2025

Calciomercato Bayer Leverkusen Ten Hag La Scelta Definitiva Per La Panchina

May 28, 2025 -

Ncaa Baseball Regionals 2024 Sec Secures Eight Hosting Spots

May 28, 2025

Ncaa Baseball Regionals 2024 Sec Secures Eight Hosting Spots

May 28, 2025 -

Indiana Pacers Admit To Subpar Play In Knicks Game 3 Defeat

May 28, 2025

Indiana Pacers Admit To Subpar Play In Knicks Game 3 Defeat

May 28, 2025 -

Haddad Maia Vs Baptiste Roland Garros 2025 Match Prediction And Betting Tips

May 28, 2025

Haddad Maia Vs Baptiste Roland Garros 2025 Match Prediction And Betting Tips

May 28, 2025