IBM's Recent Stock Decline: A Deep Dive Into Market Trends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM's Recent Stock Decline: A Deep Dive into Market Trends

IBM, a tech giant with a history spanning over a century, has recently experienced a downturn in its stock price. This decline has sparked considerable interest and speculation within the financial world, prompting analysts to delve into the underlying market trends impacting the company's performance. Understanding these trends is crucial for investors seeking to navigate the complexities of the tech sector and assess IBM's future prospects.

Understanding the Decline:

IBM's stock price hasn't plummeted dramatically, but the consistent downward pressure raises important questions. While the company reports steady revenue, the market seems less enthusiastic than in previous years. This isn't solely due to IBM's internal performance; broader market forces are undeniably at play.

Factors Contributing to the Decline:

Several factors contribute to IBM's recent stock decline:

-

Increased Competition: The technology landscape is fiercely competitive. Cloud computing giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) exert significant pressure on IBM's hybrid cloud strategy. This intense competition impacts market share and profitability.

-

Shifting Market Focus: Investor focus is heavily tilted towards high-growth, disruptive technologies like AI and machine learning. While IBM is actively involved in these areas (with offerings like Watson), the market may perceive its progress as slower compared to more agile competitors. This perception gap is impacting valuations.

-

Economic Uncertainty: The global economic climate, characterized by inflation and potential recessionary fears, contributes to general market volatility. Investors often move towards safer investments during uncertain times, potentially leading to a sell-off in even established companies like IBM.

-

Hybrid Cloud Strategy Challenges: IBM's hybrid cloud strategy, while strategically sound, faces the challenge of integrating diverse systems and managing complex deployments. The complexity could be seen as a barrier to entry for some clients, impacting adoption rates.

Analyzing IBM's Response:

IBM isn't standing still. The company is actively investing in:

-

AI and Machine Learning: Significant resources are being channeled into enhancing IBM Watson and developing new AI-powered solutions across various sectors. This is a strategic move to compete effectively in the rapidly expanding AI market.

-

Hybrid Cloud Expansion: IBM continues to refine and expand its hybrid cloud offerings, aiming to improve ease of use and integration. This focus is crucial for maintaining competitiveness in the cloud market.

-

Strategic Acquisitions: Targeted acquisitions could bolster IBM's capabilities and strengthen its position in key market segments. This aggressive strategy shows a commitment to staying relevant in the dynamic tech landscape.

Looking Ahead: Future Prospects for IBM

Predicting the future is inherently challenging, but several factors suggest potential for IBM's recovery:

-

Strong Brand Reputation: IBM retains a strong brand reputation built over decades of innovation and reliability. This brand equity offers a valuable competitive advantage.

-

Diverse Customer Base: IBM serves a vast and diverse client base across various industries, providing resilience against fluctuations in specific sectors.

-

Focus on Long-Term Value: IBM's emphasis on long-term value creation, rather than short-term gains, may be a source of strength in the long run.

Conclusion:

IBM's recent stock decline is a complex issue influenced by market dynamics and internal strategic decisions. While challenges exist, IBM's commitment to innovation, its strong brand, and diversified customer base offer a degree of resilience. Investors should carefully consider these factors when assessing IBM's long-term prospects. Further research and analysis are recommended before making any investment decisions. For more in-depth market analysis, you might find resources like [link to reputable financial news site] helpful.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM's Recent Stock Decline: A Deep Dive Into Market Trends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ufcs Maycee Barber Announces Need For Additional Medical Evaluation

Jun 06, 2025

Ufcs Maycee Barber Announces Need For Additional Medical Evaluation

Jun 06, 2025 -

Nike Air Max 95 Og Bright Mandarin Stockists And Release Info

Jun 06, 2025

Nike Air Max 95 Og Bright Mandarin Stockists And Release Info

Jun 06, 2025 -

2025 Nfl Season Kansas City Chiefs Game By Game Predictions And Super Bowl Odds

Jun 06, 2025

2025 Nfl Season Kansas City Chiefs Game By Game Predictions And Super Bowl Odds

Jun 06, 2025 -

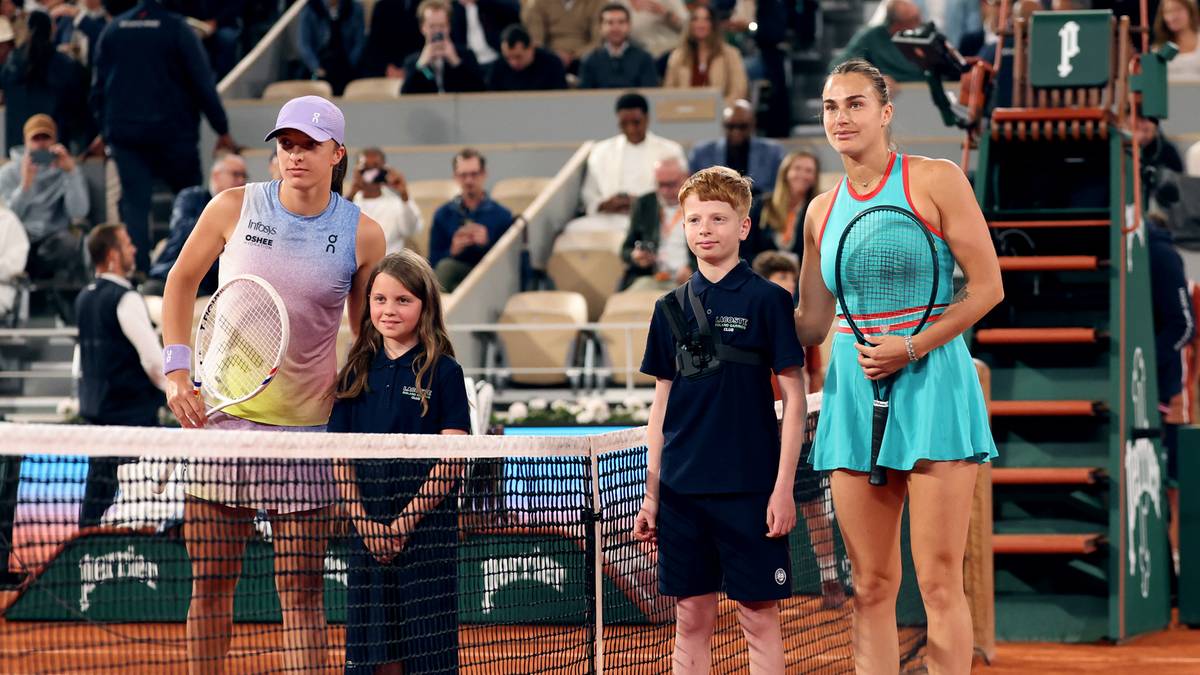

Roland Garros Swiatek Sabalenka Online Relacja Live I Wynik Meczu

Jun 06, 2025

Roland Garros Swiatek Sabalenka Online Relacja Live I Wynik Meczu

Jun 06, 2025 -

Is It Real Teyana Taylors New Video Hints At Relationship With Aaron Pierre

Jun 06, 2025

Is It Real Teyana Taylors New Video Hints At Relationship With Aaron Pierre

Jun 06, 2025