Institutional Money Floods Bitcoin ETFs: A $5 Billion Market Update

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Money Floods Bitcoin ETFs: A $5 Billion Market Update

Bitcoin exchange-traded funds (ETFs) are experiencing a surge in institutional investment, marking a significant milestone in the cryptocurrency's mainstream adoption. Recent data reveals a staggering influx of capital, pushing the total assets under management (AUM) for Bitcoin ETFs to over $5 billion. This unprecedented growth signifies a growing confidence in Bitcoin as a viable asset class among sophisticated investors.

This monumental shift underscores a broader trend: the increasing legitimization of Bitcoin within the traditional financial landscape. For years, Bitcoin's volatility and regulatory uncertainty deterred many institutional players. However, the recent approval of several Bitcoin ETFs in key markets, coupled with a maturing regulatory environment, has opened the floodgates.

The $5 Billion Milestone: A Deeper Dive

The $5 billion AUM figure represents a significant increase from just a few years ago, when Bitcoin ETF assets were a fraction of their current size. This dramatic growth can be attributed to several key factors:

-

Regulatory Approvals: The approval of Bitcoin ETFs by major regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States (though still limited), has dramatically increased investor confidence. This regulatory clarity reduces risk and makes Bitcoin more attractive to institutional investors seeking regulated exposure.

-

Increased Institutional Demand: Large financial institutions, including asset managers, hedge funds, and pension funds, are increasingly incorporating Bitcoin into their portfolios. This diversification strategy reflects a growing belief in Bitcoin's long-term potential as a store of value and a hedge against inflation.

-

Improved Infrastructure: The development of sophisticated trading platforms and custodial solutions has made it easier and safer for institutional investors to manage their Bitcoin holdings. This improved infrastructure is crucial for attracting larger sums of capital.

What Does This Mean for the Future of Bitcoin?

The influx of institutional money into Bitcoin ETFs is a strong indicator of the cryptocurrency's growing maturity and acceptance. This trend suggests several potential implications:

-

Increased Price Stability: The entry of large, sophisticated investors can potentially contribute to increased price stability in the Bitcoin market. Institutional investors tend to take a longer-term view, reducing the impact of short-term market fluctuations.

-

Further Mainstream Adoption: The success of Bitcoin ETFs will likely encourage further mainstream adoption of Bitcoin and other cryptocurrencies. As more investors gain regulated access to Bitcoin, the cryptocurrency's overall market capitalization could continue to grow.

-

New Investment Opportunities: The expanding Bitcoin ETF market will likely lead to the development of new and innovative investment products, further enriching the investment landscape.

Challenges Remain

Despite the positive developments, challenges remain. Regulatory uncertainty in certain jurisdictions continues to pose a risk, and the volatility of Bitcoin remains a concern for some investors. Furthermore, the environmental impact of Bitcoin mining remains a subject of ongoing debate and scrutiny.

Looking Ahead

The $5 billion milestone for Bitcoin ETFs represents a watershed moment for the cryptocurrency industry. As institutional investment continues to flow into this space, we can expect further growth and maturation of the Bitcoin market, ultimately paving the way for greater mainstream adoption and financial innovation. This ongoing evolution makes it a fascinating asset class to watch. Stay informed about regulatory changes and market trends to make informed investment decisions. Learn more about (external link - Investopedia). Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Money Floods Bitcoin ETFs: A $5 Billion Market Update. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stream The Critically Acclaimed Wwi Drama With Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Stream The Critically Acclaimed Wwi Drama With Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025 -

