Institutional Investors Drive $5B+ Bitcoin ETF Boom: Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Drive $5B+ Bitcoin ETF Boom: Market Analysis

A wave of institutional investment has propelled Bitcoin ETFs to unprecedented heights, exceeding $5 billion in assets under management (AUM). This surge signifies a major shift in the cryptocurrency market, attracting both seasoned investors and newcomers alike.

The cryptocurrency market has witnessed a dramatic upswing recently, fueled largely by the explosive growth of Bitcoin exchange-traded funds (ETFs). With over $5 billion in AUM, these ETFs are no longer a niche investment; they represent a significant and rapidly expanding segment of the financial landscape. This unprecedented growth is primarily driven by the influx of institutional investors, who are increasingly recognizing Bitcoin's potential as a viable asset class.

The Institutional Shift: Why Now?

For years, Bitcoin's volatility and regulatory uncertainty deterred many institutional players. However, several factors have converged to create a perfect storm for Bitcoin ETF adoption:

- Regulatory Clarity: The recent approval of several Bitcoin ETFs in major markets, like the US, has significantly reduced regulatory risk, making it easier for institutions to allocate capital. This regulatory certainty is a game-changer, providing the confidence needed for large-scale investment.

- Increased Institutional Infrastructure: The development of robust custodial solutions and trading platforms specifically designed for digital assets has facilitated smoother and more secure institutional participation. This infrastructure reduces operational hurdles and allows for easier integration into existing investment portfolios.

- Diversification Strategies: Institutional investors are increasingly looking beyond traditional assets to diversify their portfolios and mitigate risk. Bitcoin, with its low correlation to traditional markets, is becoming an attractive option for portfolio diversification.

- Inflation Hedge Potential: Many see Bitcoin as a potential hedge against inflation, particularly in times of economic uncertainty. This narrative has attracted significant interest from investors concerned about the eroding purchasing power of fiat currencies.

Market Analysis: A Bullish Outlook?

The $5 billion+ AUM figure represents a significant milestone, suggesting a long-term bullish outlook for Bitcoin ETFs. This growth is not just a short-term trend; it reflects a fundamental shift in how institutional investors perceive Bitcoin and digital assets as a whole.

However, it's crucial to acknowledge potential challenges:

- Volatility Remains: Bitcoin's price remains volatile, presenting a risk for investors. While this volatility can offer opportunities for significant returns, it also carries the potential for substantial losses.

- Regulatory Landscape: While regulatory clarity has improved, the regulatory environment for cryptocurrencies is still evolving, and future changes could impact the market.

- Competition: The growing number of Bitcoin ETFs increases competition, potentially impacting the performance of individual funds.

The Future of Bitcoin ETFs: Predictions and Implications

The future of Bitcoin ETFs looks bright, with the potential for continued growth driven by further regulatory approvals globally and increasing institutional adoption. This will likely lead to greater price stability and increased liquidity in the Bitcoin market. However, investors must proceed with caution, carefully considering the risks involved before allocating significant capital. The rapid growth highlights the increasing mainstream acceptance of Bitcoin, suggesting a significant shift towards broader crypto adoption in the financial world.

Disclaimer: This article provides general market commentary and does not constitute financial advice. Investing in cryptocurrencies involves significant risk, and you should conduct your own research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Drive $5B+ Bitcoin ETF Boom: Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Espns A J Perez Details Threats From Brett Favres Camp Following Untold Episode

