Impact Of Fed's Rate Cut Projection: US Treasury Yields Soften

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Impact of Fed's Rate Cut Projection: US Treasury Yields Soften

The Federal Reserve's recent projection of potential interest rate cuts sent ripples through the financial markets, leading to a noticeable softening in US Treasury yields. This shift, while anticipated by some, carries significant implications for investors, borrowers, and the overall economy. Understanding the nuances of this development is crucial for navigating the current economic climate.

What Drove the Yield Decline?

The primary catalyst for the decline in Treasury yields is the Fed's altered outlook on future interest rate hikes. Instead of further increases, the central bank now suggests a possibility, even a likelihood, of rate cuts later this year. This projection, based on concerns about slowing economic growth and potential inflationary pressures easing, immediately impacted investor expectations. With the anticipation of lower rates, the demand for existing higher-yielding Treasuries increased, pushing their prices up and consequently lowering their yields. This inverse relationship between bond prices and yields is a fundamental principle of fixed-income investing.

Understanding Treasury Yields and Their Significance

US Treasury yields are a key benchmark for interest rates across the economy. They influence borrowing costs for businesses and consumers, impacting everything from mortgage rates to corporate debt. A softening in Treasury yields typically translates to lower borrowing costs, potentially stimulating economic activity. However, this effect isn't always straightforward.

The Impact on Various Sectors:

- Mortgage Rates: Lower Treasury yields usually lead to lower mortgage rates, making homeownership more affordable and potentially boosting the housing market. This can be a significant benefit for prospective homebuyers.

- Corporate Debt: Companies may find it cheaper to borrow money, leading to increased investment and potentially fueling economic growth. This is particularly beneficial for businesses with expansion plans.

- Inflation: While lower rates can stimulate the economy, they also pose a risk of fueling inflation if demand outpaces supply. The Fed's careful balancing act is crucial in this regard.

- Investors: Investors will need to adjust their portfolios accordingly. Lower yields mean lower returns on fixed-income investments, pushing some towards higher-risk assets in search of greater returns. This increased risk appetite can have wider market consequences.

Potential Challenges and Uncertainties:

Despite the potential benefits of lower yields, several challenges remain. The Fed's projections are subject to change based on evolving economic data. Unexpected inflationary pressures or a sharper-than-expected economic slowdown could alter their course. Furthermore, geopolitical uncertainties and global economic conditions continue to add layers of complexity to the situation.

Looking Ahead: What to Expect

The coming months will be crucial in determining the long-term impact of the Fed's rate cut projection. Close monitoring of economic indicators, including inflation data, employment figures, and consumer spending, will be essential. Experts will continue to analyze the interplay between these factors and the Fed's policy decisions, providing valuable insights for investors and policymakers alike.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: US Treasury yields, Fed rate cut, interest rates, bond market, economic outlook, inflation, mortgage rates, investment strategy, financial markets, economic growth.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's Rate Cut Projection: US Treasury Yields Soften. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Institutional Investors Bet Big On Ethereum After Pectra Upgrade

May 20, 2025

Institutional Investors Bet Big On Ethereum After Pectra Upgrade

May 20, 2025 -

Game 7 On The Line Nuggets Await Aaron Gordons Status Against Thunder

May 20, 2025

Game 7 On The Line Nuggets Await Aaron Gordons Status Against Thunder

May 20, 2025 -

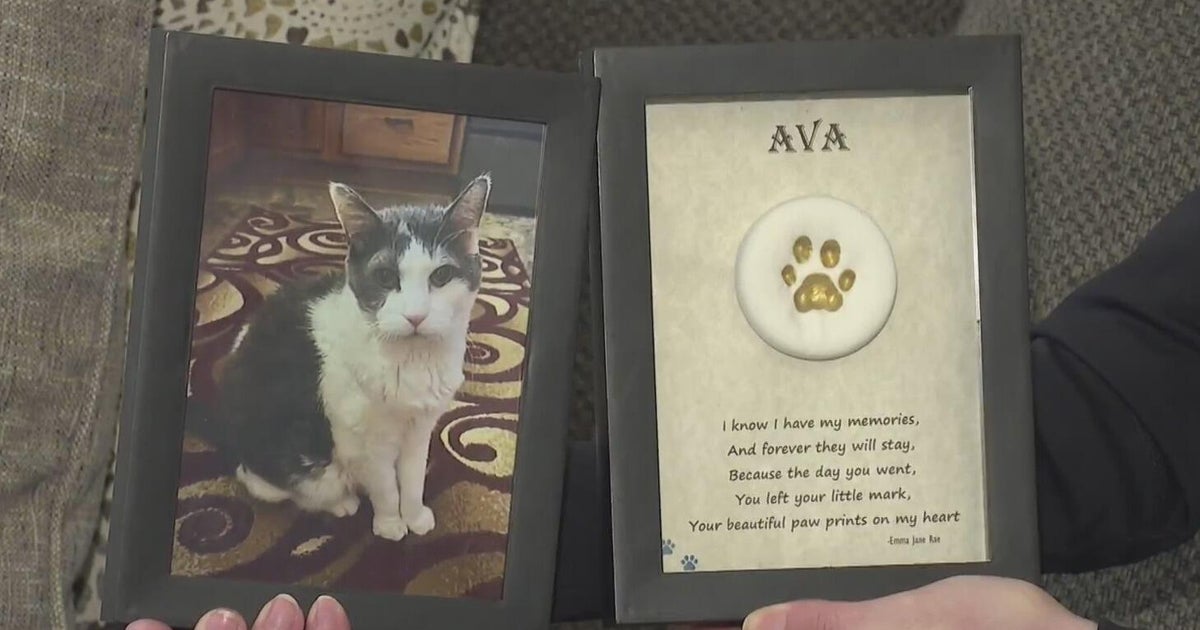

Funeral Home Cremains Case Pet Owners Remember Their Beloved Companions

May 20, 2025

Funeral Home Cremains Case Pet Owners Remember Their Beloved Companions

May 20, 2025 -

Jon Jones Aspinall Comments Spark Outrage Fans React To Strip The Duck Remark

May 20, 2025

Jon Jones Aspinall Comments Spark Outrage Fans React To Strip The Duck Remark

May 20, 2025 -

Putins Calculated Move Demonstrating Independence From Trump

May 20, 2025

Putins Calculated Move Demonstrating Independence From Trump

May 20, 2025