Institutional Investor Activity: Deutsche Bank's Recent Purchase Of AMC Entertainment Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investor Activity: Deutsche Bank's Stake in AMC Entertainment Sparks Speculation

Deutsche Bank's recent purchase of AMC Entertainment Holdings Inc. (AMC) shares has sent ripples through the financial markets, prompting significant speculation about the future trajectory of the struggling movie theater chain. The move, revealed in recent SEC filings, represents a notable shift in institutional investor sentiment towards AMC, a company that has experienced significant volatility in recent years. This article delves into the details of Deutsche Bank's investment, explores potential motivations, and analyzes the implications for AMC's stock price and future prospects.

The Details of the Purchase:

While the exact number of shares acquired by Deutsche Bank remains undisclosed in full detail (due to SEC reporting thresholds and strategic considerations), the reported purchase represents a substantial increase in their holding of AMC stock. This significant investment comes at a time when AMC’s stock price has shown signs of both strength and vulnerability, experiencing periods of sharp rises and declines fueled by factors ranging from meme stock hype to the ongoing challenges facing the theatrical movie exhibition industry. The timing of Deutsche Bank's acquisition adds another layer of intrigue to the already complex narrative surrounding AMC.

Potential Motivations Behind Deutsche Bank's Investment:

Several factors could have influenced Deutsche Bank's decision to acquire a larger stake in AMC. These include:

-

Value Investing: Some analysts believe Deutsche Bank sees AMC as undervalued, potentially betting on a turnaround driven by improved box office performance and a strategic restructuring of the company's operations. This strategy hinges on a belief that the current market price doesn't accurately reflect AMC's long-term potential.

-

Short Squeeze Potential: Given AMC's history as a popular meme stock, the possibility of a short squeeze, where a rapid increase in the stock price forces short sellers to buy shares to cover their positions, cannot be ruled out. This is a high-risk, high-reward strategy, however.

-

Strategic Partnership: There is ongoing speculation of the possibility of a strategic partnership between AMC and a major financial institution. While not yet confirmed, such a development could greatly benefit AMC, making it an attractive investment target.

-

Diversification: The investment could simply be part of Deutsche Bank's broader portfolio diversification strategy, aiming to spread risk across different sectors and asset classes.

Implications for AMC and the Broader Market:

Deutsche Bank's investment in AMC carries significant implications:

-

Stock Price Volatility: The news is likely to contribute to further volatility in AMC's stock price, as investors react to the perceived endorsement from a major financial institution.

-

Investor Sentiment: The move could influence other institutional investors to reconsider their positions in AMC, potentially leading to further buying or selling pressure.

-

Company Strategy: AMC may use this investment as leverage to secure additional funding or negotiate more favorable terms with creditors and partners.

Conclusion:

Deutsche Bank's significant purchase of AMC shares represents a significant development in the ongoing saga of the movie theater chain. While the exact motivations behind the purchase remain unclear, it highlights the enduring interest – and volatility – surrounding AMC's stock. The implications for AMC's future are far-reaching, and investors will be closely watching the company's performance in the coming months and years. Further analysis and SEC filings will be crucial in fully understanding the impact of this institutional investment. Keep an eye on further developments regarding this significant market event.

Keywords: AMC Entertainment, AMC Stock, Deutsche Bank, Institutional Investors, Stock Market, Meme Stocks, Stock Volatility, Investment Strategy, Value Investing, Short Squeeze, SEC Filings, Financial News, Market Analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investor Activity: Deutsche Bank's Recent Purchase Of AMC Entertainment Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Rigetti Computings Stock Market Rally A Deep Dive

