Institutional Money Fuels Bitcoin ETF Boom: $5 Billion And Counting

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Money Fuels Bitcoin ETF Boom: $5 Billion and Counting

The long-awaited arrival of Bitcoin exchange-traded funds (ETFs) has sparked a frenzy of investment, with institutional money pouring in at an unprecedented rate. Already, assets under management (AUM) for Bitcoin ETFs have surpassed $5 billion, signaling a significant shift in the perception and adoption of Bitcoin as a mainstream asset class. This surge represents a pivotal moment for the cryptocurrency market, potentially paving the way for broader institutional acceptance and further price appreciation.

The launch of the first Bitcoin ETF on the US market marked a watershed moment. For years, institutional investors had been hesitant due to regulatory uncertainty and concerns about Bitcoin's volatility. However, the SEC's approval changed the game, instantly legitimizing Bitcoin in the eyes of many traditional finance players. This approval has unlocked access for a vast pool of capital previously sidelined from direct Bitcoin investment.

<h3>The Institutional Stampede: Who's Investing?</h3>

The $5 billion figure isn't just a collection of small investments. Major players are heavily involved, driving this exponential growth. Hedge funds, pension funds, and even some family offices are allocating significant portions of their portfolios to Bitcoin ETFs, seeking exposure to the burgeoning cryptocurrency market while managing risk through a regulated vehicle. This diversification strategy demonstrates a growing confidence in Bitcoin's long-term potential.

- Reduced Risk: ETFs offer a more regulated and transparent way to invest in Bitcoin compared to directly purchasing the cryptocurrency. This reduces risks associated with self-custody and exchange security breaches.

- Accessibility: ETFs are easily accessible through brokerage accounts, making Bitcoin investment simpler for institutional investors already familiar with traditional markets.

- Diversification: Bitcoin's low correlation with traditional assets makes it an attractive addition to diversified investment portfolios, potentially hedging against market downturns.

<h3>What Does this Mean for Bitcoin's Future?</h3>

The influx of institutional money has significant implications for Bitcoin's future price and market capitalization. The increased demand, coupled with limited supply, is a classic recipe for price appreciation. Furthermore, this signifies a growing acceptance of Bitcoin within the mainstream financial system, strengthening its position as a legitimate asset class. This could further accelerate adoption among individual investors, further fueling the price increase.

However, it's important to remember that the market remains volatile. While the ETF boom is overwhelmingly positive, external factors could influence Bitcoin's price. Geopolitical events, regulatory changes, and macroeconomic conditions all play a role.

<h3>Looking Ahead: Potential Challenges and Opportunities</h3>

While the current trajectory is undeniably bullish, challenges remain. The SEC's approval process for future Bitcoin ETFs will continue to be a key factor, influencing market sentiment and investment flows. Furthermore, the increasing regulatory scrutiny of the cryptocurrency sector will need to be navigated carefully.

Despite these challenges, the current momentum is undeniable. The $5 billion milestone marks a significant victory for Bitcoin, highlighting its growing acceptance within the institutional investment community. This influx of capital is likely to further solidify Bitcoin's position as a major player in the global financial landscape, offering both exciting opportunities and potential risks for investors.

Learn more: For further analysis on the cryptocurrency market and investment strategies, you can explore resources like [link to reputable financial news source] and [link to a cryptocurrency analysis website]. Remember to conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Money Fuels Bitcoin ETF Boom: $5 Billion And Counting. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indy 500 2025 Analyzing The Odds After Shwartzmans Qualifying Performance

