HSBC Mutual Fund's RetireToMore Campaign: A Closer Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HSBC Mutual Fund's RetireToMore Campaign: A Closer Look at Secure Retirement Planning

Planning for retirement can feel daunting. The sheer number of investment options, the unpredictable market, and the uncertainty of future needs can leave many feeling overwhelmed. HSBC Mutual Fund's recent "RetireToMore" campaign aims to address these anxieties, offering a pathway to a financially secure retirement. But what does this campaign entail, and is it the right solution for you? Let's delve deeper.

Understanding the RetireToMore Campaign:

The RetireToMore campaign isn't just about selling mutual funds; it's about promoting a holistic approach to retirement planning. HSBC recognizes that retirement security is more than just having enough money; it's about peace of mind and the freedom to enjoy your later years. The campaign emphasizes several key aspects:

- Financial Planning Education: A core component of RetireToMore is providing resources and educational materials to help individuals understand their retirement needs and develop a personalized plan. This includes online tools, webinars, and potentially in-person consultations (depending on the specific offerings).

- Diversified Investment Strategies: HSBC likely promotes its range of mutual funds as a means to achieve diversified investment, mitigating risk and potentially maximizing returns over the long term. They will likely highlight funds tailored to different risk tolerances and retirement timelines.

- Long-Term Growth Focus: The campaign stresses the importance of starting early and investing consistently for long-term growth. This is crucial, as compounding returns are key to building a substantial retirement nest egg.

- Retirement Goal Setting: A successful retirement plan requires clearly defined goals. The campaign likely guides individuals through the process of setting realistic and achievable retirement goals, helping them determine how much they need to save and invest.

Key Features and Benefits (Likely Offered):

While specific details may vary, RetireToMore likely offers several key features aimed at simplifying and improving retirement planning:

- Online Retirement Calculator: Many financial institutions offer online calculators to help estimate retirement needs based on factors like age, current income, and desired lifestyle.

- Personalized Investment Advice (Potentially): Although this may depend on the specific investor's situation and level of investment, personalized guidance from financial advisors could be a part of the campaign's offerings.

- Access to a Range of Mutual Funds: HSBC will showcase their diverse range of mutual funds designed to cater to various risk profiles and investment horizons.

- Regular Portfolio Reviews (Potentially): Ongoing monitoring and adjustments to investment strategies could be another valuable service offered as part of the campaign.

Is RetireToMore Right for You?

The suitability of the RetireToMore campaign depends on your individual circumstances. If you are:

- Early in your career: Starting early is crucial for maximizing the benefits of compounding. This campaign could be ideal for establishing good retirement savings habits.

- Unsure about retirement planning: The educational resources and tools offered could provide valuable guidance.

- Looking for diversified investment options: HSBC's mutual funds offer diversification, potentially reducing risk.

However, it’s crucial to remember that:

- Past performance is not indicative of future results: While mutual funds aim for growth, there's always inherent market risk.

- Seek professional financial advice: While the campaign provides resources, it’s always wise to consult a qualified financial advisor for personalized advice tailored to your specific needs and circumstances.

Conclusion:

HSBC's RetireToMore campaign represents a significant effort to simplify and demystify retirement planning. By focusing on education, diversification, and long-term growth, it aims to empower individuals to secure their financial futures. While it's crucial to carefully consider your individual financial situation and seek professional advice, the campaign offers a valuable starting point for building a more confident and secure retirement. Learn more by visiting the official HSBC Mutual Fund website (insert link here if available). Remember to always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HSBC Mutual Fund's RetireToMore Campaign: A Closer Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Grace Potters Forgotten Album A Deep Dive Through Exclusive Soundbites

Jun 05, 2025

Grace Potters Forgotten Album A Deep Dive Through Exclusive Soundbites

Jun 05, 2025 -

Rashod Batemans Record Setting Nfl Deal A New High For Minnesota Gophers Wide Receivers

Jun 05, 2025

Rashod Batemans Record Setting Nfl Deal A New High For Minnesota Gophers Wide Receivers

Jun 05, 2025 -

Broadcoms Q Quarter Number Earnings Why Wall Street Is Watching Closely

Jun 05, 2025

Broadcoms Q Quarter Number Earnings Why Wall Street Is Watching Closely

Jun 05, 2025 -

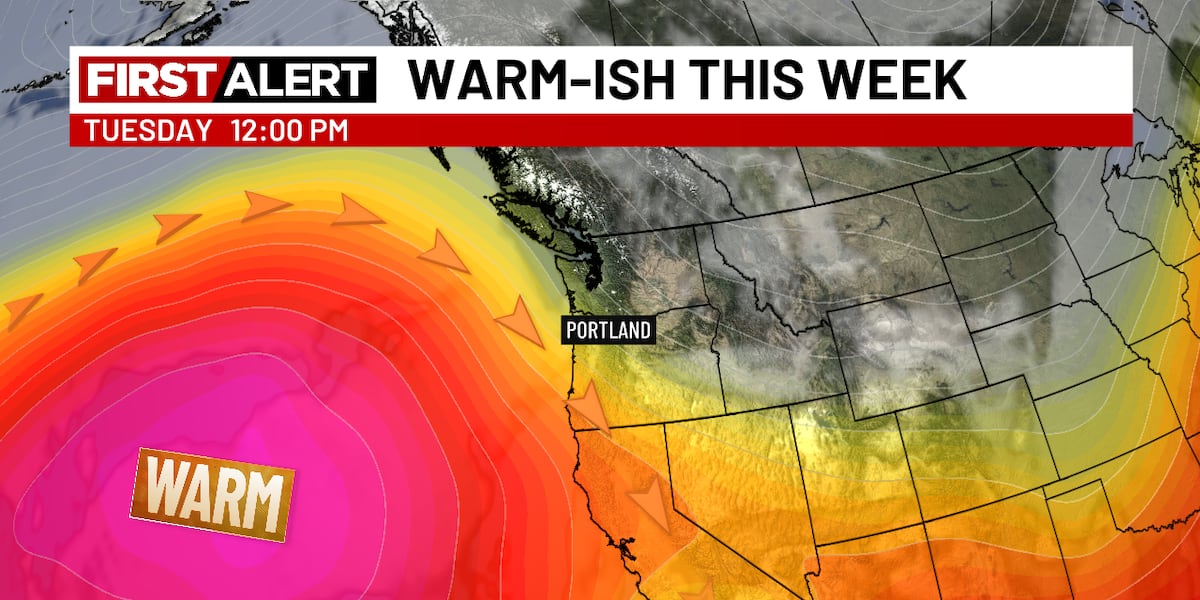

Dry Spell Continues June Starts Sunny And Warm

Jun 05, 2025

Dry Spell Continues June Starts Sunny And Warm

Jun 05, 2025 -

Will The Chiefs Reign Supreme In 2025 A Game By Game Analysis

Jun 05, 2025

Will The Chiefs Reign Supreme In 2025 A Game By Game Analysis

Jun 05, 2025