IBM Stock Market Lag: A Deep Dive Into Current Performance And Potential Recovery

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

IBM Stock Market Lag: A Deep Dive into Current Performance and Potential Recovery

IBM, a tech giant synonymous with innovation for over a century, has recently experienced a period of stock market underperformance. While the company remains a powerful force in the tech world, understanding the reasons behind its lag and the potential for recovery is crucial for investors. This in-depth analysis explores the current state of IBM stock and examines factors influencing its future trajectory.

IBM's Recent Performance: A Mixed Bag

IBM's stock price hasn't mirrored the impressive growth seen in other tech sectors. Several factors contribute to this underperformance:

-

Shifting Market Dynamics: The rapid growth of cloud computing and AI has reshaped the tech landscape. While IBM is actively involved in these areas through its hybrid cloud offerings and Watson AI, it's facing stiff competition from industry leaders like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. This competitive pressure impacts market share and profitability, influencing investor sentiment.

-

Transitioning Business Model: IBM is undergoing a significant transformation, moving away from its traditional hardware-centric business model towards a higher-margin, software and services-driven approach. This transition, while strategically sound in the long term, has resulted in short-term challenges and uncertainty for investors.

-

Economic Headwinds: Global economic uncertainty and inflationary pressures have impacted investor confidence across various sectors, including technology. This broader economic context has undoubtedly influenced IBM's stock performance.

Analyzing the Challenges and Opportunities

While the challenges are undeniable, IBM possesses several strengths that could pave the way for a potential recovery:

-

Strong Hybrid Cloud Strategy: IBM's hybrid cloud solutions are gaining traction, offering businesses a flexible approach to cloud adoption. This strategy allows organizations to seamlessly integrate their on-premises infrastructure with cloud services, addressing a key need in the market.

-

Continued Investment in AI and R&D: IBM remains committed to investing heavily in research and development, particularly in artificial intelligence. This sustained investment positions the company for future growth in rapidly expanding sectors.

-

Robust Consulting and Services Business: IBM's consulting and services arm provides a stable and recurring revenue stream, providing a buffer against volatility in other segments. This diversification mitigates risks associated with reliance on specific product lines.

-

Cost Optimization Initiatives: IBM is actively pursuing cost optimization strategies to improve profitability and efficiency. These efforts are crucial for enhancing shareholder value and attracting investor confidence.

Potential Recovery Scenarios and Factors to Watch

The potential for IBM stock recovery depends on several key factors:

-

Execution of its hybrid cloud strategy: Successful market penetration and adoption of its hybrid cloud offerings will be vital for driving growth. Watch for key performance indicators (KPIs) related to cloud revenue and market share.

-

Success in AI innovation: Breakthroughs in AI and the successful implementation of Watson AI solutions across various industries could significantly boost investor confidence.

-

Overall market conditions: A stabilization or improvement in global economic conditions would positively impact investor sentiment and potentially lead to increased investment in IBM stock.

-

Effective management of the transition: The successful execution of IBM's business model transformation will be crucial for long-term growth and profitability.

Conclusion: A Long-Term Perspective

While IBM's stock market performance has lagged recently, the company is actively addressing its challenges and positioning itself for future growth. Investors should adopt a long-term perspective, focusing on the company's strategic initiatives and its potential for success in the evolving tech landscape. Careful monitoring of key performance indicators and market trends is crucial for making informed investment decisions regarding IBM stock. Further research into competitor analysis and industry reports will provide a more comprehensive understanding of the current market dynamics. Remember to consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on IBM Stock Market Lag: A Deep Dive Into Current Performance And Potential Recovery. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Revisiting The 2020 Nfl Draft Top 10 Players And Their Impact

Jun 06, 2025

Revisiting The 2020 Nfl Draft Top 10 Players And Their Impact

Jun 06, 2025 -

Broadcom Stock Analyst And Trader Expectations Following Earnings Announcement

Jun 06, 2025

Broadcom Stock Analyst And Trader Expectations Following Earnings Announcement

Jun 06, 2025 -

Germany Vs Portugal Nations League Semifinal Match Preview And Viewing Information

Jun 06, 2025

Germany Vs Portugal Nations League Semifinal Match Preview And Viewing Information

