Investing In Nio: A Detailed Look At The Electric Vehicle Maker's Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in Nio: A Detailed Look at the Electric Vehicle Maker's Stock

The electric vehicle (EV) market is booming, and Nio (NIO) has emerged as a key player in this rapidly expanding sector. But is investing in Nio a smart move for your portfolio? This in-depth analysis explores the company's strengths, weaknesses, opportunities, and threats (SWOT analysis), helping you make an informed decision about whether to add NIO stock to your holdings.

Nio's Strengths: A Powerful Position in the EV Market

Nio boasts several significant competitive advantages. Its focus on premium EVs in the Chinese market has proven successful, tapping into a growing demand for luxury electric vehicles. The company's innovative battery-as-a-service (BaaS) model offers a compelling subscription option, lowering the initial purchase price and attracting a wider customer base. This innovative approach is a key differentiator in a fiercely competitive market. Furthermore, Nio's sophisticated technology, including advanced driver-assistance systems (ADAS) and a strong commitment to research and development (R&D), positions it well for future growth. The impressive design and performance of its vehicles are also critical to its brand appeal.

Weaknesses: Challenges and Risks for Nio Investors

While Nio's potential is undeniable, investors should acknowledge some key challenges. The company's heavy reliance on the Chinese market exposes it to geopolitical risks and potential regulatory changes within China. Competition from established automakers and other emerging EV players is intense, requiring continuous innovation and significant investment to maintain market share. Profitability remains a concern, with the company still operating at a loss. Furthermore, supply chain disruptions and the global chip shortage continue to present significant headwinds.

Opportunities: Future Growth and Expansion for Nio

Nio's opportunities are vast. Expansion into new international markets beyond China presents a significant growth avenue. Continued technological advancements, particularly in autonomous driving capabilities, could solidify Nio's position as a leader in the EV industry. The growing global awareness of environmental concerns and government incentives for EV adoption fuel significant market potential. Furthermore, strategic partnerships and collaborations can accelerate growth and market penetration.

Threats: Competitive Landscape and Market Volatility

The EV market is incredibly competitive, with established automakers investing heavily in their own electric vehicle offerings. Price wars and intense competition for market share pose a significant threat. Fluctuations in the price of raw materials, particularly battery components, can impact profitability. Economic downturns and changes in consumer spending habits can also negatively affect sales. Lastly, negative publicity or regulatory setbacks could damage the company's reputation and investor confidence.

Nio Stock: A Detailed Financial Overview

Before making any investment decisions, it's crucial to analyze Nio's financial performance, including revenue growth, profitability, debt levels, and cash flow. Reviewing financial statements and analyst reports will provide a more comprehensive picture of the company's financial health. Remember to consult a financial advisor before making any investment decisions.

Conclusion: Is Investing in Nio Right for You?

Investing in Nio involves considerable risk, but also substantial potential reward. The company's innovative approach and strong brand presence in the growing EV market are attractive, but investors must be aware of the significant challenges and competitive landscape. Thorough due diligence, understanding the company's financials, and considering your own risk tolerance are critical before investing in NIO stock. This detailed analysis provides a framework for your decision-making process. Remember to always conduct your own research and seek professional financial advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In Nio: A Detailed Look At The Electric Vehicle Maker's Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

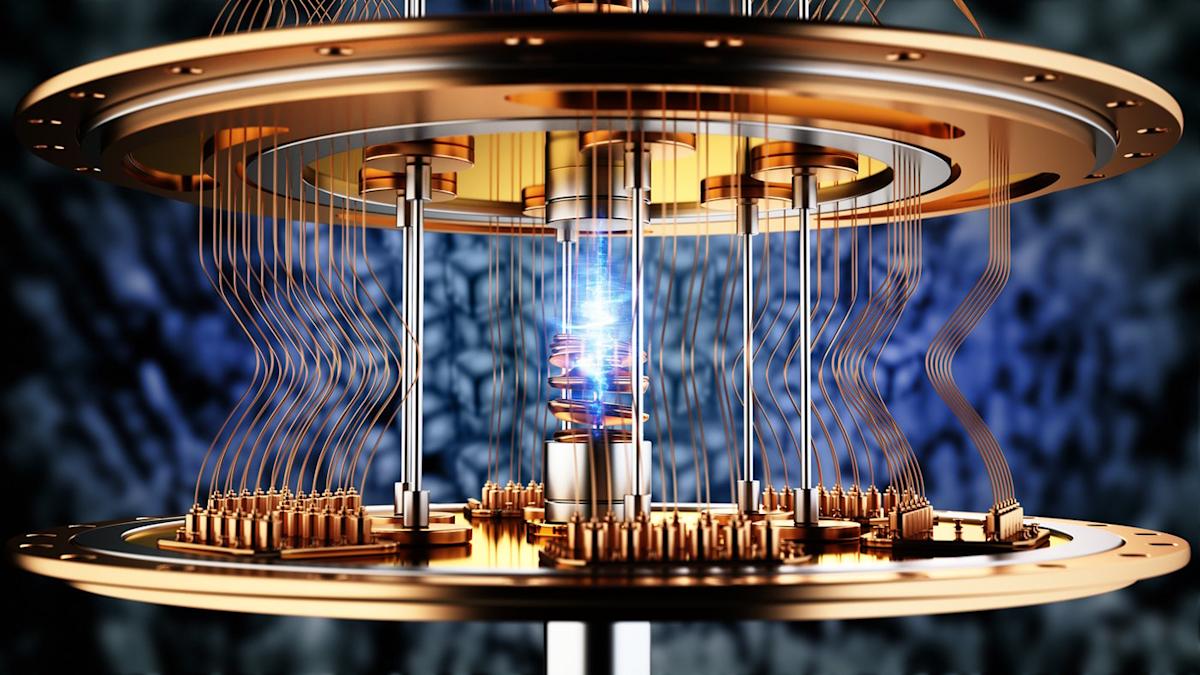

Quantum Computing Stocks Is Rigetti Or D Wave The Better Long Term Bet

May 28, 2025

Quantum Computing Stocks Is Rigetti Or D Wave The Better Long Term Bet

May 28, 2025 -

Chaos At The Start Comparing The 1992 And 109th Indy 500 Races

May 28, 2025

Chaos At The Start Comparing The 1992 And 109th Indy 500 Races

May 28, 2025 -

Three Peat Dream Shattered Josef Newgardens Indy 500 Reflection

May 28, 2025

Three Peat Dream Shattered Josef Newgardens Indy 500 Reflection

May 28, 2025 -

Understanding June Hurricanes Atlantic Storm Formation And Recent Trends

May 28, 2025

Understanding June Hurricanes Atlantic Storm Formation And Recent Trends

May 28, 2025 -

College Football Star Travis Hunter Officially Marries Leanna De La Fuente

May 28, 2025

College Football Star Travis Hunter Officially Marries Leanna De La Fuente

May 28, 2025