May 20, 2025

Indy 500 2025 Analyzing The Odds After Shwartzmans Qualifying Performance

May 20, 2025 -

Super Regional Bound Liberty Topples Texas A And M In Upset Win

May 20, 2025

Super Regional Bound Liberty Topples Texas A And M In Upset Win

May 20, 2025 -

New Regulations Target Bad Tourist Behavior In Bali What You Need To Know

May 20, 2025

New Regulations Target Bad Tourist Behavior In Bali What You Need To Know

May 20, 2025 -

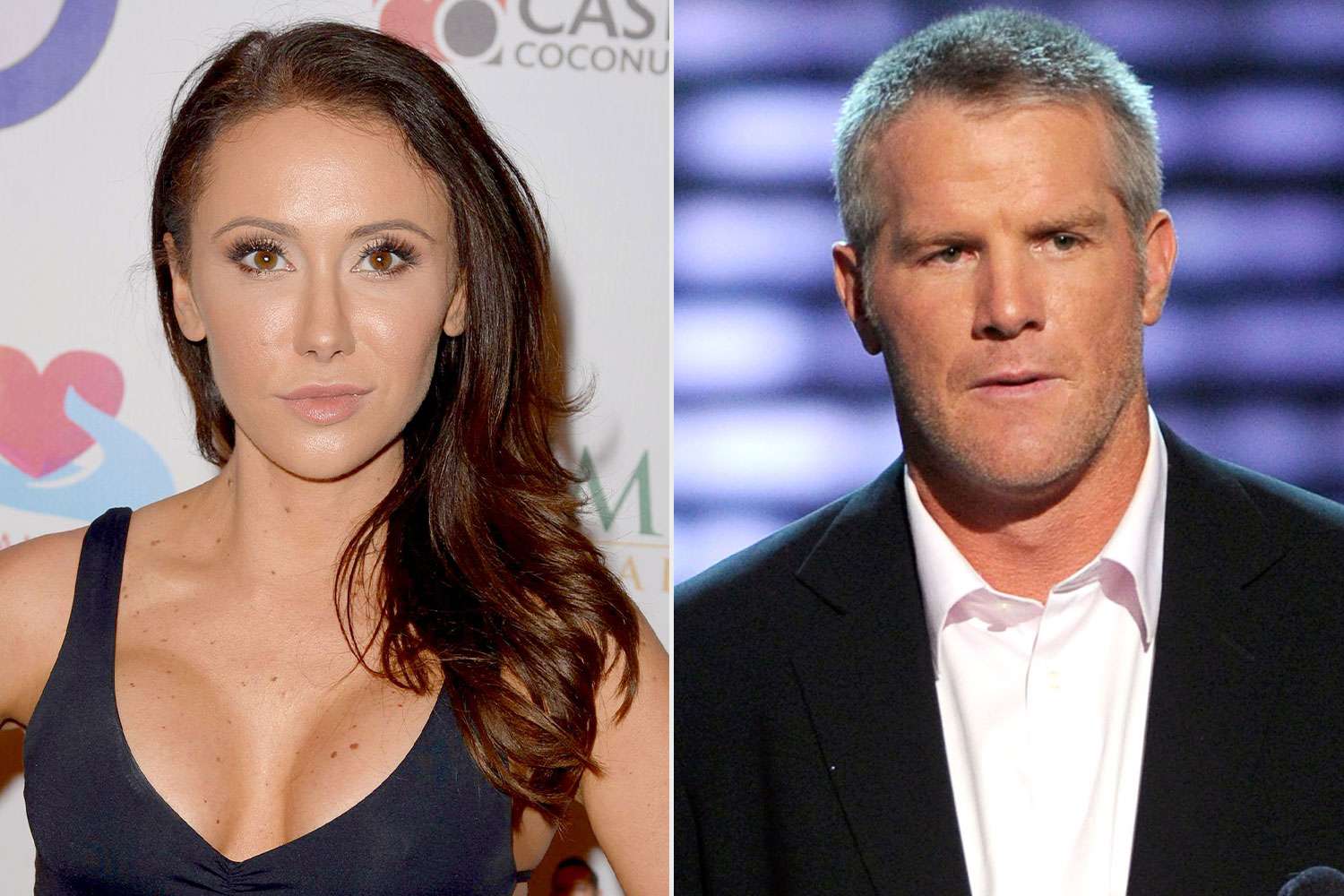

Jenn Sterger Details Personal Struggle Following Brett Favre Scandal

May 20, 2025

Jenn Sterger Details Personal Struggle Following Brett Favre Scandal

May 20, 2025 -

Nascar All Star Race At North Wilkesboro A Comprehensive Race Update

May 20, 2025

Nascar All Star Race At North Wilkesboro A Comprehensive Race Update

May 20, 2025