Impact Of Fed's 2025 Rate Cut Projection On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's 2025 Rate Cut Projection: A Ripple Effect on U.S. Treasury Yields

The Federal Reserve's recent projection of interest rate cuts in 2025 has sent ripples through the financial markets, significantly impacting U.S. Treasury yields. This unexpected shift in the Fed's outlook has investors re-evaluating their strategies and raises crucial questions about the future trajectory of the U.S. economy. Understanding the implications is vital for anyone invested in the bond market or concerned about broader economic trends.

The Fed's Unexpected Pivot: A Sign of Shifting Economic Winds?

For months, the Fed maintained a hawkish stance, emphasizing its commitment to combating inflation even at the cost of slower economic growth. However, the projection of rate cuts as early as 2025 signals a potential change in this strategy. This pivot suggests the Fed anticipates a significant cooling of the economy, potentially leading to lower inflation and reduced pressure on interest rates. This projection, while tentative, has already had a notable impact on investor sentiment and Treasury yields.

The Impact on U.S. Treasury Yields: A Deeper Dive

The immediate consequence of the Fed's projection has been a decline in U.S. Treasury yields. Yields, which move inversely to bond prices, dropped following the announcement. This is because investors, anticipating lower future interest rates, are now willing to accept lower returns on longer-term Treasury bonds. This decrease in yields affects various sectors:

-

Mortgage Rates: Lower Treasury yields often translate to lower mortgage rates, potentially boosting the housing market. However, this effect is not always direct and depends on other market factors. For a more in-depth analysis on the current mortgage landscape, check out this recent report from [link to a relevant reputable financial news source].

-

Corporate Borrowing Costs: Reduced Treasury yields can also reduce borrowing costs for corporations, encouraging investment and potentially stimulating economic growth. However, this benefit is contingent on the overall economic climate and investor confidence.

-

Investment Strategies: The shift in the Fed's outlook necessitates a reassessment of investment portfolios. Investors may need to adjust their holdings of Treasury bonds and other fixed-income securities to reflect the altered interest rate environment.

Uncertainty Remains: Navigating the Economic Landscape

While the Fed's projection offers a glimpse into its anticipated future actions, considerable uncertainty remains. The actual timing and magnitude of any rate cuts will depend on several factors, including inflation data, economic growth, and the overall health of the financial system. Experts are divided on the accuracy of the projection, with some arguing that the Fed is underestimating the persistence of inflation while others believe the current economic slowdown justifies the anticipated rate cuts.

What to Watch For:

- Inflation Data: Upcoming inflation reports will be crucial in confirming or refuting the Fed's assessment of the economic situation. Any unexpected surges in inflation could lead to a reversal of the current trajectory.

- Economic Growth Indicators: Monitoring key economic indicators like GDP growth, employment numbers, and consumer spending will provide valuable insights into the health of the economy and the likelihood of rate cuts.

- Global Economic Conditions: Global economic instability could significantly influence the Fed's decisions, adding another layer of complexity to the situation.

Conclusion: A Cautious Optimism

The Fed's projection of rate cuts in 2025 presents a complex picture for investors and economists alike. While the immediate impact on U.S. Treasury yields is clear, the long-term implications remain uncertain. Careful monitoring of key economic indicators and a cautious approach to investment strategies are essential in navigating this evolving landscape. Staying informed about the latest developments is crucial for making sound financial decisions in the face of this uncertainty.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's 2025 Rate Cut Projection On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investors Pour 200 Million Into Ethereum Following Pectra Upgrade