Jun 06, 2025 -

The Untold Story How Carrie Fisher Helped Mark Hamill Accept His Iconic Role

Jun 06, 2025

The Untold Story How Carrie Fisher Helped Mark Hamill Accept His Iconic Role

Jun 06, 2025 -

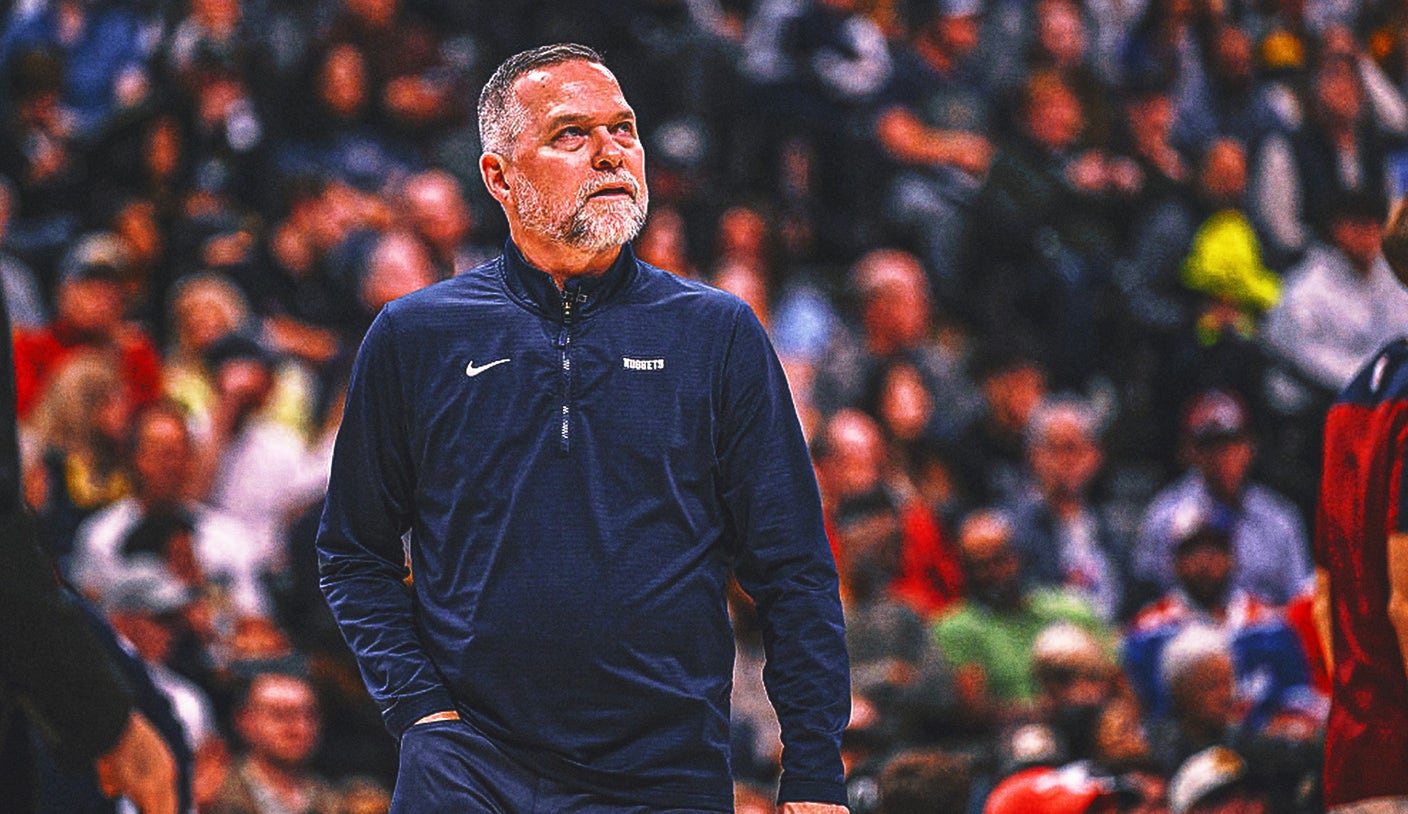

New York Knicks Head Coach Search Latest Odds And Potential Replacements

Jun 06, 2025

New York Knicks Head Coach Search Latest Odds And Potential Replacements

Jun 06, 2025