Investing In Super Micro Computer: Understanding The Risk Of Correction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Super Micro Computer: Understanding the Risk of Correction

Super Micro Computer (SMCI) has enjoyed a remarkable run, captivating investors with its strong performance in the server market and its position at the forefront of data center technology. However, with any high-growth stock, the potential for a correction looms large. This article delves into the factors that could trigger a SMCI price correction and offers insights for navigating this risk.

Super Micro Computer's Success Story: A Quick Recap

Super Micro Computer's success is largely attributed to its dominance in the high-performance computing (HPC) and artificial intelligence (AI) sectors. The company's innovative server solutions are crucial for data centers worldwide, fueling its impressive revenue growth. This growth has naturally attracted significant investor interest, leading to a substantial rise in SMCI's stock price. But this rapid ascent raises the question: is a correction inevitable?

Factors that Could Trigger a Super Micro Computer Stock Correction

Several factors could contribute to a potential SMCI price correction. Understanding these is crucial for any investor considering adding SMCI to their portfolio.

1. Overvaluation: One of the primary risks is the potential for overvaluation. While SMCI's growth has been impressive, its current valuation might not fully reflect the long-term sustainability of this growth. A sharp decline in future earnings or slower-than-expected growth could lead to a significant price adjustment. Analyzing key financial metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio is crucial in assessing whether the current valuation is justified.

2. Competition: The server market is highly competitive, with established players like Dell Technologies (DELL) and Hewlett Packard Enterprise (HPE) constantly vying for market share. The emergence of new competitors and disruptive technologies could impact SMCI's market position and potentially hinder its growth trajectory.

3. Supply Chain Disruptions: Global supply chain disruptions, particularly concerning components like semiconductors, can significantly impact SMCI's production capabilities and profitability. Any major disruptions could lead to decreased revenue and negatively impact investor sentiment.

4. Economic Slowdown: A broader economic slowdown could dampen demand for data center infrastructure, impacting SMCI's sales and potentially triggering a stock price correction. Economic indicators and forecasts should be carefully monitored.

5. Geopolitical Risks: Geopolitical uncertainties and trade tensions can create significant volatility in the stock market, impacting even the strongest companies like SMCI.

Mitigating the Risk of a Correction

While a correction is a possibility, investors can take steps to mitigate the risk:

- Diversification: Diversifying your investment portfolio across various asset classes and sectors is crucial to reduce risk. Don't put all your eggs in one basket.

- Long-Term Perspective: Investing in growth stocks like SMCI often requires a long-term perspective. Short-term market fluctuations should be viewed within the context of the company's long-term growth potential.

- Fundamental Analysis: Thoroughly research SMCI's financials, competitive landscape, and future growth prospects before investing. Understand the company's strengths and weaknesses.

- Dollar-Cost Averaging (DCA): Investing regularly over time, regardless of short-term price fluctuations, can help reduce the impact of a correction.

Conclusion:

Super Micro Computer presents an exciting investment opportunity, but it's crucial to acknowledge the inherent risks involved. By carefully considering the factors outlined above and implementing a sound investment strategy, investors can better navigate the potential for a correction and potentially benefit from SMCI's long-term growth prospects. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions. This article provides general information and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Super Micro Computer: Understanding The Risk Of Correction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba Playoffs Timberwolves Even The Series Okcs Game 4 Response Crucial

May 27, 2025

Nba Playoffs Timberwolves Even The Series Okcs Game 4 Response Crucial

May 27, 2025 -

Ross Chastains Dramatic Coca Cola 600 Win A Nascar Milestone

May 27, 2025

Ross Chastains Dramatic Coca Cola 600 Win A Nascar Milestone

May 27, 2025 -

Where To Watch Emma Navarro At The 2025 French Open Schedule And Live Streaming Options

May 27, 2025

Where To Watch Emma Navarro At The 2025 French Open Schedule And Live Streaming Options

May 27, 2025 -

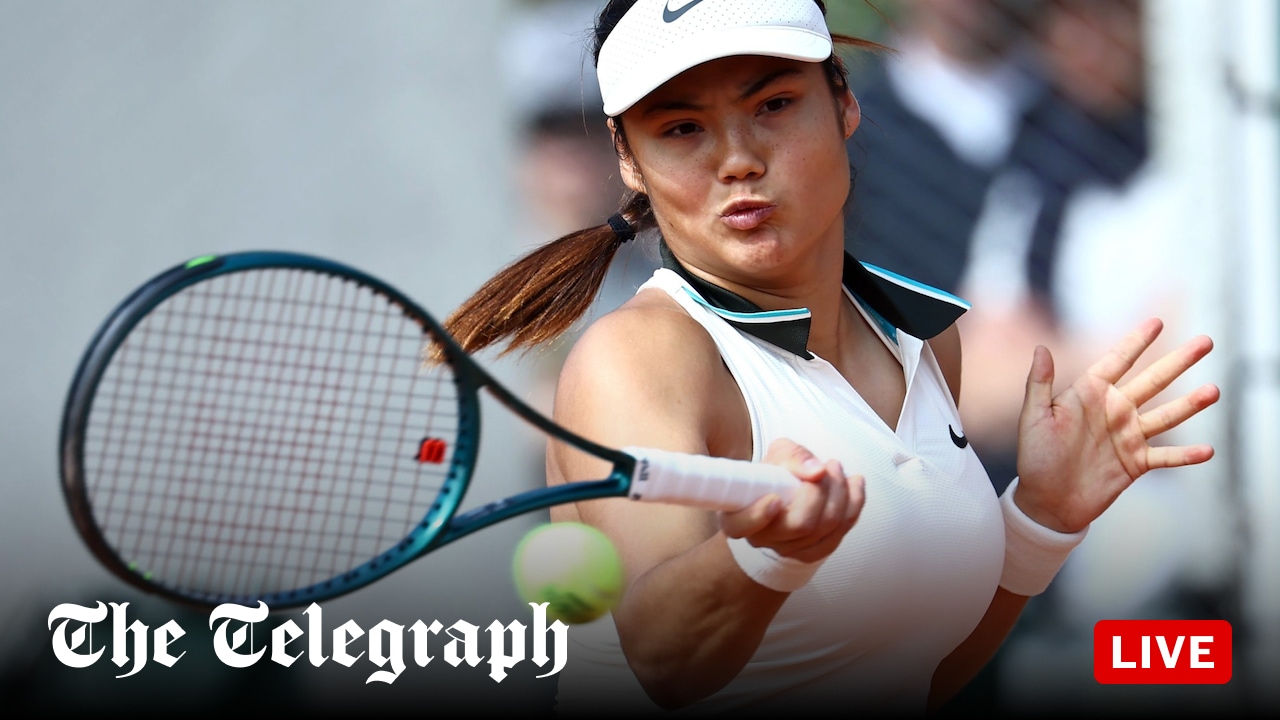

Live Score Raducanu Battles Wang Xinyu At The French Open

May 27, 2025

Live Score Raducanu Battles Wang Xinyu At The French Open

May 27, 2025 -

World Ice Hockey Team Usa Triumphs Over Switzerland

May 27, 2025

World Ice Hockey Team Usa Triumphs Over Switzerland

May 27, 2025