Investing In AVGO: Analyzing Broadcom's Upcoming Q2 Earnings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in AVGO: Analyzing Broadcom's Upcoming Q2 Earnings

Broadcom (AVGO) is set to release its second-quarter earnings report soon, leaving investors eagerly anticipating the results and their implications for future stock performance. This report is crucial, not only for understanding the company's current financial health but also for gauging the broader semiconductor industry's trajectory. This article delves into the key factors influencing AVGO's Q2 performance and provides insights for investors considering adding AVGO to their portfolio or adjusting their existing holdings.

Broadcom's Strong Position in a Dynamic Market:

Broadcom, a leading designer, developer, and global supplier of a wide range of high-performance semiconductor and infrastructure software solutions, enjoys a dominant position in several key markets. Its diverse product portfolio, spanning networking, storage, wireless communications, and industrial applications, provides a degree of insulation against cyclical downturns affecting specific sectors. However, the current economic climate and geopolitical uncertainties present challenges that need careful consideration.

Key Factors to Watch in the Q2 Earnings Report:

Several key metrics will shape investor sentiment surrounding AVGO's Q2 earnings:

-

Revenue Growth: Analysts will be scrutinizing revenue figures across various segments. Any deviation from projected growth rates will significantly impact the stock price. Strong growth in key areas like cloud infrastructure and 5G could signal robust future performance.

-

Gross Margins: Maintaining healthy gross margins is crucial for profitability. Pressure from increased competition or rising manufacturing costs could negatively affect margins and investor confidence.

-

Guidance for Q3 and Beyond: The company's outlook for the remainder of the year is equally important. Positive guidance suggests confidence in future growth, while cautious guidance might signal potential headwinds.

-

Software Revenue: Broadcom's increasing focus on software solutions is a critical aspect of its long-term growth strategy. Strong performance in this sector would be a positive indicator.

-

Impact of Geopolitical Factors: The ongoing US-China trade tensions and global supply chain disruptions continue to influence the semiconductor industry. AVGO's ability to navigate these complexities will be a key focus for investors.

Analyzing the Risks:

While AVGO boasts a strong market position, investors should be aware of potential risks:

- Competition: Intense competition from other major players in the semiconductor industry could impact market share and profitability.

- Economic Slowdown: A global economic downturn could significantly reduce demand for semiconductor products, affecting AVGO's revenue.

- Supply Chain Disruptions: Ongoing supply chain challenges could impact production and delivery timelines.

Should You Invest in AVGO?

The upcoming Q2 earnings report will be a pivotal moment for AVGO investors. While the company's strong market position and diversified portfolio offer a degree of stability, careful analysis of the reported figures and future guidance is crucial. Consider consulting with a financial advisor before making any investment decisions. [Link to a reputable financial advisor website]. Remember, past performance is not indicative of future results. Thorough due diligence is always recommended before investing in any stock.

Stay Updated:

For the latest updates on Broadcom and other significant market events, follow reputable financial news sources like [Link to a reputable financial news source]. Monitoring news and analyst reports leading up to and following the earnings release will allow you to make informed investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In AVGO: Analyzing Broadcom's Upcoming Q2 Earnings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

