Investing In AI: CRDO Or AVGO – Which Semiconductor Stock Reigns Supreme?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in AI: CRDO or AVGO – Which Semiconductor Stock Reigns Supreme?

The artificial intelligence (AI) boom is reshaping the tech landscape, and semiconductor companies are at the forefront of this revolution. Two prominent players vying for investor attention are Broadcom (AVGO) and Analog Devices (CRDO). But which stock offers the superior investment opportunity in this burgeoning market? Let's delve into a comparative analysis to help you make an informed decision.

The AI Semiconductor Landscape: A High-Stakes Game

The demand for advanced semiconductors is skyrocketing due to the increasing adoption of AI across various sectors, from data centers and cloud computing to autonomous vehicles and the Internet of Things (IoT). This explosive growth creates significant opportunities for semiconductor companies like Broadcom and Analog Devices, each with its own strengths and strategic positioning within the AI ecosystem.

Broadcom (AVGO): A Diversified Giant

Broadcom is a behemoth in the semiconductor industry, boasting a diverse portfolio that extends beyond AI. Their strength lies in their broad range of products, including networking chips, infrastructure software, and wireless components. This diversification mitigates risk, offering a degree of stability that appeals to risk-averse investors.

- Strengths: Diversified revenue streams, strong market position in key sectors, consistent financial performance.

- Weaknesses: Less direct exposure to the core of AI hardware acceleration compared to CRDO. Valuation might be considered high by some analysts.

- AI Relevance: AVGO's chips are crucial for data centers and networking infrastructure, which are essential for AI operations.

Analog Devices (CRDO): A Focus on High-Performance Analog

Analog Devices specializes in high-performance analog and mixed-signal semiconductors, which are critical components in many AI applications. Their expertise in signal processing, power management, and sensor technologies makes them a key player in the AI hardware acceleration space. This targeted approach allows for deeper penetration into specific, high-growth AI segments.

- Strengths: Strong presence in high-growth AI-related segments like sensor technology and data acquisition, superior technology in specific niches.

- Weaknesses: More concentrated exposure to the AI sector, potentially making them more vulnerable to market fluctuations in this specific area.

- AI Relevance: CRDO's components are directly integrated into AI hardware, such as high-performance computing systems and autonomous driving systems.

CRDO vs. AVGO: A Head-to-Head Comparison

| Feature | Broadcom (AVGO) | Analog Devices (CRDO) |

|---|---|---|

| Market Cap | Significantly Larger | Smaller |

| Diversification | Highly Diversified | More Focused on AI-related segments |

| AI Exposure | Indirect, through infrastructure | Direct, through hardware acceleration |

| Growth Potential | Steady, but potentially slower growth | Higher growth potential, but higher risk |

| Risk | Lower overall risk | Higher risk due to market concentration |

Which Stock is Right for You?

The "better" investment depends entirely on your individual investment goals and risk tolerance.

-

Conservative Investors: AVGO's diversification and established market position might be more appealing. The lower risk comes with potentially lower returns.

-

Growth-Oriented Investors: CRDO offers higher growth potential, but with increased risk. Its concentrated focus on AI hardware could lead to significant returns if the sector continues its rapid expansion.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consult with a financial advisor before making any investment decisions. Always consider your own risk tolerance and investment goals. Remember to diversify your portfolio to mitigate risk. Learn more about investing in the semiconductor industry by researching [link to relevant article/resource]. Stay informed about market trends by following [link to relevant financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In AI: CRDO Or AVGO – Which Semiconductor Stock Reigns Supreme?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