May 20, 2025

Investors Pour 200 Million Into Ethereum Following Pectra Upgrade

May 20, 2025 -

Scheffler Secures 2025 Pga Championship A Winning Performance

May 20, 2025

Scheffler Secures 2025 Pga Championship A Winning Performance

May 20, 2025 -

Putins Dismissal Of Trump A New Era In Us Russia Relations

May 20, 2025

Putins Dismissal Of Trump A New Era In Us Russia Relations

May 20, 2025 -

Bali Implements Stricter Guidelines To Improve Tourist Conduct

May 20, 2025

Bali Implements Stricter Guidelines To Improve Tourist Conduct

May 20, 2025 -

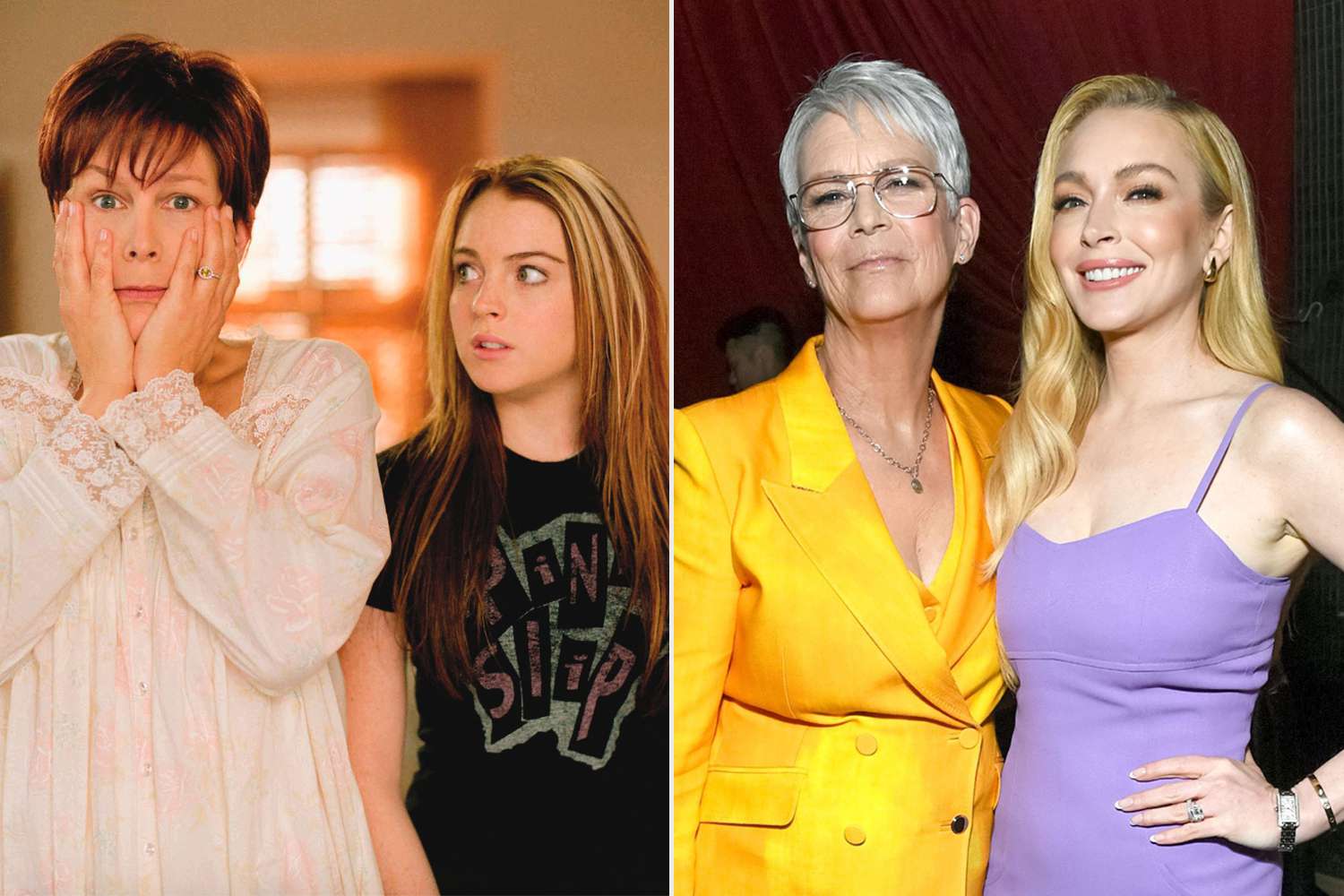

Jamie Lee Curtis Reveals Update On Her Bond With Lindsay Lohan Post Freaky Friday

May 20, 2025

Jamie Lee Curtis Reveals Update On Her Bond With Lindsay Lohan Post Freaky Friday

May 20, 2025