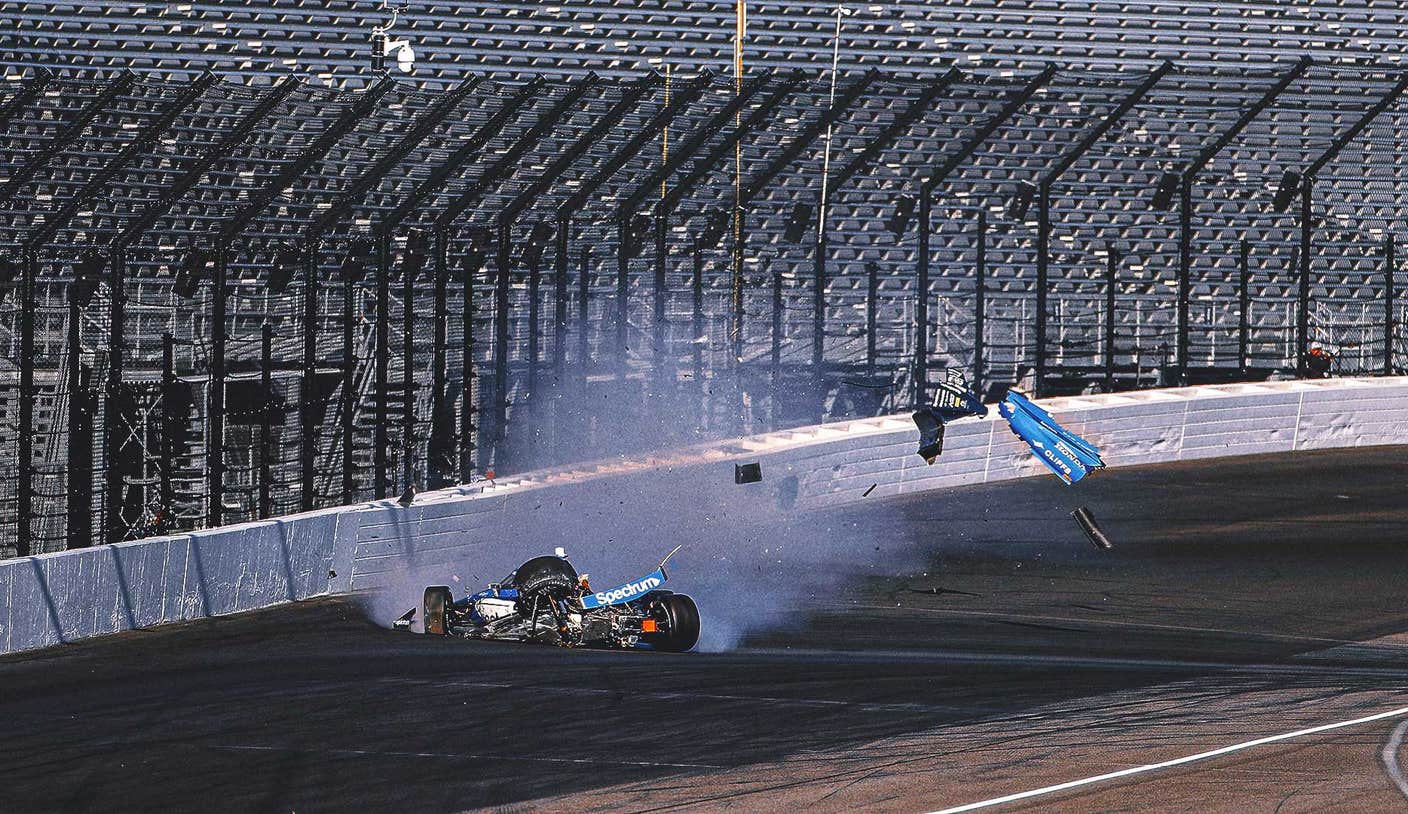

Multiple Crashes Rock Indy 500 Practice Weekend

May 20, 2025

Multiple Crashes Rock Indy 500 Practice Weekend

May 20, 2025 -

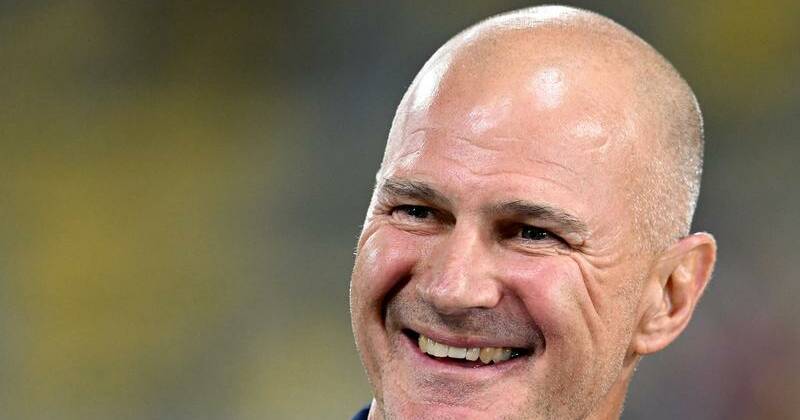

Arthur Triumphs Key Moments From The Aussie Coaching Clash In Super League

May 20, 2025

Arthur Triumphs Key Moments From The Aussie Coaching Clash In Super League

May 20, 2025 -

Christen Press Released From Hospital Full Recovery Expected For Angel City Forward

May 20, 2025

Christen Press Released From Hospital Full Recovery Expected For Angel City Forward

May 20, 2025 -

Soccer Player Christen Press Released Following Angel City Match Medical Emergency

May 20, 2025

Soccer Player Christen Press Released Following Angel City Match Medical Emergency

May 20, 2025