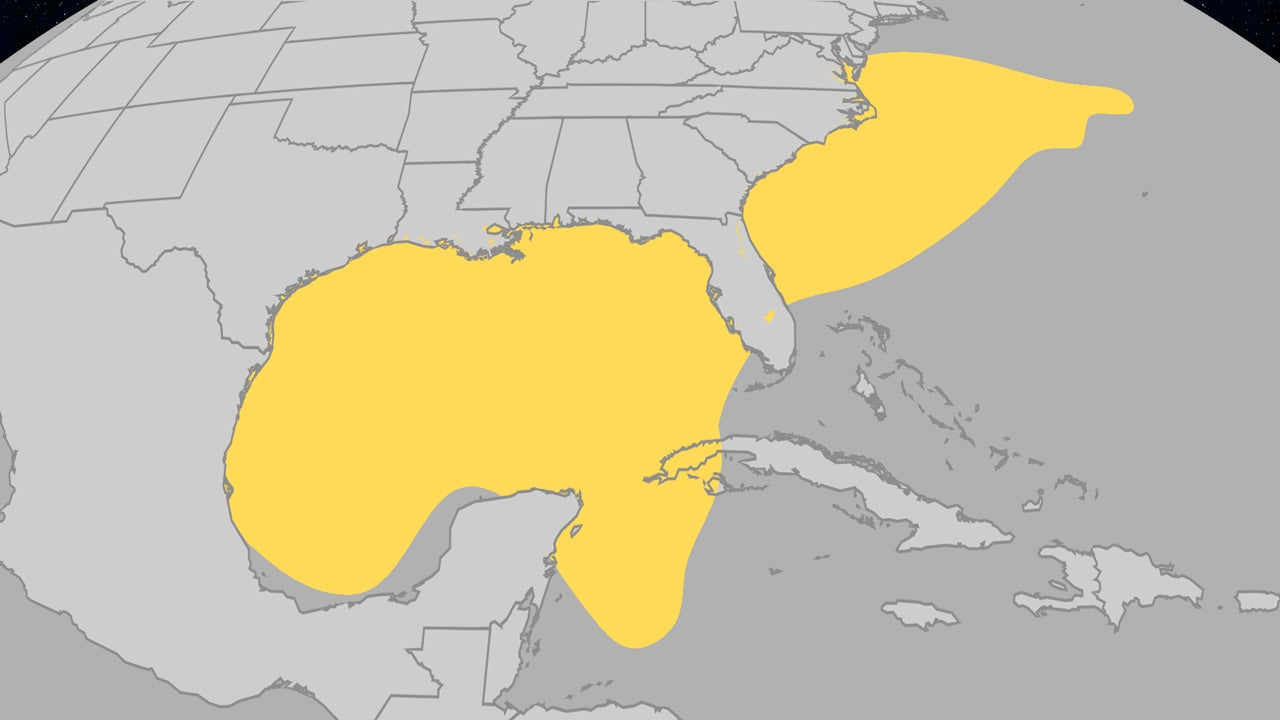

June Hurricanes A Look At Atlantic Storm Development And Recent Trends

May 27, 2025

June Hurricanes A Look At Atlantic Storm Development And Recent Trends

May 27, 2025 -

Roland Garros Former Cavaliers French Open Campaign Begins

May 27, 2025

Roland Garros Former Cavaliers French Open Campaign Begins

May 27, 2025 -

French Open Showdown Ex Cavaliers To Compete In Paris

May 27, 2025

French Open Showdown Ex Cavaliers To Compete In Paris

May 27, 2025 -

Elena Rybakina Vs Diane Parry Roland Garros 2025 Match Analysis And Odds

May 27, 2025

Elena Rybakina Vs Diane Parry Roland Garros 2025 Match Analysis And Odds

May 27, 2025 -

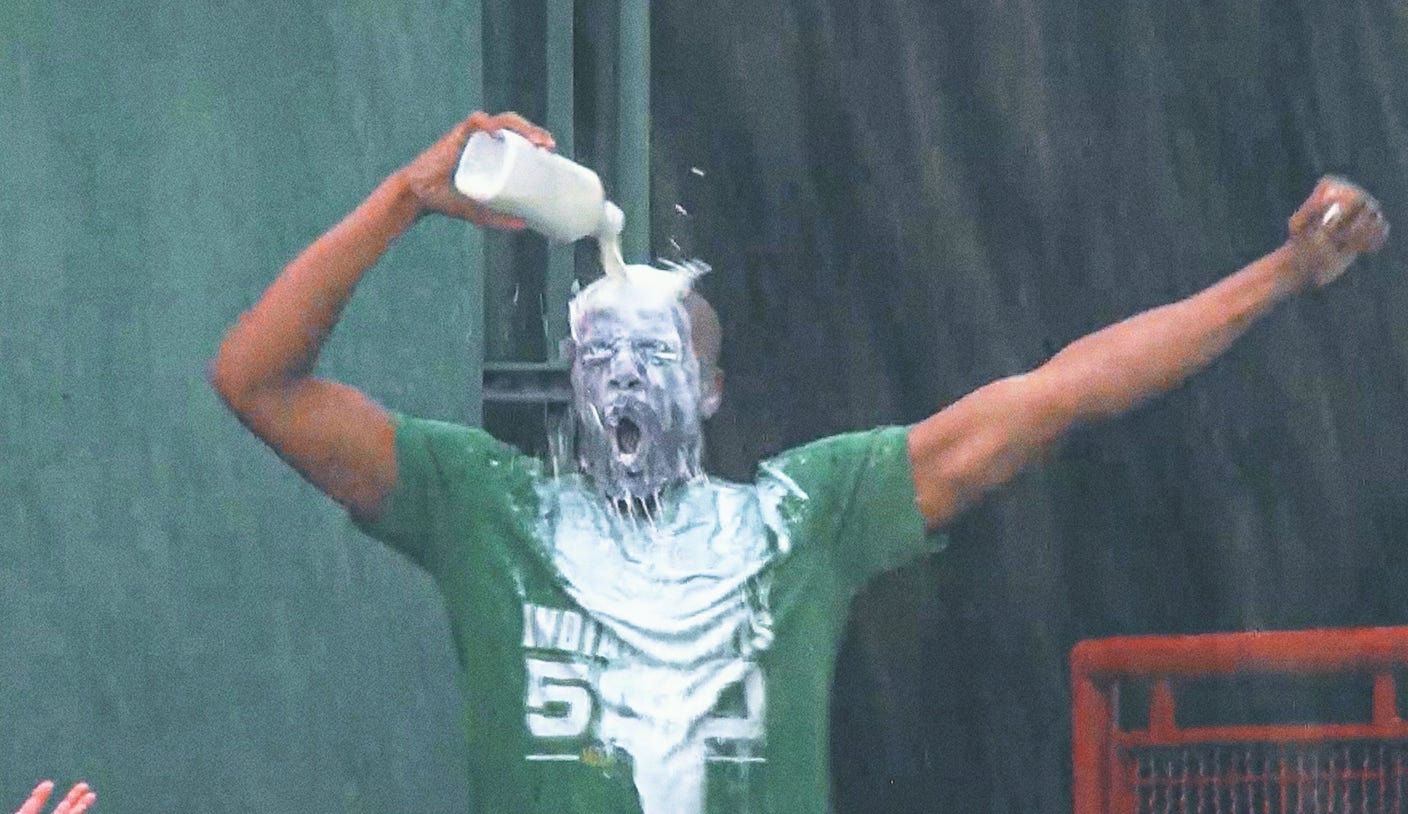

Milk Showers And Home Runs The Strange Baseball Tradition Taking Over

May 27, 2025

Milk Showers And Home Runs The Strange Baseball Tradition Taking Over

May 27, 2025