Impact Of Fed's Rate Cut Projection: U.S. Treasury Yields Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's Rate Cut Projection Sends U.S. Treasury Yields Plummeting

The Federal Reserve's recent projection of potential interest rate cuts sent shockwaves through the financial markets, leading to a significant decline in U.S. Treasury yields. This unexpected shift in monetary policy expectations has created both opportunities and anxieties for investors and the broader economy. The move reflects the Fed's growing concern about potential economic slowdown and its commitment to mitigating inflation without triggering a recession.

Understanding the Connection: Rate Cuts and Treasury Yields

The relationship between interest rate cuts and Treasury yields is inverse. When the Fed signals a potential for lower interest rates, investors anticipate reduced returns on future Treasury bonds. This leads to a decreased demand for existing bonds, pushing their prices up and consequently lowering their yields. This dynamic is crucial for understanding the recent market reaction.

The Market's Response: A Deep Dive into Yield Declines

The immediate aftermath of the Fed's projection witnessed a sharp drop across the Treasury yield curve. Short-term yields experienced the most dramatic decline, reflecting the market's anticipation of imminent rate cuts. Longer-term yields also fell, albeit at a less pronounced rate, indicating a shift in expectations regarding the future path of interest rates. This decline has significant implications for various sectors of the economy.

Impact on Investors: Navigating the Shifting Landscape

The decrease in Treasury yields presents a mixed bag for investors. While lower yields might seem less attractive for income-seeking investors, they also signal a potential for capital appreciation as bond prices rise. This shift necessitates a reassessment of investment strategies, potentially favoring longer-term bonds for those seeking stability and capital growth. However, it's crucial to remember that bond prices are inversely related to interest rates – rising interest rates would cause bond prices to fall.

Economic Implications: A Cautious Outlook

The Fed's actions reflect a cautious approach to navigating the current economic climate. While aiming to curb inflation, the central bank also acknowledges the risk of triggering a recession. The rate cut projection aims to stimulate economic growth by making borrowing cheaper for businesses and consumers. However, the effectiveness of this approach remains subject to several factors, including the persistence of inflation and the overall health of the global economy.

Looking Ahead: Uncertainty and Opportunity

The future trajectory of Treasury yields remains uncertain, dependent on various economic indicators and the Fed's future policy decisions. While the recent decline presents opportunities, it also underlines the inherent risks involved in investing in the bond market. Careful analysis and diversification are crucial for investors seeking to navigate this shifting landscape. Staying informed about economic data releases and the Fed's future pronouncements is vital for making informed investment choices.

Key Takeaways:

- Inverse Relationship: Lower Fed interest rates generally lead to lower Treasury yields.

- Market Volatility: The bond market reacted swiftly to the Fed's projections, highlighting its sensitivity to monetary policy changes.

- Investment Strategies: Investors need to adapt their strategies considering the changing yield environment.

- Economic Uncertainty: The Fed's actions reflect a cautious approach to balancing inflation control and economic growth.

This dynamic situation necessitates continuous monitoring of economic indicators and careful consideration of investment strategies to navigate the evolving landscape of U.S. Treasury yields. For further analysis and in-depth market insights, consider consulting with a financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's Rate Cut Projection: U.S. Treasury Yields Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Thunders Gritty Win Over Nuggets Secures Spot In West Finals