May 21, 2025

Espns A J Perez Details Threats From Brett Favres Camp Following Untold Episode

May 21, 2025 -

160 Japanese Firms Compete On Nature Conservation For Enhanced Corporate Value

May 21, 2025

160 Japanese Firms Compete On Nature Conservation For Enhanced Corporate Value

May 21, 2025 -

Jamie Lee Curtis And Lindsay Lohans Friendship A Story Of Honest Support

May 21, 2025

Jamie Lee Curtis And Lindsay Lohans Friendship A Story Of Honest Support

May 21, 2025 -

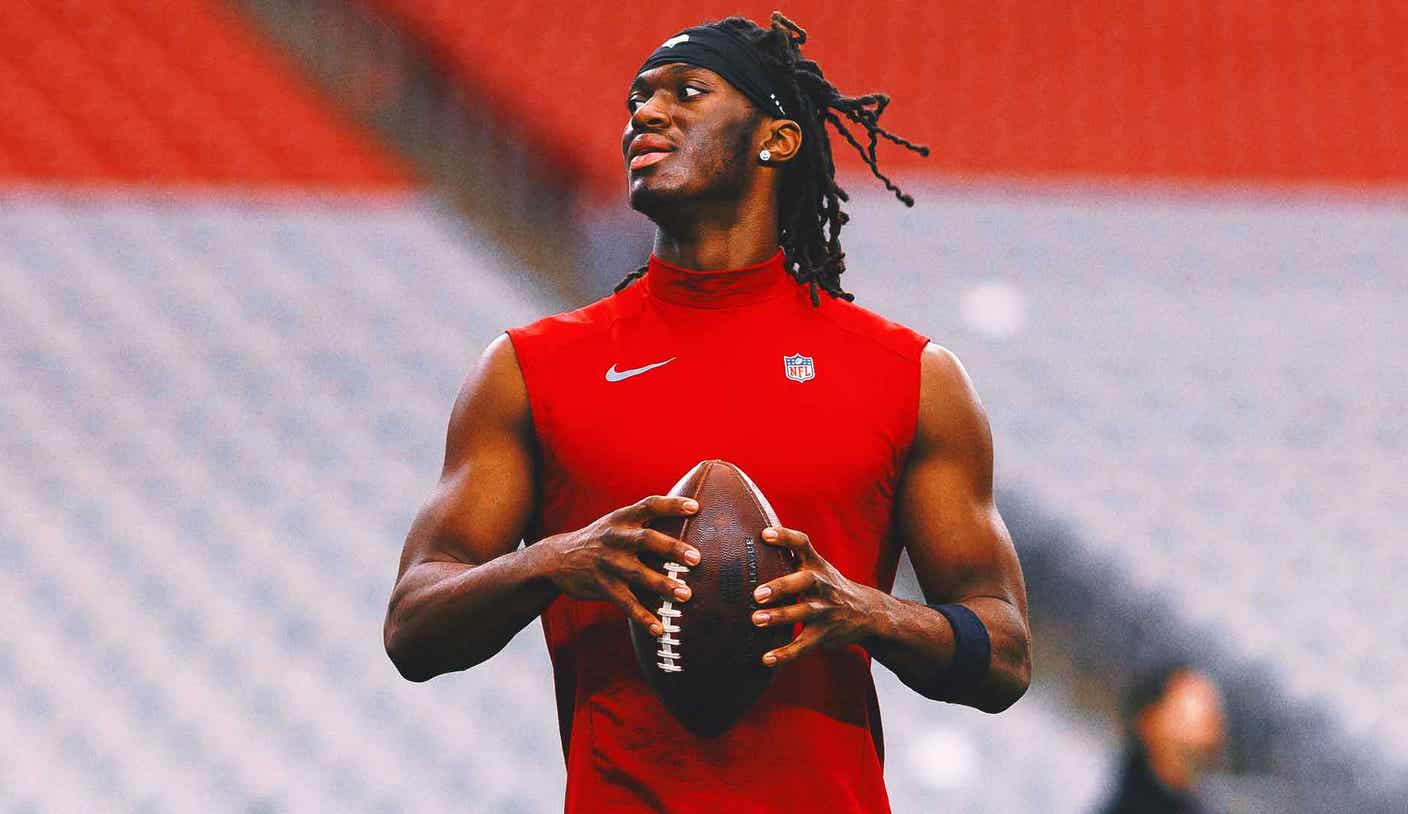

Stronger Faster Better Marvin Harrison Jr Aims For A Sophomore Breakout Season

May 21, 2025

Stronger Faster Better Marvin Harrison Jr Aims For A Sophomore Breakout Season

May 21, 2025 -

Police Investigate Church Defacement Two Boys In Custody

May 21, 2025

Police Investigate Church Defacement Two Boys In Custody

May 21, 2025