Impact Of Fed's Rate Cut Projection On US Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's Rate Cut Projection Sends US Treasury Yields Tumbling: What It Means for Investors

The Federal Reserve's recent projection of interest rate cuts sent shockwaves through the financial markets, leading to a significant decline in US Treasury yields. This unexpected shift in monetary policy has profound implications for investors, businesses, and the overall US economy. Understanding the intricacies of this development is crucial for navigating the current market landscape.

The Fed's Pivot and its Market Impact

The Federal Open Market Committee (FOMC) surprised many analysts by signaling a potential pivot towards lower interest rates later this year. This projection, driven by concerns about slowing economic growth and potential banking sector instability, immediately impacted investor sentiment. The expectation of lower rates fueled a rush into Treasury bonds, driving their prices higher and consequently pushing yields lower. This is a classic inverse relationship: bond prices and yields move in opposite directions.

Understanding the Mechanics: Why Lower Yields?

When investors anticipate lower interest rates, they are more likely to invest in existing bonds offering higher yields than expected future bonds. This increased demand for existing bonds pushes their prices upward. Because yield is calculated as the return relative to the bond's price, an increase in price results in a decrease in yield. This is why the Fed's projection led to a noticeable drop in US Treasury yields across the maturity spectrum.

Impact on Various Sectors:

The decline in Treasury yields has ripple effects across various sectors:

- Mortgage Rates: Lower Treasury yields typically translate to lower mortgage rates, potentially stimulating the housing market. However, the ongoing banking sector concerns might temper this effect.

- Corporate Borrowing: Companies may find it cheaper to borrow money, boosting investment and potentially spurring economic growth. This, however, depends on the overall credit environment and investor confidence.

- Dollar Value: Lower yields can weaken the US dollar relative to other currencies, as investors seek higher returns elsewhere. This can impact international trade and investment flows.

- Inflation Expectations: The Fed's actions reflect concerns about inflation cooling, but the impact on inflation expectations themselves remains to be seen. Further rate cuts could fuel inflationary pressures if not carefully managed.

Looking Ahead: Uncertainty Remains

While the immediate impact of the Fed's projection is a drop in US Treasury yields, the longer-term implications remain uncertain. Several factors could influence the trajectory of yields, including:

- Inflation data: Future inflation reports will significantly impact the Fed's future decisions. Persistently high inflation could force the Fed to reconsider its rate cut projection.

- Economic growth: The strength of the US economy will play a crucial role. A significant slowdown could justify further rate cuts, while stronger-than-expected growth might postpone or even reverse the trend.

- Banking sector stability: The stability of the banking sector is paramount. Further stress in the sector could prompt the Fed to act aggressively to lower rates and boost liquidity.

What this Means for Investors:

Investors need to carefully consider the implications of these yield changes for their portfolios. The lower yields on Treasury bonds might necessitate a reassessment of investment strategies, potentially seeking higher returns in other asset classes, while remaining mindful of increased risk. Diversification and a long-term investment horizon remain critical strategies during periods of market uncertainty. Consulting with a financial advisor is always recommended.

Keywords: US Treasury Yields, Fed Rate Cut, Interest Rates, Bond Yields, Monetary Policy, Federal Reserve, FOMC, Economic Growth, Inflation, Investment Strategy, Market Volatility, Banking Sector, Mortgage Rates, Dollar Value.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's Rate Cut Projection On US Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Celtics Championship Hopes Can They Maintain Momentum This Offseason

May 21, 2025

Celtics Championship Hopes Can They Maintain Momentum This Offseason

May 21, 2025 -

Adelman Earns Players Backing Amidst Rising Praise For Nuggets Coaching

May 21, 2025

Adelman Earns Players Backing Amidst Rising Praise For Nuggets Coaching

May 21, 2025 -

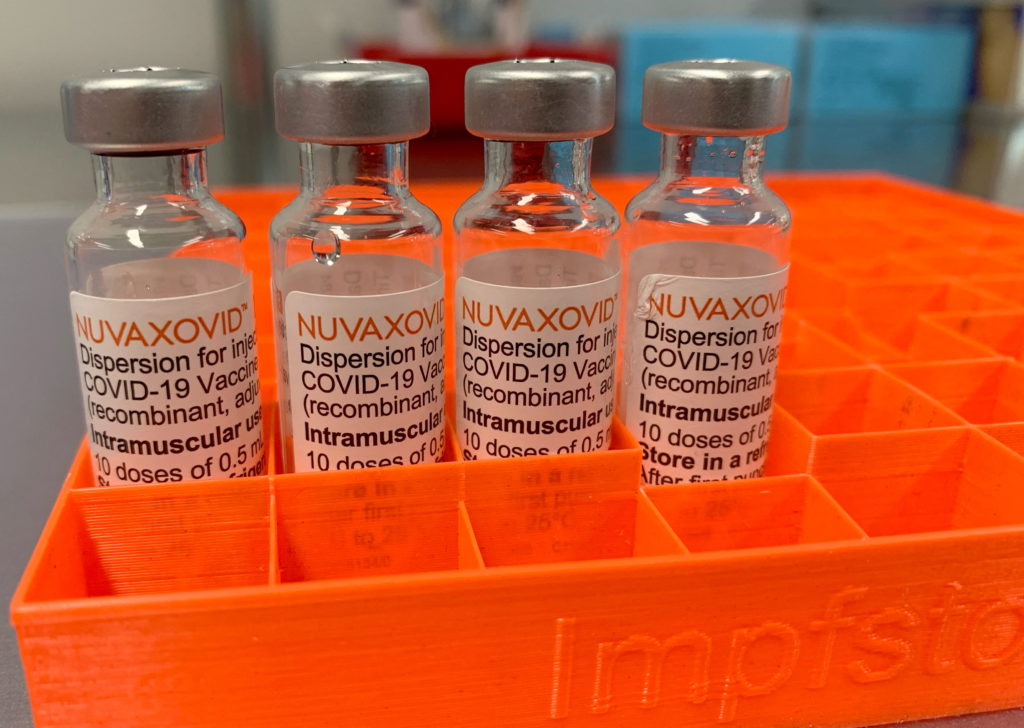

Fda Greenlights Novavax Covid 19 Vaccine But With Strict Usage Guidelines

May 21, 2025

Fda Greenlights Novavax Covid 19 Vaccine But With Strict Usage Guidelines

May 21, 2025 -

Marvin Harrison Jr S Offseason Gains A Look At His Year 2 Potential For Ohio State

May 21, 2025

Marvin Harrison Jr S Offseason Gains A Look At His Year 2 Potential For Ohio State

May 21, 2025 -

Watch This Critically Acclaimed Wwi Movie Starring Daniel Craig

May 21, 2025

Watch This Critically Acclaimed Wwi Movie Starring Daniel Craig

May 21, 2025