IBM Stock Performance: A Deep Dive Into Recent Trends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM Stock Performance: A Deep Dive into Recent Trends

IBM, a titan of the tech industry, has seen its stock performance fluctuate significantly in recent years. While once a steady, predictable investment, the company's strategic shift towards hybrid cloud and AI has introduced both opportunities and challenges for investors. This deep dive analyzes recent trends in IBM stock performance, exploring the factors driving its movement and offering insights for potential investors.

IBM's Transformation and its Impact on Stock Price

IBM's stock performance is inextricably linked to its ongoing transformation. The company's strategic pivot away from its legacy hardware business towards high-growth areas like hybrid cloud (Red Hat acquisition playing a key role), artificial intelligence (Watson), and consulting services has been a defining factor in its recent stock trajectory. This transformation, while promising long-term growth, has created short-term volatility.

Key Factors Influencing IBM Stock:

-

Hybrid Cloud Growth: The success of IBM's hybrid cloud strategy, powered by Red Hat, is a major driver of investor sentiment. Strong growth in this sector significantly impacts IBM's overall performance and market valuation. [Link to IBM's latest earnings report highlighting cloud revenue].

-

AI Investments and Innovation: IBM's substantial investments in AI, particularly through Watson, are viewed as crucial for future growth. However, the competitive landscape in AI is fierce, and the successful monetization of these technologies is key to sustained stock appreciation. [Link to an article discussing IBM's AI advancements].

-

Economic Conditions: Like most tech stocks, IBM's performance is sensitive to broader macroeconomic factors. Recessions, inflation, and interest rate hikes can negatively impact investor confidence and lead to stock price declines.

-

Competition: IBM faces stiff competition from other tech giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. Maintaining a competitive edge in the cloud and AI markets is essential for future stock growth.

-

Dividends and Share Buybacks: IBM's consistent dividend payouts and share buyback programs offer a level of stability for investors, particularly those seeking income. This can help cushion the impact of short-term stock price fluctuations. [Link to IBM's investor relations page detailing dividend policy].

Analyzing Recent Trends:

The past year has witnessed a mixed bag for IBM's stock. While certain quarters have shown promising growth driven by hybrid cloud adoption, other periods experienced slower growth or even declines, reflecting the challenges of a rapidly evolving technological landscape. [Insert a chart or graph illustrating recent stock price movements – this would require external data sourcing].

Looking Ahead:

Predicting future stock performance is inherently challenging, but several factors suggest potential future growth for IBM:

- Continued Hybrid Cloud Adoption: The growing demand for hybrid cloud solutions positions IBM favorably for sustained growth.

- AI-Driven Innovation: Breakthroughs in AI and successful integration into various industries could significantly boost IBM's revenue and market share.

- Strong Client Relationships: IBM's long-standing relationships with major corporations provide a solid foundation for future business.

Conclusion:

IBM's stock performance is a complex interplay of strategic shifts, market conditions, and competitive pressures. While the company's transformation presents both risks and rewards, investors should carefully consider its long-term strategic goals and the potential for sustained growth in hybrid cloud and AI before making investment decisions. Conduct thorough due diligence and consult with a financial advisor before investing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM Stock Performance: A Deep Dive Into Recent Trends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Antigua And Barbuda Vs Cuba Your Guide To Watching The World Cup Qualifier

