Institutional Investment: Deutsche Bank Adds AMC Entertainment Holdings To Portfolio

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Deutsche Bank Bets Big on AMC: Institutional Investment Signals Confidence in Meme Stock

Deutsche Bank's recent addition of AMC Entertainment Holdings to its investment portfolio has sent ripples through the financial world, sparking renewed interest in the volatile meme stock. The move, announced [Insert Date of Announcement Here], signifies a potential shift in institutional investor sentiment towards AMC and could influence future trading activity. This strategic decision by a major player like Deutsche Bank warrants a closer look at the implications for AMC and the broader market.

Why the Sudden Interest in AMC?

AMC Entertainment, once a struggling theater chain, has become a darling (and sometimes a punching bag) of retail investors, fueled by online forums and social media trends. Its rollercoaster stock price, often defying traditional market analysis, has made it a captivating case study in meme stock behavior. While the company is still navigating challenges in the post-pandemic landscape, several factors might have contributed to Deutsche Bank's investment:

- Signs of Recovery: AMC has shown signs of recovery in recent quarters, reporting improved attendance and revenue. This positive trend, however slight, could be a key factor influencing institutional investors.

- Debt Reduction Efforts: AMC's ongoing efforts to reduce its significant debt burden are likely seen as a positive sign of long-term stability. Successful debt restructuring could significantly improve the company's financial outlook.

- Diversification Strategy: For Deutsche Bank, the investment in AMC could be part of a broader diversification strategy, aiming to capitalize on potential growth in the entertainment sector, even amidst market volatility.

- Value Investing Potential: Some analysts might view AMC's current valuation as undervalued, presenting a potential opportunity for long-term growth.

The Implications for Investors

Deutsche Bank's investment is a significant development, suggesting that at least some institutional investors see potential in AMC. However, it's crucial to remember that:

- Risk Remains High: AMC remains a high-risk investment. Its stock price is notoriously volatile and subject to significant swings based on market sentiment and social media trends.

- Not a Guarantee of Success: The investment by Deutsche Bank is not a guarantee of future success for AMC. The company still faces significant challenges, and its stock price could decline further.

- Due Diligence is Crucial: Before investing in AMC, potential investors should conduct thorough due diligence and understand the inherent risks involved. Consult with a financial advisor before making any investment decisions.

Looking Ahead: What to Expect?

The impact of Deutsche Bank's investment on AMC's stock price remains to be seen. It could lead to increased investor confidence and potentially drive further price increases. However, it’s equally possible that the effect will be minimal or short-lived. The company's long-term success will depend on its ability to navigate the evolving entertainment landscape and address its financial challenges effectively.

Further Reading:

- [Link to AMC Entertainment Holdings Investor Relations Page]

- [Link to Deutsche Bank's Investment News Release (if available)]

- [Link to a reputable financial news source discussing meme stocks]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investment: Deutsche Bank Adds AMC Entertainment Holdings To Portfolio. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investing In Smci Buy Sell Or Hold Decision At 14 62x P E Ratio

May 28, 2025

Investing In Smci Buy Sell Or Hold Decision At 14 62x P E Ratio

May 28, 2025 -

Paolinis Roland Garros Run Seventh Straight Win Defeats Yuan

May 28, 2025

Paolinis Roland Garros Run Seventh Straight Win Defeats Yuan

May 28, 2025 -

Impact Of Spectators Preferences On Roland Garros Night Session Allocation

May 28, 2025

Impact Of Spectators Preferences On Roland Garros Night Session Allocation

May 28, 2025 -

Beatriz Haddad Maia Vs Hailey Baptiste French Open 2025 Prediction And Odds

May 28, 2025

Beatriz Haddad Maia Vs Hailey Baptiste French Open 2025 Prediction And Odds

May 28, 2025 -

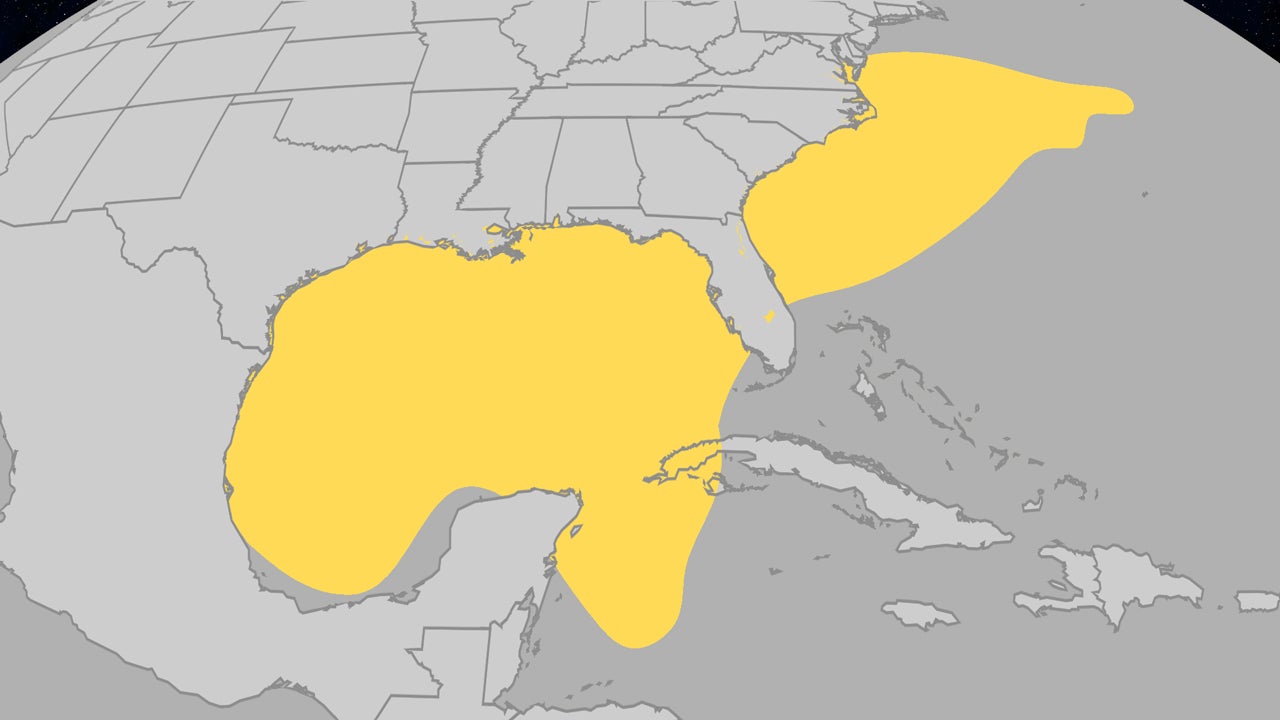

Atlantic Storm Formation A Look At Junes Hurricane Season Beginnings

May 28, 2025

Atlantic Storm Formation A Look At Junes Hurricane Season Beginnings

May 28, 2025