Investing In SMCI: Weighing The Risks And Rewards At A 14.62 P/E.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in SMCI: Weighing the Risks and Rewards at a 14.62 P/E

Is SMCI a smart investment at its current price-to-earnings ratio? This article dives deep into the financials and future prospects of [insert full company name of SMCI here], analyzing its current 14.62 P/E ratio to help you decide if it's the right addition to your portfolio. The stock market is inherently risky, and understanding the potential upsides and downsides before investing is crucial. Let's explore whether SMCI fits your investment strategy.

Understanding SMCI's Current Valuation:

A price-to-earnings ratio (P/E ratio) of 14.62 suggests that investors are willing to pay $14.62 for every $1 of SMCI's earnings. This is considered a relatively low P/E ratio compared to the broader market, potentially indicating that the stock might be undervalued. However, a low P/E ratio isn't always a guarantee of a good investment. We need to delve deeper.

Potential Rewards of Investing in SMCI:

- Lower Entry Point: The relatively low P/E ratio offers a potentially lower entry point compared to higher-valued competitors within the [insert SMCI's industry sector] sector. This could translate into higher potential returns if the company's earnings grow as expected.

- Growth Potential: [Insert details about SMCI's growth potential, citing specific examples like new product launches, expansion into new markets, or positive industry trends]. Researching the company's financial reports and investor presentations can provide further insight into their growth strategy. Look for details on revenue projections, market share, and competitive advantages.

- Dividend Potential: Does SMCI offer a dividend? If so, the dividend yield, in conjunction with potential capital appreciation, could contribute significantly to your overall return. Always review the company's dividend history and payout ratio for stability. [Link to relevant SMCI financial reports or investor relations page].

Potential Risks Associated with SMCI:

- Industry-Specific Risks: The [insert SMCI's industry sector] sector is subject to its own unique challenges and risks. [Discuss relevant industry-specific risks, such as competition, regulatory changes, economic downturns, or technological disruptions]. Understanding these risks is vital before investing.

- Financial Performance: While the P/E ratio is low, it's essential to examine the underlying financial health of SMCI. Analyze key financial metrics such as debt levels, cash flow, and profitability margins. A low P/E ratio could reflect concerns about the company's future earnings or financial stability.

- Market Volatility: No investment is immune to market volatility. External factors, such as economic downturns or geopolitical events, can significantly impact SMCI's stock price regardless of its intrinsic value.

Analyzing the 14.62 P/E Ratio in Context:

A P/E ratio alone isn't sufficient for making an investment decision. It’s crucial to compare SMCI's P/E ratio to its competitors within the [insert SMCI's industry sector] sector and the overall market. Is it significantly lower, suggesting undervaluation, or is it in line with industry averages? [Link to relevant industry analysis or market reports].

Conclusion:

Investing in SMCI at a 14.62 P/E ratio presents both opportunities and risks. Thorough due diligence is crucial. Consider your personal risk tolerance, investment goals, and a comprehensive analysis of SMCI's financial health and future prospects before making an investment decision. Consulting with a qualified financial advisor is always recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing involves risk, and you could lose money. Always conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In SMCI: Weighing The Risks And Rewards At A 14.62 P/E.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Scouting Report Shohei Ohtanis Impressive Dodger Pitching Debut

May 27, 2025

Scouting Report Shohei Ohtanis Impressive Dodger Pitching Debut

May 27, 2025 -

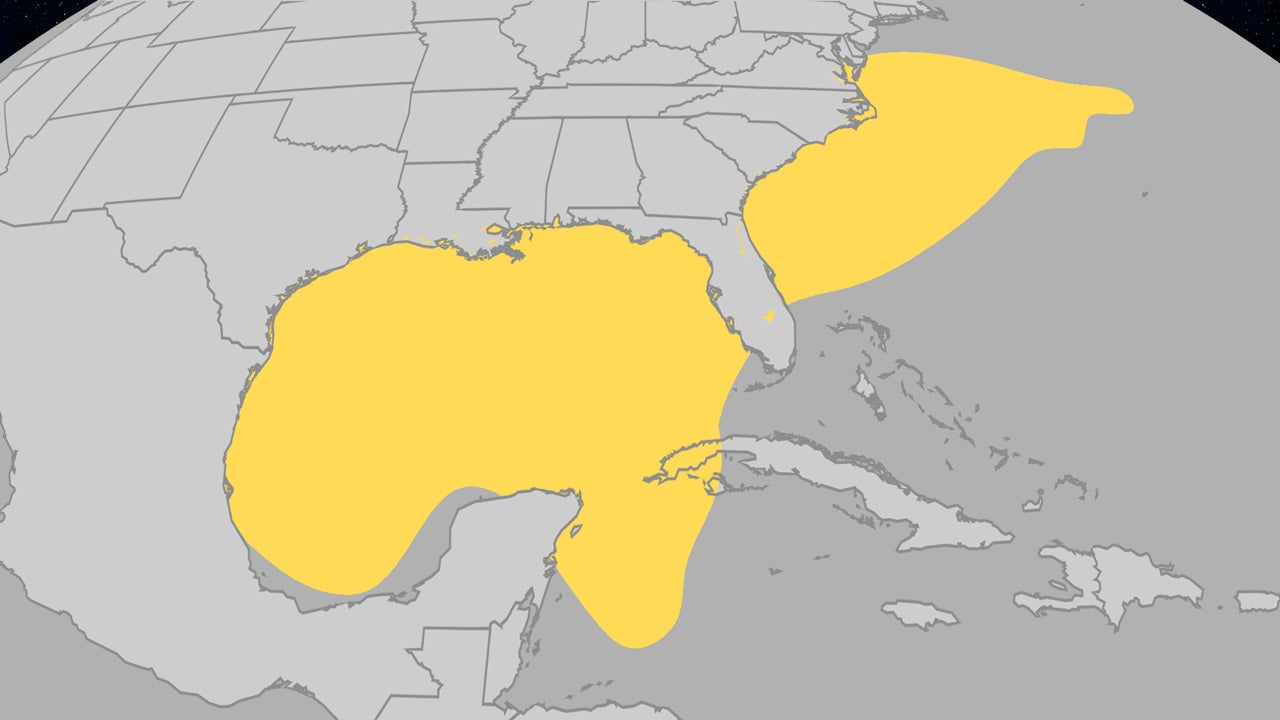

Understanding June Hurricanes Atlantic Storm Development And Increased Activity

May 27, 2025

Understanding June Hurricanes Atlantic Storm Development And Increased Activity

May 27, 2025 -

Nio Expands Ev Infrastructure 100 New Battery Swap Stations For Northeast China

May 27, 2025

Nio Expands Ev Infrastructure 100 New Battery Swap Stations For Northeast China

May 27, 2025 -

William Byron Vs Ross Chastain Coca Cola 600 Showdown Ends In Chastain Victory

May 27, 2025

William Byron Vs Ross Chastain Coca Cola 600 Showdown Ends In Chastain Victory

May 27, 2025 -

Rybakina Vs Bencic French Open 2025 Match Preview And Prediction

May 27, 2025

Rybakina Vs Bencic French Open 2025 Match Preview And Prediction

May 27, 2025