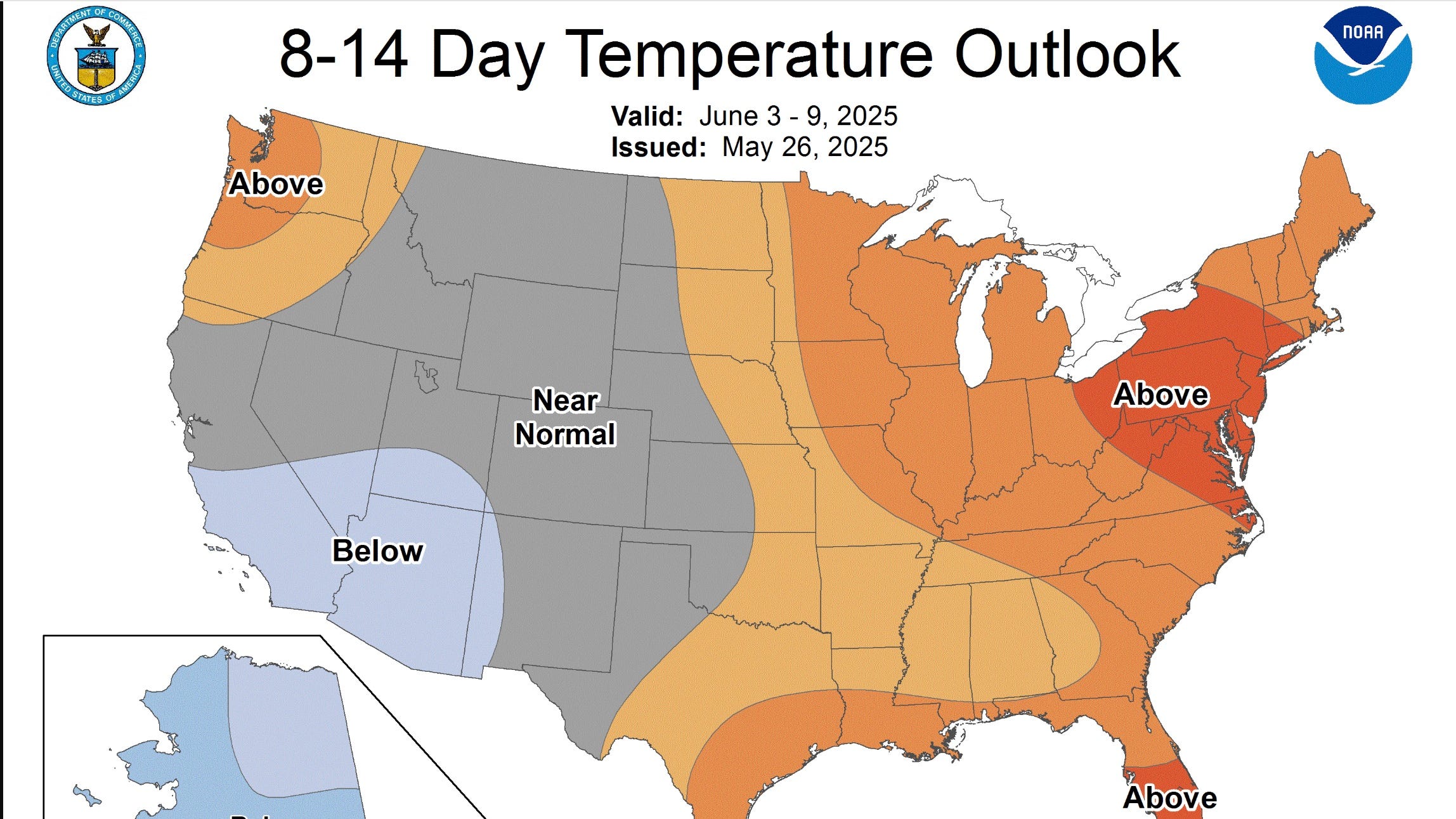

Willamette Valley Oregon High Temperatures In The 80s And 90s This Week

Jun 05, 2025

Willamette Valley Oregon High Temperatures In The 80s And 90s This Week

Jun 05, 2025 -

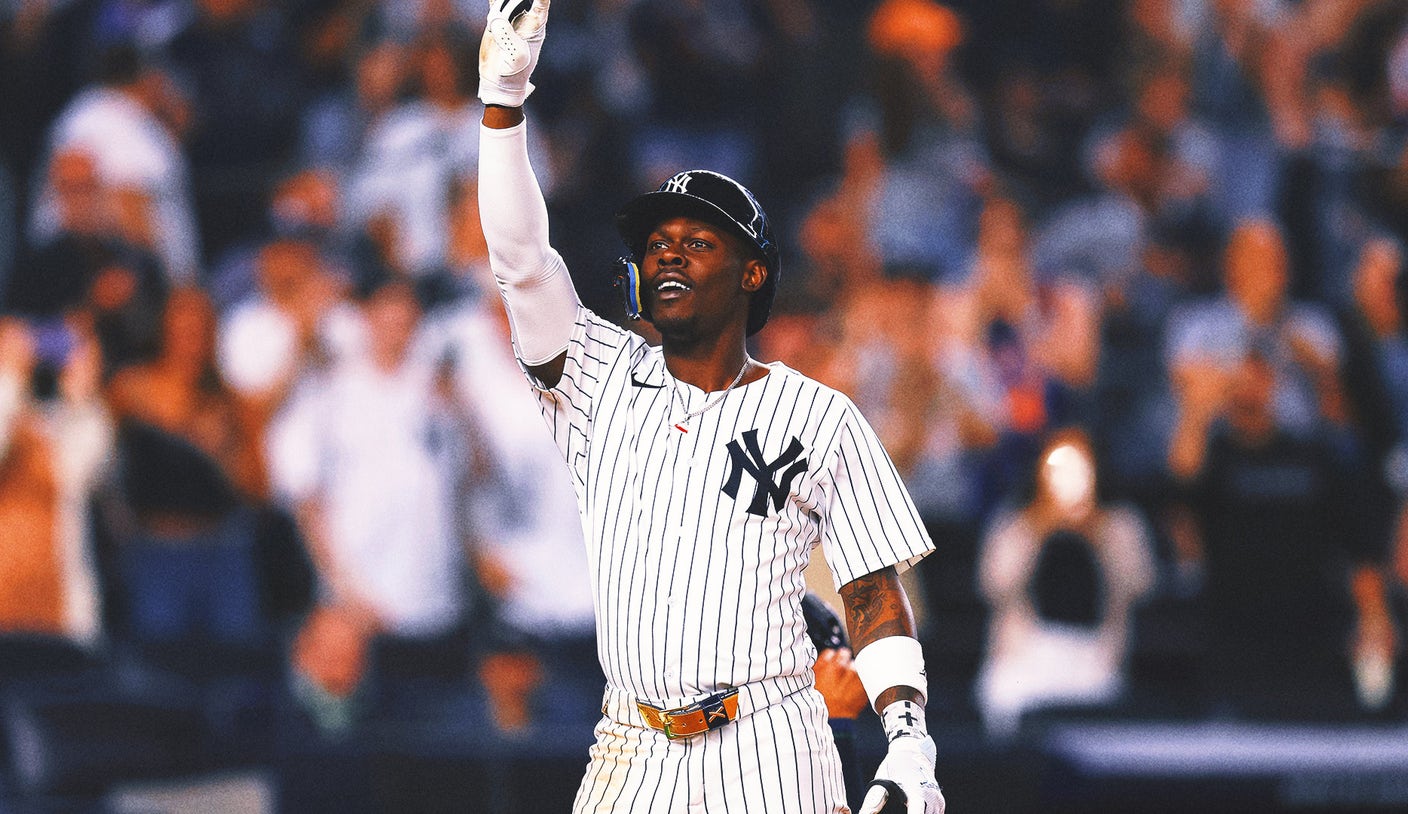

Chisholm Jr S Return Sparks Yankees Win Jazz Back In Action

Jun 05, 2025

Chisholm Jr S Return Sparks Yankees Win Jazz Back In Action

Jun 05, 2025 -

Cameron Young Rallies To Qualify For The U S Open

Jun 05, 2025

Cameron Young Rallies To Qualify For The U S Open

Jun 05, 2025 -

Meet Carl Nassib The Story Behind The Nfls First Openly Gay Athlete

Jun 05, 2025

Meet Carl Nassib The Story Behind The Nfls First Openly Gay Athlete

Jun 05, 2025 -

Report Joe Sacco Leaving Boston Bruins For Coaching Position

Jun 05, 2025

Report Joe Sacco Leaving Boston Bruins For Coaching Position

Jun 05, 2025