May 21, 2025

Thunders Gritty Win Over Nuggets Secures Spot In West Finals

May 21, 2025 -

Underdog Liberty Topples Top Ranked Texas A And M Secures Super Regional Berth

May 21, 2025

Underdog Liberty Topples Top Ranked Texas A And M Secures Super Regional Berth

May 21, 2025 -

Solo Leveling First Award Signals More Success To Come

May 21, 2025

Solo Leveling First Award Signals More Success To Come

May 21, 2025 -

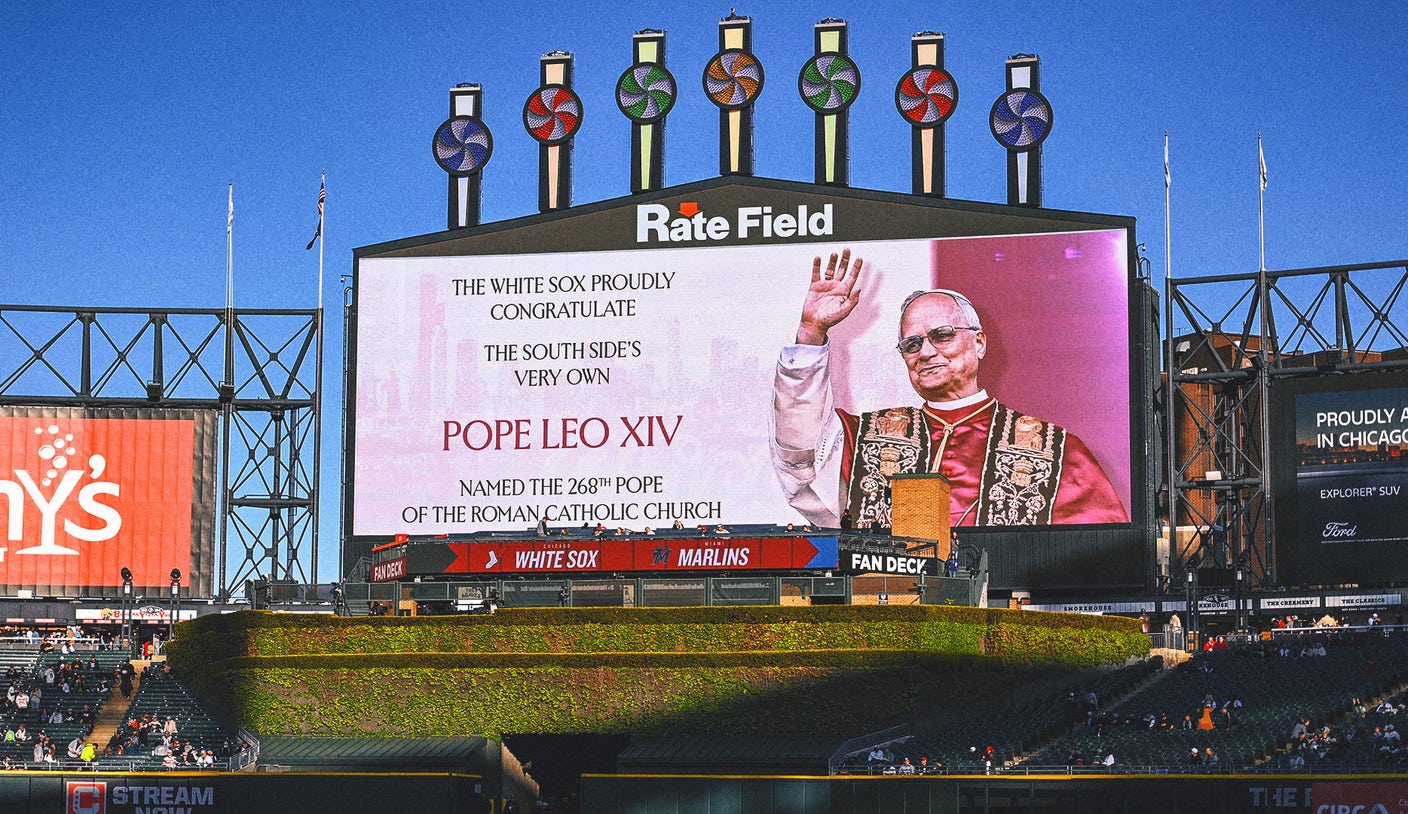

White Sox Unveils Striking New Art Installation A Tribute To Pope Leo Xiii

May 21, 2025

White Sox Unveils Striking New Art Installation A Tribute To Pope Leo Xiii

May 21, 2025 -

Thunder Silence Critics Dominate Nuggets In Decisive Game 7 Victory

May 21, 2025

Thunder Silence Critics Dominate Nuggets In Decisive Game 7 Victory

May 21, 2025