GameStop (GME) Stock Surge: Understanding Today's Price Jump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

GameStop (GME) Stock Surge: Understanding Today's Price Jump

GameStop (GME) stock experienced another significant price jump today, leaving investors wondering about the driving forces behind this volatility. While the company's turnaround strategy continues to unfold, understanding the factors influencing these price swings is crucial for anyone holding or considering investing in GME. This article delves into the potential reasons behind today's surge, examining both fundamental and speculative elements.

What Sparked Today's Rally?

Pinpointing the precise cause of any single day's stock movement is challenging, particularly with a volatile stock like GME. However, several contributing factors are likely at play:

-

Increased Retail Investor Interest: GameStop remains a favorite among retail investors, often active on social media platforms like Reddit's WallStreetBets. A renewed wave of positive sentiment or coordinated buying could easily influence the price. This "meme stock" status continues to be a significant factor in GME's price fluctuations.

-

Short Squeeze Potential: While the short interest in GME is significantly lower than its peak in 2021, any significant increase in buying pressure could still trigger a short squeeze. This occurs when short sellers, who bet against the stock's price, are forced to buy shares to cover their positions, driving the price even higher.

-

Speculation around Future Developments: News or rumors regarding the company's strategic initiatives, such as its NFT marketplace or its expansion into new areas, could fuel speculation and attract investors. Any positive developments, even minor ones, can be amplified in the current market climate.

-

Overall Market Sentiment: The broader market's performance also plays a role. A positive overall market trend often leads to increased investor confidence and risk appetite, potentially boosting the price of even volatile stocks like GME.

Analyzing GameStop's Fundamentals:

While speculative trading heavily influences GME's price, it's crucial to consider the company's fundamental performance. GameStop is actively attempting a transformation from a traditional brick-and-mortar retailer to a more digitally focused business. Their progress in this area, including the success of their online sales and the performance of their NFT marketplace, will ultimately influence the long-term value of the stock. Investors should carefully examine the company's financial reports and strategic plans to assess its long-term viability.

The Risks of Investing in GME:

It's important to acknowledge the significant risks associated with investing in GameStop. The stock's price is highly volatile and susceptible to unpredictable swings based on social media trends and speculative trading. Investing in GME requires a high-risk tolerance and a thorough understanding of the potential downsides. Consider diversifying your portfolio to mitigate risk and always conduct thorough research before making any investment decisions.

Where to Go From Here:

Today's price jump highlights the continued unpredictability of GME's stock price. For potential investors, it's vital to approach this stock with caution, understanding the inherent risks involved. Staying informed about the company's strategic initiatives, market sentiment, and any significant news affecting the stock is crucial for making informed investment decisions. Remember to consult with a financial advisor before making any investment choices. The information provided here is for educational purposes and shouldn't be considered financial advice.

Keywords: GameStop, GME, stock, stock market, price jump, volatility, meme stock, retail investors, short squeeze, NFT, investment, risk, financial advice, WallStreetBets, stock price, market sentiment, trading.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on GameStop (GME) Stock Surge: Understanding Today's Price Jump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Automation Anxiety Addressing Concerns About Ai And Job Displacement

May 28, 2025

Automation Anxiety Addressing Concerns About Ai And Job Displacement

May 28, 2025 -

Switzerland Vs Usa Team Usas World Ice Hockey Championship Triumph

May 28, 2025

Switzerland Vs Usa Team Usas World Ice Hockey Championship Triumph

May 28, 2025 -

Knicks Game 3 Win 20 Point Comeback Against Pacers

May 28, 2025

Knicks Game 3 Win 20 Point Comeback Against Pacers

May 28, 2025 -

Investing In Smci A Comprehensive Look At Its 14 62 P E Ratio

May 28, 2025

Investing In Smci A Comprehensive Look At Its 14 62 P E Ratio

May 28, 2025 -

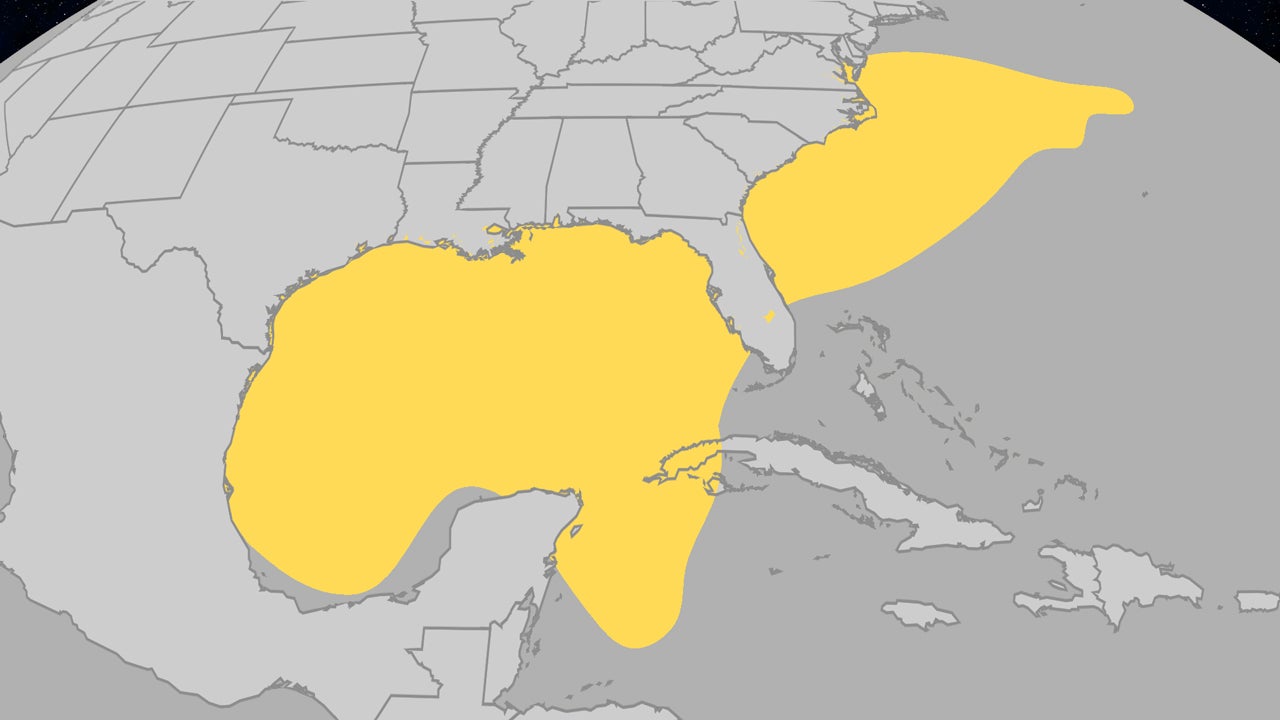

Early Hurricane Season Tracking Atlantic Storms June Origins

May 28, 2025

Early Hurricane Season Tracking Atlantic Storms June Origins

May 28, 2025