Investing In AI: CRDO Or AVGO – A Comparative Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Investing in AI: CRDO or AVGO – A Comparative Analysis

The artificial intelligence (AI) revolution is reshaping industries, and savvy investors are looking for ways to capitalize on this transformative technology. Two prominent players frequently mentioned in discussions about AI investment are CrowdStrike Holdings, Inc. (CRDO) and Broadcom Inc. (AVGO). But which one offers a better investment opportunity? This comparative analysis delves into both companies, examining their strengths, weaknesses, and potential for future growth within the AI landscape.

Understanding the Landscape: CRDO's Focus on Cybersecurity and AVGO's Broader Reach

Before diving into a direct comparison, it's crucial to understand the distinct approaches each company takes. CrowdStrike (CRDO) is a cybersecurity company leveraging AI and machine learning for threat detection and response. Their core product, Falcon, is a cloud-native platform providing endpoint protection, threat intelligence, and incident response capabilities. This makes them a strong contender for investors specifically interested in the burgeoning AI-powered cybersecurity sector. Learn more about the importance of cybersecurity in the age of AI [link to relevant external article on cybersecurity and AI].

Broadcom (AVGO), on the other hand, operates in a much broader market. While AI is a significant component of their growth strategy, their portfolio includes semiconductor solutions, infrastructure software, and wireless communication technologies. Their involvement in AI is more diversified, encompassing the provision of crucial hardware and software components for AI development and deployment across various sectors.

CRDO: A Pure-Play AI Cybersecurity Investment

- Strengths: CRDO is a clear leader in cloud-native endpoint protection, leveraging AI to enhance its effectiveness. Their recurring revenue model provides stability and predictability. The increasing sophistication of cyber threats fuels demand for their AI-driven solutions.

- Weaknesses: As a more focused company, CRDO's growth is tied heavily to the cybersecurity market. A downturn in this sector could significantly impact their performance. Their valuation might be considered high relative to their current size.

- AI Integration: CRDO's AI integration is core to its business model, directly impacting its threat detection and response capabilities. This makes it an attractive investment for those focused specifically on AI's role in cybersecurity.

AVGO: Diversification and AI Integration Across Multiple Sectors

- Strengths: AVGO benefits from diversification across multiple technology sectors, reducing reliance on any single market. Their strong financial position allows for strategic acquisitions and expansion into new AI-related areas. They are a significant supplier to major tech companies developing AI solutions.

- Weaknesses: Their broad portfolio may dilute the impact of their AI-related investments on overall performance. Competition in the semiconductor and infrastructure software markets is intense.

- AI Integration: AVGO's AI integration is more subtle, providing the underlying infrastructure and components that power AI development and deployment in various applications.

Head-to-Head Comparison: CRDO vs. AVGO

| Feature | CRDO | AVGO |

|---|---|---|

| Focus | Cybersecurity (AI-driven) | Semiconductors, Software, Wireless |

| AI Integration | Core to business model | Supporting role across multiple sectors |

| Risk Profile | Higher (more focused market) | Lower (diversified portfolio) |

| Growth Potential | High (in the rapidly growing cybersecurity AI market) | Moderate to High (broad market presence) |

| Valuation | Potentially High | Generally considered more moderate |

Conclusion: Choosing Your AI Investment Path

The choice between CRDO and AVGO depends on your individual investment strategy and risk tolerance. CRDO presents a higher-risk, higher-reward opportunity for investors specifically targeting the burgeoning AI-powered cybersecurity market. AVGO offers a more conservative approach, with diversified growth potential across several technology sectors, albeit with a less direct exposure to the core AI narrative. Thorough due diligence, considering your investment timeline and risk appetite, is crucial before making any investment decisions. Remember to consult with a financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Investing In AI: CRDO Or AVGO – A Comparative Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hurricane Seasons Unexpected June Surge Tracking Atlantic Storm Development

