HOOD Stock Surge: Robinhood Shares Up 6.46% — What Investors Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

HOOD Stock Surge: Robinhood Shares Up 6.46% — What Investors Need to Know

Robinhood Markets, Inc. (HOOD) experienced a significant surge on [Date of surge], with its stock price jumping 6.46%. This unexpected boost has left many investors wondering: what's driving this rally, and what does it mean for the future of the popular trading app? This article delves into the potential factors behind this increase and offers insights for investors considering HOOD stock.

Understanding the 6.46% Jump:

Several factors could contribute to this sudden upward trend in HOOD stock. While no single cause definitively explains the entire increase, a confluence of events likely played a role. These include:

-

Improved Financials (if applicable): Recent financial reports might have revealed positive signs, such as increased user engagement, higher trading volume, or improved revenue streams. Stronger-than-expected earnings, for example, often lead to positive market reactions. Check Robinhood's official investor relations page for the latest financial updates. [Link to Robinhood Investor Relations]

-

Positive Market Sentiment: Broader market trends can significantly impact individual stocks. A generally positive market sentiment, fueled by economic indicators or other news, could have lifted HOOD along with other tech stocks. Keeping an eye on overall market indices is crucial for understanding the context of such movements.

-

Analyst Upgrades: Positive analyst ratings and price target increases for HOOD could influence investor confidence and buying pressure. Look for recent reports from reputable financial analysts to understand their perspective on the company's future prospects.

-

Speculation and Short Covering: The stock market is often driven by speculation. A surge in buying could be triggered by rumors or anticipation of future positive developments. Similarly, short sellers closing their positions (short covering) can create a rapid price increase.

What Investors Need to Know:

While the 6.46% increase is encouraging, investors should proceed with caution. Past performance is not indicative of future results. Before making any investment decisions, consider these points:

-

Long-Term Perspective: Investing in HOOD should be viewed as a long-term strategy rather than a short-term trade. Focus on the company's fundamental strength and long-term growth potential.

-

Risk Assessment: Investing in the stock market always involves risk. Understand the inherent volatility of the stock market and the specific risks associated with HOOD. Diversification is key to mitigating risk.

-

Company Fundamentals: Thoroughly research Robinhood's business model, competitive landscape, and financial health. Read their quarterly and annual reports to understand their performance and growth trajectory.

-

Market Volatility: Remain aware of broader market fluctuations. External factors can influence the price of HOOD regardless of its internal performance.

Looking Ahead:

The future performance of HOOD remains uncertain. Continued monitoring of the company's performance, market trends, and analyst opinions is essential for informed decision-making. It's advisable to consult with a financial advisor before making any significant investment decisions.

Call to Action: Stay informed about HOOD and other market developments by subscribing to reliable financial news sources and following the company’s official channels. Remember, responsible investing requires thorough research and a long-term perspective.

Keywords: HOOD stock, Robinhood stock, stock market, stock price, investment, trading app, financial news, market analysis, investor relations, stock surge, market volatility, analyst ratings, short covering.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on HOOD Stock Surge: Robinhood Shares Up 6.46% — What Investors Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mark Hamill On Carrie Fisher Her Support Shaped My Star Wars Legacy

Jun 06, 2025

Mark Hamill On Carrie Fisher Her Support Shaped My Star Wars Legacy

Jun 06, 2025 -

Karl Anthony Towns Injury Update Sources Detail Treatment Plan Espn

Jun 06, 2025

Karl Anthony Towns Injury Update Sources Detail Treatment Plan Espn

Jun 06, 2025 -

Investing In Robinhood Assessing The Risks And Rewards

Jun 06, 2025

Investing In Robinhood Assessing The Risks And Rewards

Jun 06, 2025 -

Evaluating Trade Offers For Top Draft Prospect Cooper Flagg 2025

Jun 06, 2025

Evaluating Trade Offers For Top Draft Prospect Cooper Flagg 2025

Jun 06, 2025 -

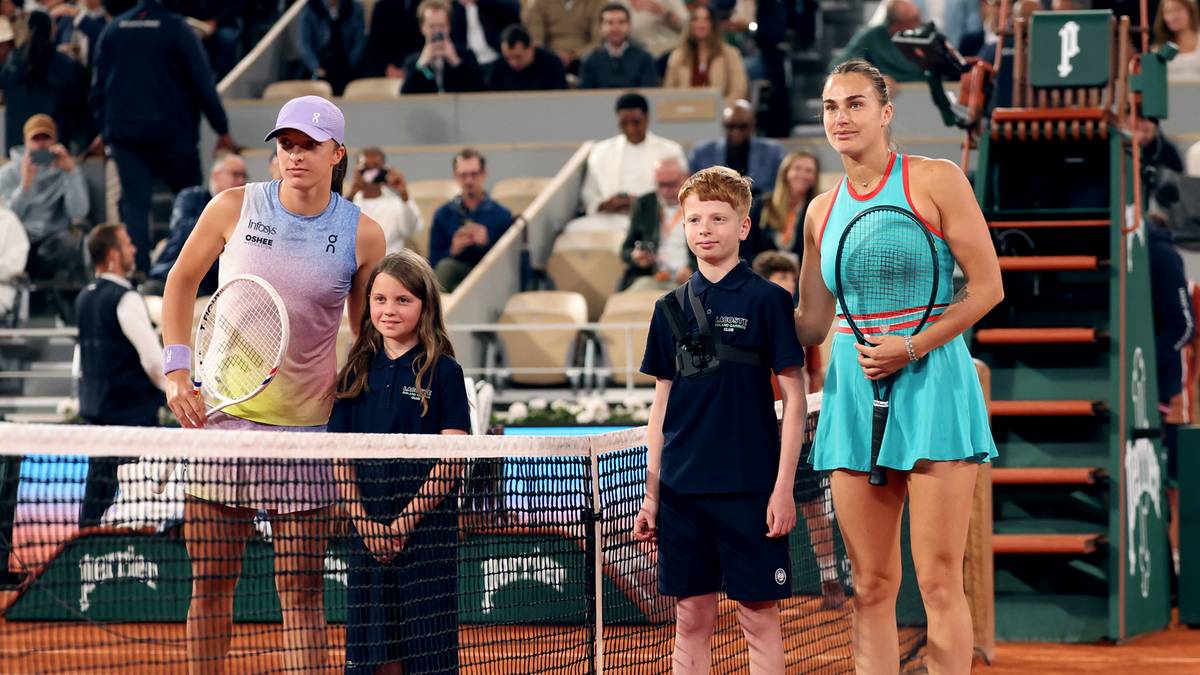

Iga Swiatek Aryna Sabalenka Mecz Roland Garros Relacja Live I Wynik

Jun 06, 2025

Iga Swiatek Aryna Sabalenka Mecz Roland Garros Relacja Live I Wynik

Jun 06, 2025