May 27, 2025

Rigetti Computings Stock Market Rally A Deep Dive

May 27, 2025 -

When Is Memorial Day 2025 Remembering Americas Fallen

May 27, 2025

When Is Memorial Day 2025 Remembering Americas Fallen

May 27, 2025 -

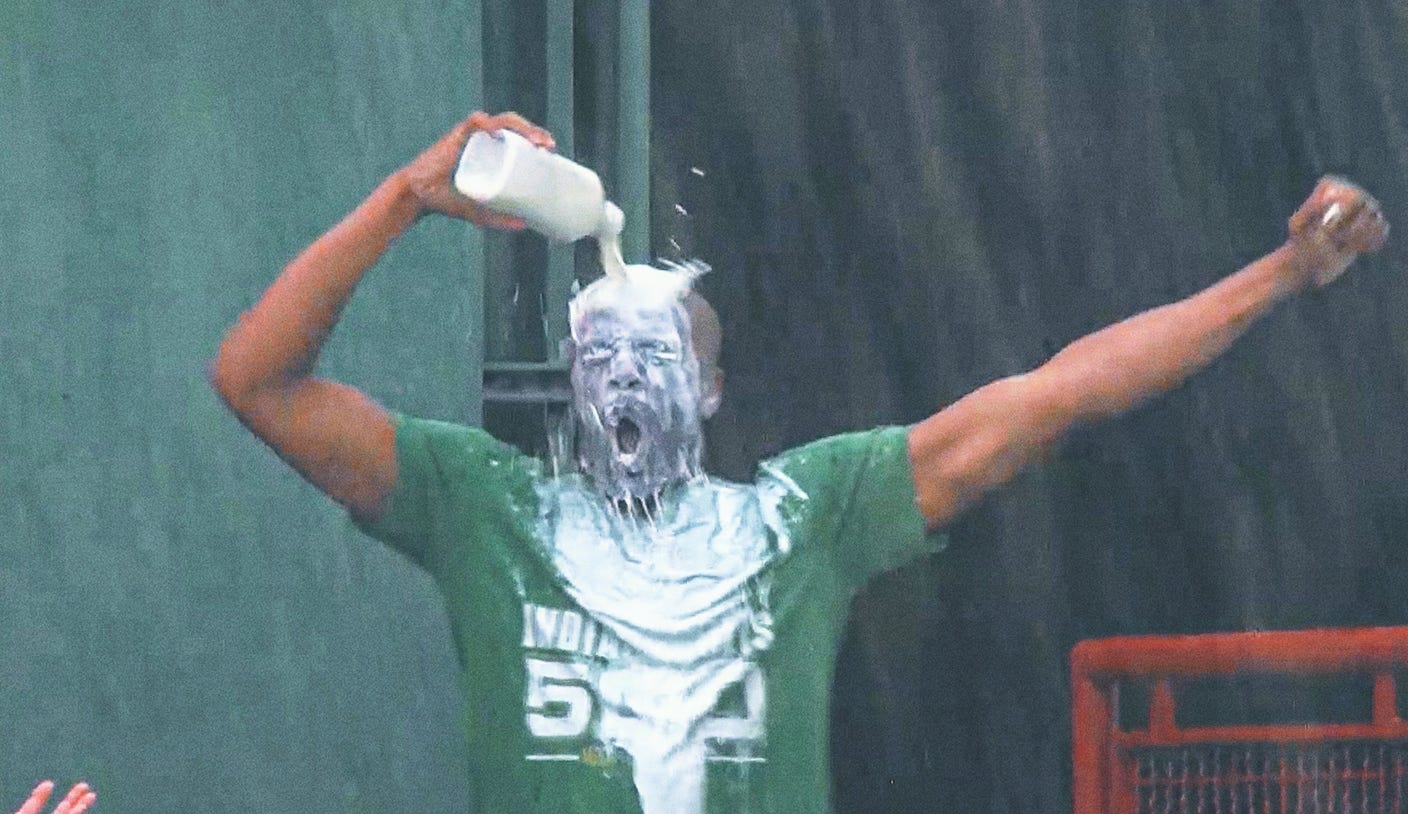

From Indy 500 To Baseball The Milk Shower Craze Explained

May 27, 2025

From Indy 500 To Baseball The Milk Shower Craze Explained

May 27, 2025 -

Florida Panthers Dominate Third Period Take Commanding 3 0 Series Lead

May 27, 2025

Florida Panthers Dominate Third Period Take Commanding 3 0 Series Lead

May 27, 2025 -

Dastan Njat Psr Bchh Tbryzy Az Myan Dw Dywar

May 27, 2025

Dastan Njat Psr Bchh Tbryzy Az Myan Dw Dywar

May 27, 2025