Institutional Investors Bet Big On Ethereum After Pectra Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investors Bet Big on Ethereum After Shanghai Upgrade: A New Era of Staking?

The recent Shanghai upgrade to the Ethereum network has sent ripples through the cryptocurrency market, with institutional investors showing significant renewed interest in the world's second-largest cryptocurrency. The upgrade, also known as the Shapella upgrade, finally unlocked staked ETH, allowing validators to withdraw their staked ether and accumulated rewards. This crucial development is being hailed as a game-changer, boosting confidence and attracting major players back into the Ethereum ecosystem.

What is the significance of the Shanghai Upgrade?

Before the Shanghai upgrade, Ethereum's proof-of-stake (PoS) mechanism required validators to lock up their ETH for an indefinite period. This presented a significant risk for institutional investors, who are accustomed to liquidity and quick access to their assets. The inability to withdraw staked ETH acted as a major barrier to entry for large-scale investment. The Shapella upgrade directly addresses this concern, opening the floodgates for institutional participation.

Increased Institutional Investment in ETH

Several reports indicate a marked increase in institutional investment in Ethereum following the successful implementation of the Shanghai upgrade. While precise figures are difficult to obtain immediately, anecdotal evidence from various sources points to significant buying activity. This renewed interest is driven by several factors:

- Improved Liquidity: The ability to withdraw staked ETH significantly improves liquidity, making it a more attractive investment for institutional portfolios.

- Reduced Risk: The unlock mechanism mitigates the risk associated with locking up substantial capital for extended periods.

- Increased Confidence: The successful execution of the Shanghai upgrade demonstrates Ethereum's ongoing development and its commitment to innovation. This reinforces confidence in the long-term prospects of the network.

- Growing DeFi Ecosystem: Ethereum continues to dominate the decentralized finance (DeFi) landscape. The growing adoption of DeFi applications offers further incentives for institutional investors to participate in the Ethereum ecosystem.

Is this a new bull market for ETH?

While the Shanghai upgrade is a hugely positive development, it's crucial to avoid premature declarations of a new bull market. The cryptocurrency market is inherently volatile, and several macroeconomic factors still influence its trajectory. However, the increased institutional investment signals a growing belief in Ethereum's long-term potential.

What lies ahead for Ethereum?

The future looks bright for Ethereum. The ongoing development of layer-2 scaling solutions, such as Polygon and Arbitrum, aims to further enhance the network's scalability and transaction throughput. This will make it even more attractive to institutional investors and everyday users. Furthermore, the growing adoption of Ethereum in various sectors, including NFTs and Web3 applications, ensures continued growth and relevance.

Conclusion:

The Shanghai upgrade represents a significant milestone in the evolution of Ethereum. By unlocking staked ETH, it has opened the doors for increased institutional investment and significantly bolstered confidence in the network. While it's too early to definitively call it a bull market, the positive signals are undeniable. The long-term prospects for Ethereum remain strong, and the increasing institutional involvement is a powerful indicator of its growing maturity and potential. It will be fascinating to observe the market's reaction in the coming months and see how this increased liquidity and investor confidence impacts the price of ETH and the broader crypto market. Stay tuned for further updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investors Bet Big On Ethereum After Pectra Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Balis Tourism Crisis A Need For International Collaboration On Safety And Conduct

May 20, 2025

Balis Tourism Crisis A Need For International Collaboration On Safety And Conduct

