IBM's Stock Performance: A Deep Dive Into Recent Trends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM's Stock Performance: A Deep Dive into Recent Trends

IBM, a tech giant with a history spanning over a century, has seen its stock performance fluctuate significantly in recent years. Understanding these trends is crucial for investors and anyone interested in the future of this technological behemoth. This in-depth analysis examines the key factors driving IBM's stock price, exploring both the positive and negative influences shaping its trajectory.

Recent Stock Performance: A Rollercoaster Ride?

IBM's stock (IBM) has shown a mixed performance in the past year, mirroring the broader tech sector's volatility. While experiencing periods of growth, it has also faced challenges, resulting in periods of decline. This inconsistency reflects the company's ongoing transformation and its efforts to adapt to the rapidly evolving technological landscape. Analyzing the company's quarterly earnings reports reveals a complex picture, with revenue growth in certain segments offset by declines in others. A deeper look into these specifics is necessary to fully grasp the situation.

Key Factors Influencing IBM's Stock Price:

Several factors significantly impact IBM's stock price. Understanding these elements is key to predicting future trends:

-

Hybrid Cloud Growth: IBM's significant investments in hybrid cloud solutions, particularly through Red Hat, represent a major growth driver. This strategic move positions IBM to capitalize on the increasing demand for flexible and scalable cloud infrastructure. The success of this strategy will be crucial in determining future stock performance.

-

Artificial Intelligence (AI) Initiatives: IBM's robust AI capabilities, including Watson, are another significant factor. The increasing adoption of AI across various industries offers substantial growth potential. However, the competitive landscape in the AI market is intense, requiring continuous innovation and strategic partnerships.

-

Legacy Business Challenges: IBM's traditional business segments, while still contributing revenue, are facing challenges in a rapidly changing market. The company's ability to successfully transition away from these legacy systems while fostering growth in newer technologies will greatly influence its stock price.

-

Global Economic Conditions: Like many multinational corporations, IBM's stock price is susceptible to global economic fluctuations. Recessions, geopolitical instability, and shifts in currency exchange rates can all affect its performance.

-

Competition: The technology sector is highly competitive. IBM faces stiff competition from major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Maintaining a competitive edge requires constant innovation and adaptation.

H2: Analyzing the Future: Where is IBM Headed?

Predicting future stock performance is inherently challenging. However, by considering the factors outlined above, we can draw some conclusions. IBM's strategic focus on hybrid cloud and AI positions it favorably for long-term growth. However, successful execution of these strategies is paramount. The company’s ability to manage its transition away from legacy businesses and navigate the fiercely competitive tech landscape will be crucial determinants of its future success.

H3: Investor Considerations:

Investors should carefully consider their risk tolerance and investment horizon before investing in IBM. While the company’s strategic shifts offer potential for growth, the inherent volatility of the tech sector and the challenges associated with a major corporate transformation need to be factored into any investment decision. Conduct thorough due diligence and consider consulting with a financial advisor before making any investment choices.

Conclusion:

IBM's stock performance reflects a complex interplay of factors, including its successful strategic pivots toward hybrid cloud and AI, challenges in its legacy business, and broader macroeconomic conditions. While the future holds both opportunities and challenges, careful monitoring of the company's progress in these key areas will provide valuable insights into its potential for future growth. Stay informed, stay engaged, and make informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM's Stock Performance: A Deep Dive Into Recent Trends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2023 Nfl Playoffs Predicting The Unexpected Contenders

Jun 07, 2025

2023 Nfl Playoffs Predicting The Unexpected Contenders

Jun 07, 2025 -

Nascar Michigan 2025 Firekeepers Casino 400 Race Schedule Start Time And Tv Channel Guide

Jun 07, 2025

Nascar Michigan 2025 Firekeepers Casino 400 Race Schedule Start Time And Tv Channel Guide

