Investing In SMCI: Buy, Sell, Or Hold Decision At 14.62X P/E

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in SMCI: Buy, Sell, or Hold at a 14.62X P/E Ratio?

Should you buy, sell, or hold shares of SMCI (assuming SMCI refers to a publicly traded company)? The decision hinges on a variety of factors, most notably its current Price-to-Earnings (P/E) ratio of 14.62X. This seemingly straightforward number, however, requires deeper analysis before making any investment choices. This article will delve into the key considerations for determining the best course of action for your investment portfolio.

Understanding SMCI's P/E Ratio

The Price-to-Earnings ratio (P/E) is a crucial valuation metric. It represents the price investors are willing to pay for every dollar of a company's earnings. A P/E ratio of 14.62X suggests that investors are paying $14.62 for every $1 of SMCI's earnings per share (EPS). This figure, on its own, doesn't offer a definitive buy, sell, or hold signal. Its significance depends heavily on context.

Factors influencing the interpretation of SMCI's 14.62X P/E:

- Industry Benchmarks: Comparing SMCI's P/E ratio to its competitors within the same industry is critical. A higher P/E ratio than its peers might signal overvaluation, while a lower ratio could indicate undervaluation. Understanding industry trends and growth prospects is crucial.

- Company Growth Rate: A higher P/E ratio can be justified if SMCI demonstrates strong and sustainable earnings growth. Fast-growing companies often command higher multiples. Investors should carefully analyze SMCI's historical growth rate and future projections.

- Debt Levels: High levels of debt can significantly impact a company's profitability and future performance. Analyzing SMCI's debt-to-equity ratio and other debt metrics is crucial.

- Overall Market Conditions: The broader market environment plays a significant role. During bull markets, P/E ratios tend to be higher across the board. A seemingly high P/E ratio might be normal in a robust market.

- Future Earnings Expectations: Analyst forecasts for SMCI's future earnings are vital. Positive revisions suggest strong future prospects, potentially justifying a higher P/E. Conversely, negative revisions could raise concerns.

Analyzing SMCI's Financials: Beyond the P/E Ratio

While the P/E ratio provides valuable insight, it's just one piece of the puzzle. A thorough due diligence process requires analyzing additional financial metrics, including:

- Revenue Growth: Is SMCI experiencing consistent revenue growth? This indicates the company's ability to generate sales and expand its market share.

- Profit Margins: Are SMCI's profit margins healthy and improving? This shows the company's efficiency in converting sales into profits.

- Cash Flow: A strong cash flow indicates financial stability and the ability to meet its obligations. Examine SMCI's operating cash flow and free cash flow.

- Return on Equity (ROE): ROE measures how effectively SMCI utilizes shareholder investments to generate profits.

Buy, Sell, or Hold: Your Decision

Ultimately, the decision to buy, sell, or hold SMCI depends on your individual investment goals, risk tolerance, and a comprehensive analysis of the company's financial health and future prospects. The 14.62X P/E ratio provides a starting point for your analysis, but it's crucial to delve deeper into the factors mentioned above.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Before making any investment decisions, consult with a qualified financial advisor. Always conduct your own thorough research and assess your risk tolerance. Remember to consider your individual circumstances before making any investment decisions.

Further Research: To perform your own thorough due diligence, consider researching SMCI's SEC filings (10-K and 10-Q reports) and consulting financial news sources and analyst reports.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In SMCI: Buy, Sell, Or Hold Decision At 14.62X P/E. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Calgary Bandits Reign Supreme Three Peat In Nll Finals

May 27, 2025

Calgary Bandits Reign Supreme Three Peat In Nll Finals

May 27, 2025 -

College Football Playoff Odds 2025 Updated Predictions Post Format Change

May 27, 2025

College Football Playoff Odds 2025 Updated Predictions Post Format Change

May 27, 2025 -

Palous Historic Indy 500 Win First Spaniard To Claim Victory

May 27, 2025

Palous Historic Indy 500 Win First Spaniard To Claim Victory

May 27, 2025 -

Room For Disappointment Analysts Take On Super Micro Computers Stock Performance

May 27, 2025

Room For Disappointment Analysts Take On Super Micro Computers Stock Performance

May 27, 2025 -

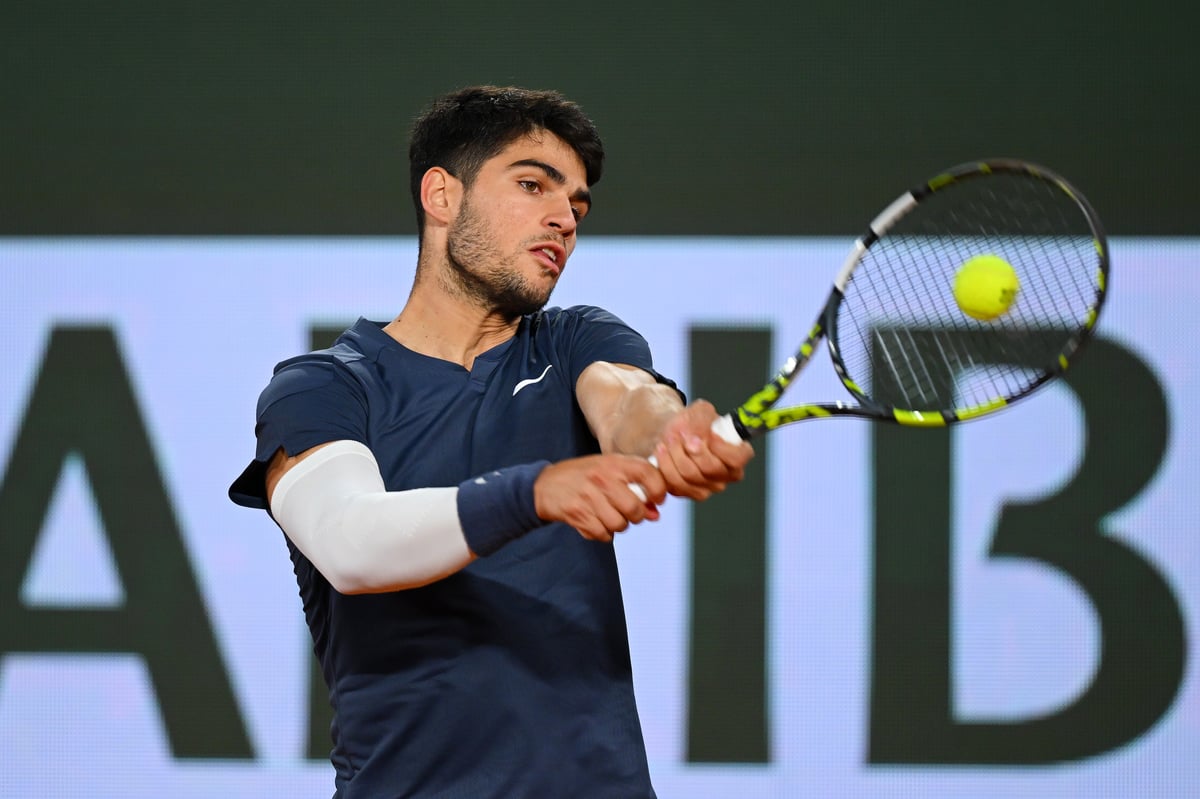

Watch The French Open 2025 In The Uk Live Stream And Tv Coverage

May 27, 2025

Watch The French Open 2025 In The Uk Live Stream And Tv Coverage

May 27, 2025