Institutional Investing: Deutsche Bank Adds To AMC Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Institutional Investing: Deutsche Bank Increases AMC Entertainment Holdings

Deutsche Bank's recent SEC filings reveal a significant increase in their holdings of AMC Entertainment Holdings (AMC), sparking renewed interest in the volatile meme stock. This move by a major institutional investor signals a potential shift in sentiment towards the struggling movie theater chain, and has sent ripples through the financial markets. The details surrounding this investment, its implications for AMC's future, and the broader context of institutional investing in meme stocks are discussed below.

Deutsche Bank's Increased Stake in AMC

The filing with the Securities and Exchange Commission (SEC) showed that Deutsche Bank significantly boosted its position in AMC Entertainment. While the exact figures might vary slightly depending on the source and the timing of the filing, the increase represents a substantial commitment from the German banking giant. This unexpected move follows a period of relative uncertainty for AMC, marked by fluctuating stock prices and ongoing challenges within the entertainment industry.

This strategic decision by Deutsche Bank adds another layer of complexity to the ongoing narrative surrounding AMC. The company, once a darling of retail investors, has experienced considerable volatility. Understanding the reasoning behind Deutsche Bank's increased investment is crucial for investors looking to navigate this complex market. Was it a calculated risk, a hedge against market instability, or something else entirely?

Implications for AMC and the Meme Stock Phenomenon

The involvement of a major institutional investor like Deutsche Bank in a meme stock like AMC is noteworthy. Traditionally, institutional investors have shown a preference for more stable, established companies. This move could indicate a growing acceptance of, or at least a willingness to engage with, the unique dynamics of the meme stock market.

-

Increased Market Stability? Some analysts suggest that the influx of institutional money might help to stabilize AMC's volatile stock price. The presence of a large, sophisticated investor could lend a degree of credibility and attract other institutional investors.

-

Long-Term Strategy? Alternatively, Deutsche Bank's investment could be a long-term play, betting on AMC's eventual recovery and resurgence in the post-pandemic entertainment landscape. This would require a positive outlook on the company's restructuring efforts and its ability to adapt to changing consumer behavior.

-

Short-Term Speculation? It is also possible that the investment is more short-term in nature, taking advantage of perceived market inefficiencies or short-term price fluctuations. This type of speculative investing carries inherent risks.

Understanding Institutional Investing

Institutional investing involves the management of large sums of money by professional investors on behalf of institutions such as pension funds, insurance companies, mutual funds, and endowments. These investors often conduct thorough due diligence before making investments, considering various financial factors and long-term prospects.

The involvement of institutional investors can have a significant impact on a company's stock price and overall market performance. Their investment decisions are closely watched by market analysts and other investors, influencing market sentiment and trading activity.

The Future of AMC and Institutional Involvement

The future trajectory of AMC Entertainment remains uncertain. The company faces ongoing challenges, including competition from streaming services and the evolving landscape of the entertainment industry. However, the increased involvement of institutional investors like Deutsche Bank could provide crucial support and potentially contribute to a more stable future.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market carries inherent risks, and you should always conduct thorough research and consult with a financial advisor before making any investment decisions. Always refer to official SEC filings for the most accurate and up-to-date information.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Institutional Investing: Deutsche Bank Adds To AMC Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open 2025 Day 2 Live Scores Results And Highlights Navarro Swiatek Sinner Alcaraz

May 27, 2025

French Open 2025 Day 2 Live Scores Results And Highlights Navarro Swiatek Sinner Alcaraz

May 27, 2025 -

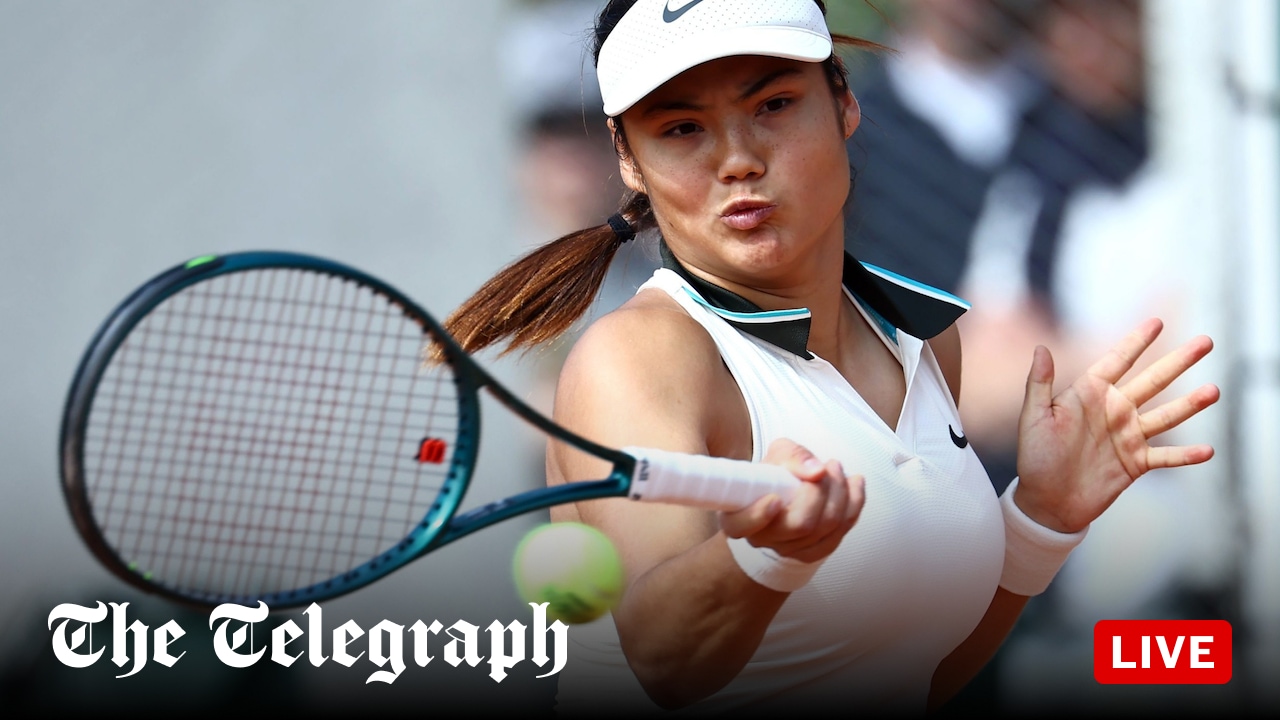

Roland Garros Get The Latest Scores And Updates On Raducanu Vs Wang Xinyu

May 27, 2025

Roland Garros Get The Latest Scores And Updates On Raducanu Vs Wang Xinyu

May 27, 2025 -

Boosting Ev Adoption Nio Adds 100 Swap Stations In Northeast China

May 27, 2025

Boosting Ev Adoption Nio Adds 100 Swap Stations In Northeast China

May 27, 2025 -

Indy 500 Larsons Double Quest Shattered By Crash

May 27, 2025

Indy 500 Larsons Double Quest Shattered By Crash

May 27, 2025 -

Leanna De La Fuente And Travis Hunter Newlyweds After A Hectic Month

May 27, 2025

Leanna De La Fuente And Travis Hunter Newlyweds After A Hectic Month

May 27, 2025