Jun 07, 2025

Antigua And Barbuda Vs Cuba Your Guide To Watching The World Cup Qualifier

Jun 07, 2025 -

Will The Thunder Or Pacers Win The 2025 Nba Finals Our Pick

Jun 07, 2025

Will The Thunder Or Pacers Win The 2025 Nba Finals Our Pick

Jun 07, 2025 -

Chris The Bear Fallicas Analysis Your Guide To Betting The 2025 Belmont Stakes

Jun 07, 2025

Chris The Bear Fallicas Analysis Your Guide To Betting The 2025 Belmont Stakes

Jun 07, 2025 -

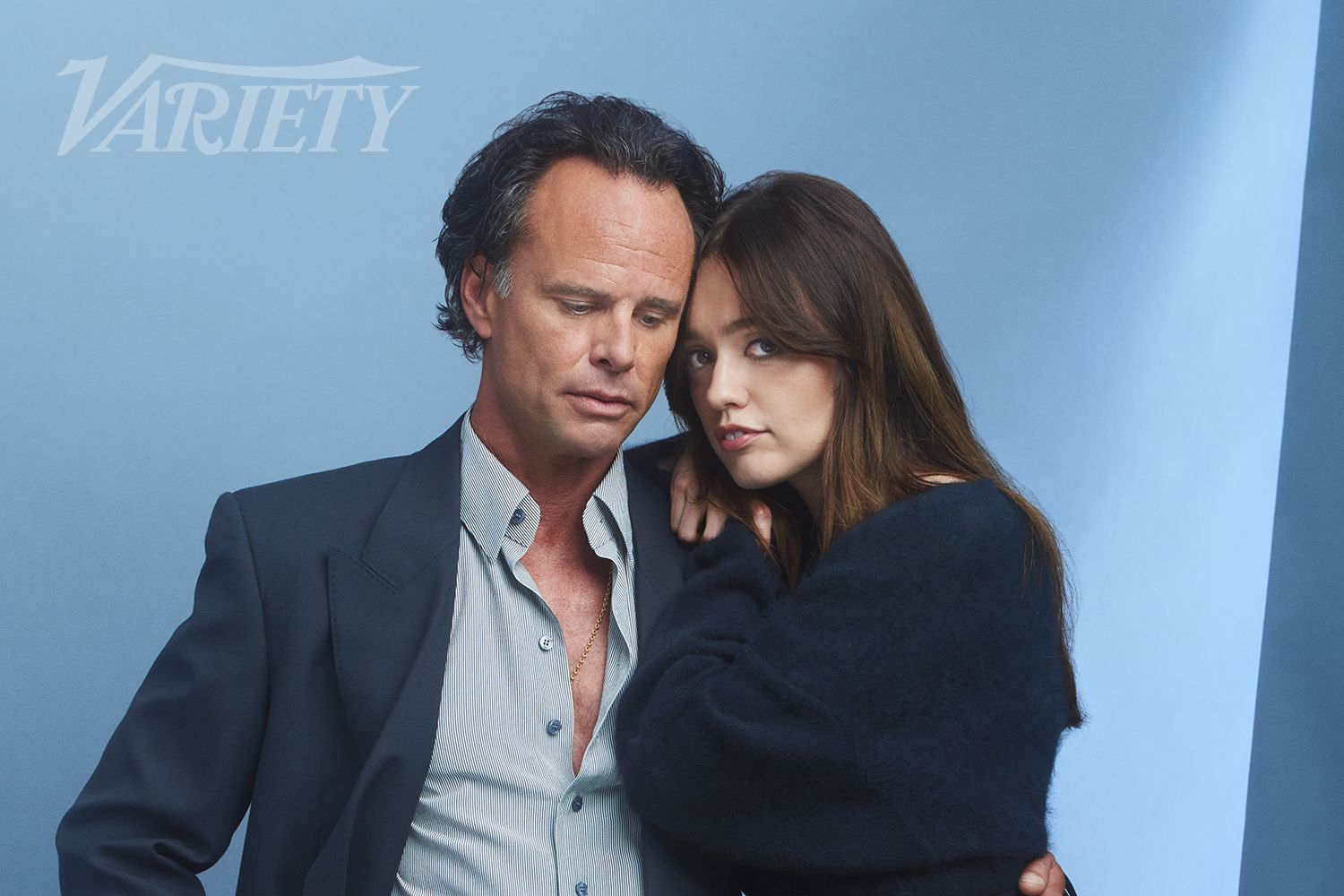

Walton Goggins And Aimee Lou Wood Addressing Feud Rumors In A New Interview

Jun 07, 2025

Walton Goggins And Aimee Lou Wood Addressing Feud Rumors In A New Interview

Jun 07, 2025 -

Verdict Expected Soon Maxwell Anderson Trial For Sade Robinson Murder Continues

Jun 07, 2025

Verdict Expected Soon Maxwell Anderson Trial For Sade Robinson Murder Continues

Jun 07, 2025