May 20, 2025 -

Trumps Proposal Immediate Peace Negotiations Between Russia And Ukraine

May 20, 2025

Trumps Proposal Immediate Peace Negotiations Between Russia And Ukraine

May 20, 2025 -

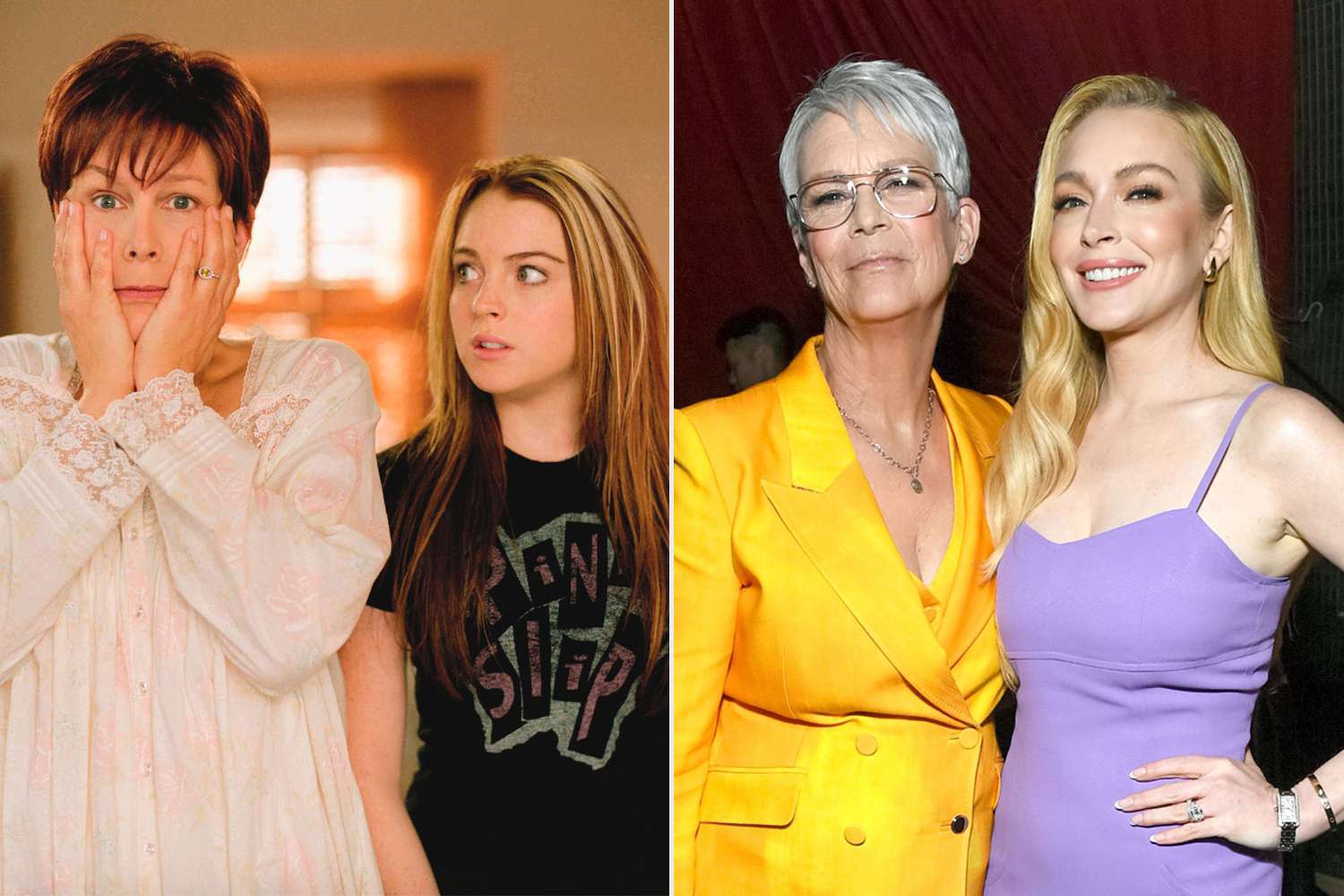

Jamie Lee Curtis And Lindsay Lohan Their Friendship After Freaky Friday

May 20, 2025

Jamie Lee Curtis And Lindsay Lohan Their Friendship After Freaky Friday

May 20, 2025 -

S And P 500 Dow Nasdaq Rise Stock Market Defies Moodys Credit Rating Downgrade

May 20, 2025

S And P 500 Dow Nasdaq Rise Stock Market Defies Moodys Credit Rating Downgrade

May 20, 2025 -

Post Pectra Upgrade Investors Pour 200 M Into Ethereum Funds

May 20, 2025

Post Pectra Upgrade Investors Pour 200 M Into Ethereum Funds

May 20, 2025