May 27, 2025

Hurricane Seasons Unexpected June Surge Tracking Atlantic Storm Development

May 27, 2025 -

Electric Vehicle Boost Nio Adds 100 Battery Swap Stations Across Northeast China

May 27, 2025

Electric Vehicle Boost Nio Adds 100 Battery Swap Stations Across Northeast China

May 27, 2025 -

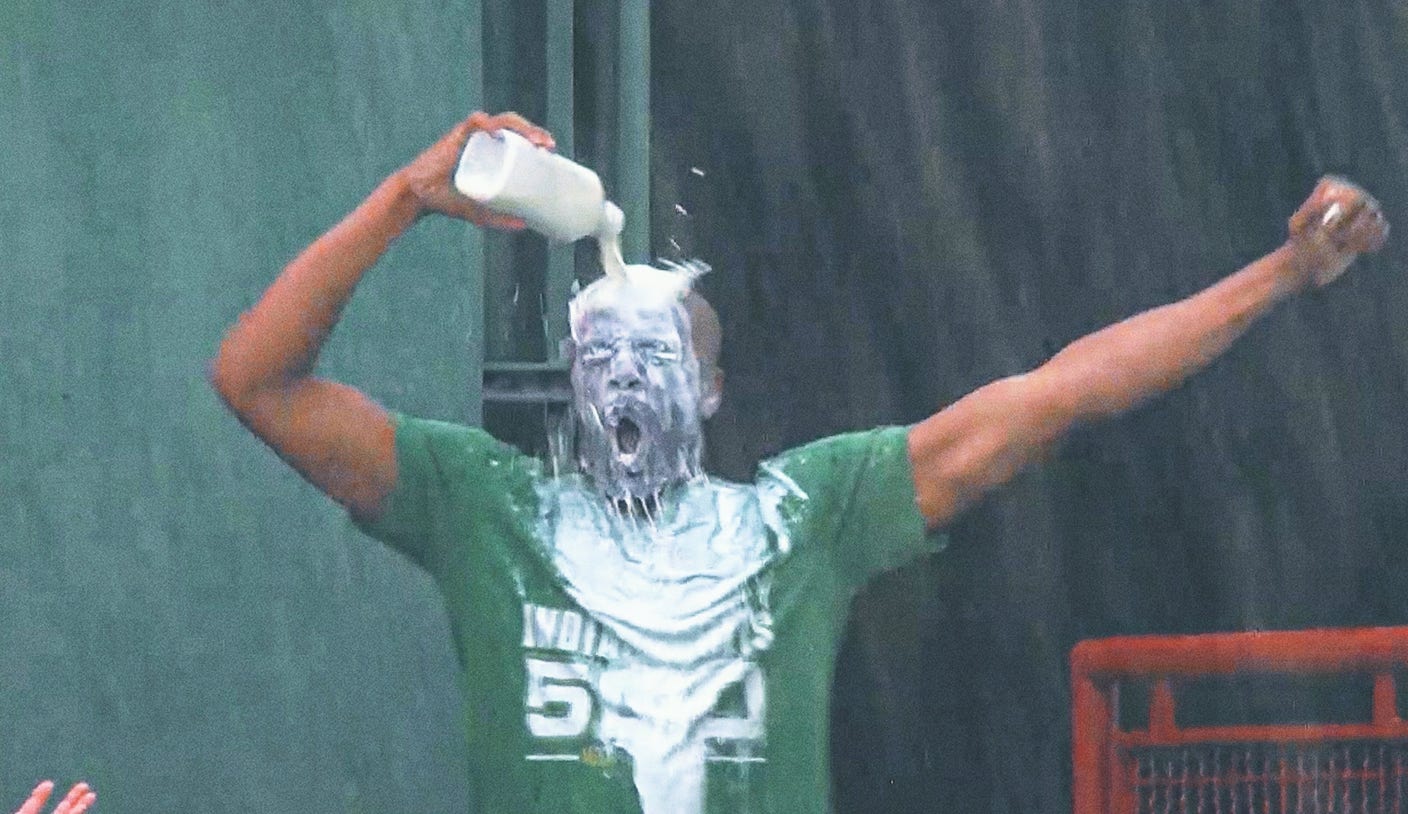

From Indy 500 To Baseball The Unexpected Milk Bath Trend

May 27, 2025

From Indy 500 To Baseball The Unexpected Milk Bath Trend

May 27, 2025 -

Liberty Edge Out Caitlin Clarks Fever A Game Decided By Controversial Calls

May 27, 2025

Liberty Edge Out Caitlin Clarks Fever A Game Decided By Controversial Calls

May 27, 2025 -

Raducanu Vs Wang At Roland Garros French Open 2025 Live Tennis

May 27, 2025

Raducanu Vs Wang At Roland Garros French Open 2025 Live Tennis

May 27, 2025