Impact Of Fed's 2025 Rate Cut Outlook On U.S. Treasury Yields

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed's 2025 Rate Cut Outlook: Shaking Up U.S. Treasury Yields

The Federal Reserve's hinted-at rate cuts in 2025 have sent ripples through the financial markets, significantly impacting U.S. Treasury yields. This shift marks a notable change from the aggressive interest rate hikes implemented throughout 2022 and 2023 to combat inflation. Understanding this impact is crucial for investors, economists, and anyone interested in the future direction of the U.S. economy.

The Fed's Pivot: From Hawks to Doves?

For much of 2022 and the first half of 2023, the Federal Reserve maintained a hawkish stance, aggressively raising interest rates to curb stubbornly high inflation. This led to a significant increase in U.S. Treasury yields, as investors sought higher returns in a rising rate environment. However, recent comments from Fed officials suggest a potential pivot towards a more dovish approach in 2025. This expectation of future rate cuts is already influencing market behavior.

How Rate Cut Expectations Affect Treasury Yields:

The anticipation of lower interest rates in 2025 has several key implications for Treasury yields:

-

Decreased Demand for Existing Treasuries: If investors expect future rates to fall, the current yields on existing U.S. Treasury bonds become less attractive. This reduced demand can lead to a decrease in their prices, thereby pushing yields lower.

-

Increased Demand for Shorter-Term Treasuries: Investors may shift their investments towards shorter-term Treasury securities to capitalize on the expected rate cuts. This increased demand can temporarily boost the yields of short-term Treasuries.

-

Uncertainty and Volatility: The transition from a period of aggressive rate hikes to the expectation of cuts creates uncertainty in the market. This uncertainty can lead to increased volatility in Treasury yields as investors adjust their positions.

The Economic Implications:

The impact extends beyond the bond market. Lower yields can:

-

Stimulate Economic Growth: Lower borrowing costs make it cheaper for businesses to invest and expand, potentially boosting economic activity.

-

Increase Inflationary Pressures: Conversely, lower interest rates could also fuel inflation if the economy overheats. The Fed's delicate balancing act in navigating this will be critical.

-

Affect the Dollar's Value: Lower interest rates can make the U.S. dollar less attractive to foreign investors, potentially weakening its value.

Looking Ahead: Navigating the Uncertain Terrain

Predicting the precise impact of the Fed's 2025 rate cut outlook on U.S. Treasury yields remains challenging. Several factors, including the pace of inflation, economic growth, and geopolitical events, will play a significant role. Investors should carefully consider their risk tolerance and investment horizon when making decisions in this dynamic environment. Staying informed about economic indicators and Fed pronouncements is crucial for navigating these market shifts.

Further Reading:

- (Replace with actual link)

- (Replace with actual link)

Disclaimer: This article provides general information and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Impact Of Fed's 2025 Rate Cut Outlook On U.S. Treasury Yields. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Heartbreak And Healing Ellen De Generes Social Media Reappearance And Fan Support

May 21, 2025

Heartbreak And Healing Ellen De Generes Social Media Reappearance And Fan Support

May 21, 2025 -

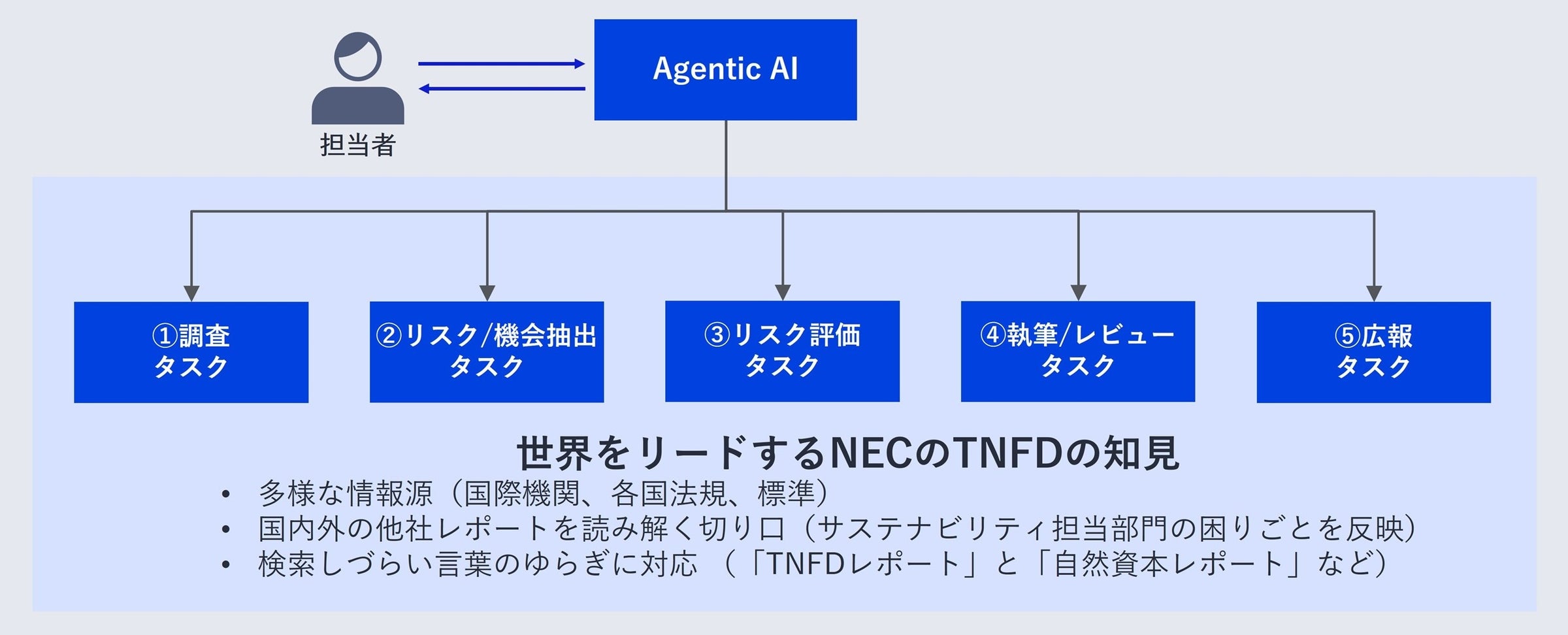

Tnfd Nec Agentic Ai

May 21, 2025

Tnfd Nec Agentic Ai

May 21, 2025 -

Espn Report Trae Youngs Post Game Comments On Knicks And Thunder Fanbases

May 21, 2025

Espn Report Trae Youngs Post Game Comments On Knicks And Thunder Fanbases

May 21, 2025 -

Jon Jones Strip The Duck Remark Mma Fans Erupt Over Aspinall Comments

May 21, 2025

Jon Jones Strip The Duck Remark Mma Fans Erupt Over Aspinall Comments

May 21, 2025 -

Beyond The Headlines The Director Of Netflixs Fall Of Favre On The Films Challenges

May 21, 2025

Beyond The Headlines The Director Of Netflixs Fall Of Favre On The Films Challenges

May 21, 2025