Jun 07, 2025 -

Nba Finals Nuggets Take Game 1 Heat Vow To Fight Back

Jun 07, 2025

Nba Finals Nuggets Take Game 1 Heat Vow To Fight Back

Jun 07, 2025 -

Coco Gauffs Partner Everything We Know About Her Romantic Life

Jun 07, 2025

Coco Gauffs Partner Everything We Know About Her Romantic Life

Jun 07, 2025 -

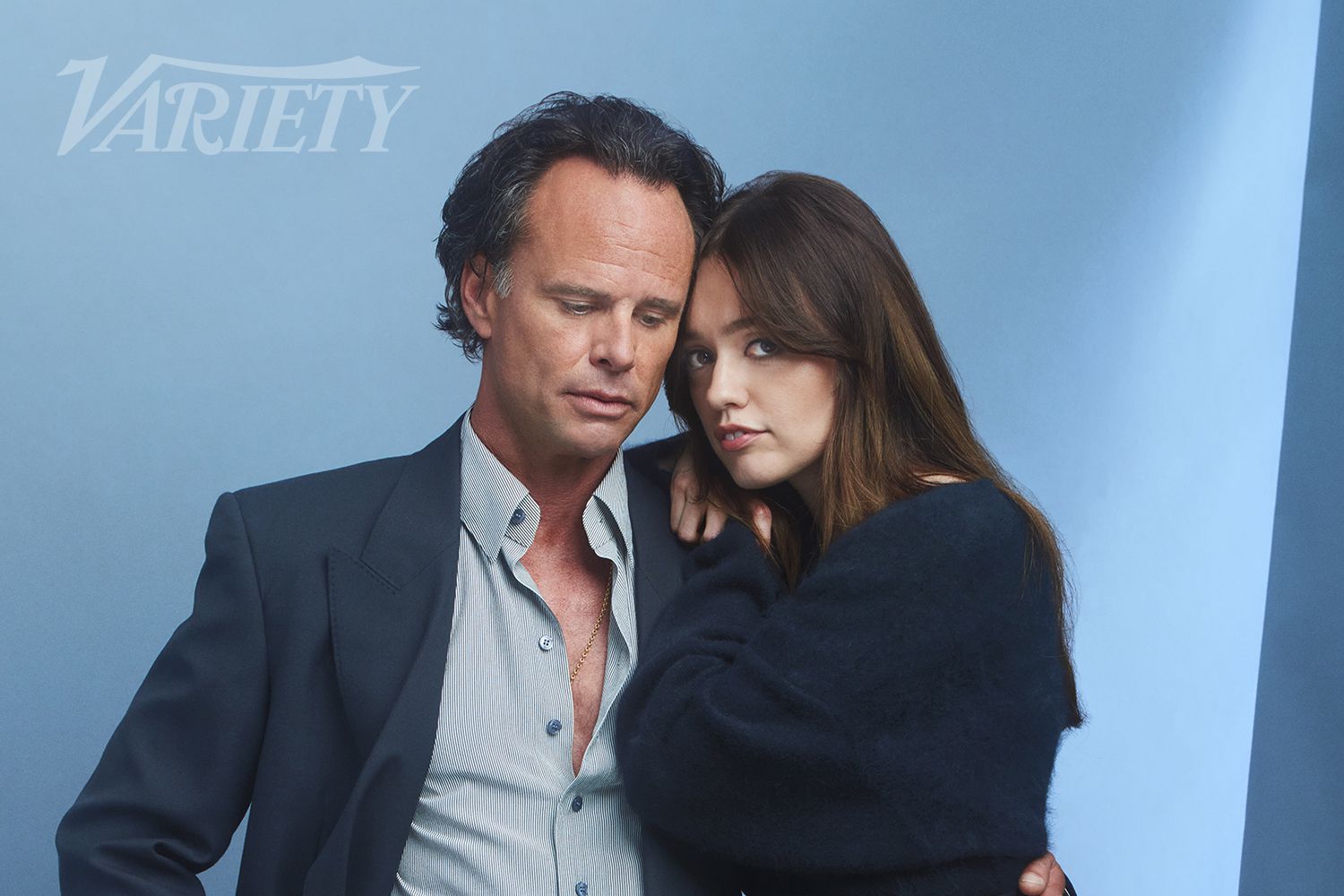

Walton Goggins And Aimee Lou Wood Setting The Record Straight On Public Feud

Jun 07, 2025

Walton Goggins And Aimee Lou Wood Setting The Record Straight On Public Feud

Jun 07, 2025