Interest Rate Cut Bets Surge After Nasdaq 100 Retreats From Record

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Interest Rate Cut Bets Surge After Nasdaq 100 Retreats from Record High

The Nasdaq 100's recent retreat from its record high has sent shockwaves through the market, sparking a surge in bets on interest rate cuts by the Federal Reserve. Investors, initially optimistic about sustained economic growth, are now reassessing their positions in the face of growing uncertainty. This shift suggests a potential pivot in the Federal Reserve's monetary policy, a development with significant implications for both the US and the global economy.

Nasdaq 100's Retreat: A Sign of Things to Come?

The Nasdaq 100, a technology-heavy index, serves as a key barometer of investor sentiment. Its recent pullback, following a period of sustained growth, has raised concerns about the overall health of the market. Analysts point to several factors contributing to this decline, including rising inflation, geopolitical tensions, and the potential for a more aggressive Federal Reserve stance on interest rates. This downturn has led many to believe that the current economic expansion may be nearing its peak.

The Market's Reaction: A Flight to Safety?

The market's response to the Nasdaq 100's retreat has been swift and significant. Investors, fearing further declines, are increasingly hedging their bets, leading to a spike in demand for assets perceived as safer havens, such as government bonds. This shift in investor behavior is a key indicator of growing unease about the economic outlook.

Interest Rate Cut Expectations Rise:

Perhaps the most striking consequence of the Nasdaq 100's retreat is the surge in bets on future interest rate cuts. Futures markets are now pricing in a significant probability of the Federal Reserve lowering interest rates in the coming months. This represents a dramatic shift from earlier expectations of continued rate hikes aimed at combating inflation.

- Why the change? The market's expectation is that the economic slowdown indicated by the tech sector's dip requires a less hawkish Fed approach. A rate cut could stimulate economic growth and prevent a sharper downturn.

- What does this mean for investors? Investors should closely monitor economic indicators and Fed statements for clues about the future direction of interest rates. Portfolio diversification is crucial in times of uncertainty.

The Fed's Dilemma: Balancing Inflation and Growth

The Federal Reserve now faces a difficult balancing act. While inflation remains stubbornly high, the slowing growth signaled by the Nasdaq 100’s performance suggests a need for a less restrictive monetary policy. Any decision by the Fed will have far-reaching consequences, affecting everything from borrowing costs to investment strategies. The coming months will be crucial in determining the Fed's approach and the subsequent impact on the global economy.

Looking Ahead: Uncertainty Remains

The recent market volatility highlights the inherent uncertainties in the current economic climate. While interest rate cut bets are surging, it remains to be seen whether the Federal Reserve will actually implement such a policy. Careful monitoring of economic data and central bank announcements is vital for investors to navigate this period of uncertainty effectively. Seeking advice from a qualified financial advisor can also be beneficial during these turbulent times. The future direction of the market and the economy remains uncertain, but one thing is clear: the Nasdaq 100's retreat has fundamentally shifted the landscape of investor expectations.

Keywords: Nasdaq 100, interest rate cut, Federal Reserve, stock market, economic downturn, inflation, recession, investment strategy, market volatility, financial markets, interest rates, monetary policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Interest Rate Cut Bets Surge After Nasdaq 100 Retreats From Record. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

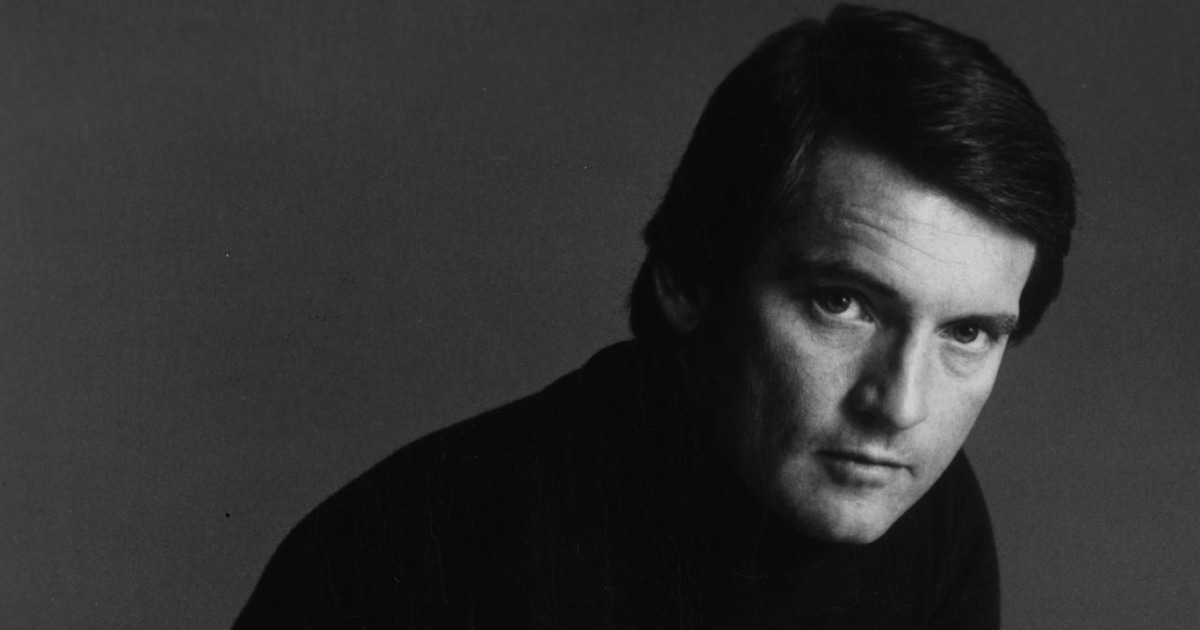

Chris Robinson Beloved General Hospital Actor Dead At 86

Jun 12, 2025

Chris Robinson Beloved General Hospital Actor Dead At 86

Jun 12, 2025 -

Early 2025 Mlb Cy Young Odds Evaluating Paul Skenes Prospects

Jun 12, 2025

Early 2025 Mlb Cy Young Odds Evaluating Paul Skenes Prospects

Jun 12, 2025 -

Inflation Report Us China Trade Tensions And Teslas Robo Taxi Reveal Key Developments

Jun 12, 2025

Inflation Report Us China Trade Tensions And Teslas Robo Taxi Reveal Key Developments

Jun 12, 2025 -

No Cousins Concerns Morris Confident In Penix Jr S Performance

Jun 12, 2025

No Cousins Concerns Morris Confident In Penix Jr S Performance

Jun 12, 2025 -

After 15 Seasons Allie Quigley Officially Retires From The Sky

Jun 12, 2025

After 15 Seasons Allie Quigley Officially Retires From The Sky

Jun 12, 2025