GameStop (GME) Stock Price Increase: Understanding The Market Drivers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

GameStop (GME) Stock Price Increase: Understanding the Market Drivers

GameStop (GME) has once again captivated the attention of investors, experiencing a significant surge in its stock price. This volatility, a hallmark of the company in recent years, begs the question: what are the underlying market drivers fueling this latest increase? While pinpointing a single cause is impossible, several factors are contributing to the renewed interest in GME stock.

The Persistent Meme Stock Effect: The legacy of the 2021 short squeeze continues to cast a long shadow. GameStop remains a favorite among retail investors, particularly those active on platforms like Reddit's r/WallStreetBets. These online communities, known for their collective trading power, can significantly influence the price of meme stocks like GME through coordinated buying pressure. This "meme stock" effect, while unpredictable, is a potent force shaping the stock's trajectory. Understanding this dynamic is crucial for anyone analyzing GME's price movements.

Speculation and Short Interest: High short interest remains a key factor. When a significant portion of a company's shares are shorted (betting on a price decline), the potential for a short squeeze – a rapid price increase forcing short-sellers to buy back shares to limit their losses – is always present. While analyzing short interest data requires careful consideration, it's undeniably a crucial element in the GME narrative. [Link to reputable financial news source on short interest data]

Company Transformation Efforts: It's important to note that GameStop isn't solely reliant on meme stock hype. The company has been actively trying to transform its business model, shifting towards e-commerce and exploring new avenues in the gaming and technology sectors. These initiatives, while still in their early stages, contribute to a more nuanced understanding of the stock's value proposition beyond the speculative elements. Investors are watching closely to see if these strategies bear fruit.

Market Sentiment and Overall Market Conditions: The broader market environment also plays a significant role. Periods of increased market volatility or optimism can lead to heightened interest in speculative assets like GME, leading to price increases. Conversely, periods of market downturn might dampen this enthusiasm. [Link to reputable market analysis website].

NFT Marketplace and Web3 Initiatives: GameStop's foray into the NFT marketplace and broader Web3 space represents another element driving investor interest. While the success of this strategy remains to be seen, it taps into a rapidly growing sector, potentially attracting investors seeking exposure to the burgeoning metaverse and digital asset landscape. This strategic shift towards future-oriented technologies offers a potential long-term growth catalyst, although considerable risks remain.

Understanding the Risks: It’s crucial to acknowledge the inherent risks involved in investing in GameStop. The stock's price is exceptionally volatile, making it a high-risk investment unsuitable for risk-averse investors. The speculative nature of the stock means its price can fluctuate dramatically based on sentiment shifts, rather than solely on fundamental company performance.

Conclusion:

The recent increase in GameStop's stock price is a complex phenomenon resulting from a confluence of factors, including the persistent meme stock effect, speculation driven by high short interest, the company's ongoing transformation efforts, broader market sentiment, and its foray into Web3. Investors must carefully weigh these factors alongside the significant risks before making any investment decisions. Conduct thorough due diligence and consider consulting a financial advisor before investing in any volatile stock like GME. Remember, past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on GameStop (GME) Stock Price Increase: Understanding The Market Drivers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indycar Sanctions Three Indy 500 Finishers Penalized For Rules Infractions

May 29, 2025

Indycar Sanctions Three Indy 500 Finishers Penalized For Rules Infractions

May 29, 2025 -

The Future Of Work Understanding Why Ai Isnt Taking Over Jobs

May 29, 2025

The Future Of Work Understanding Why Ai Isnt Taking Over Jobs

May 29, 2025 -

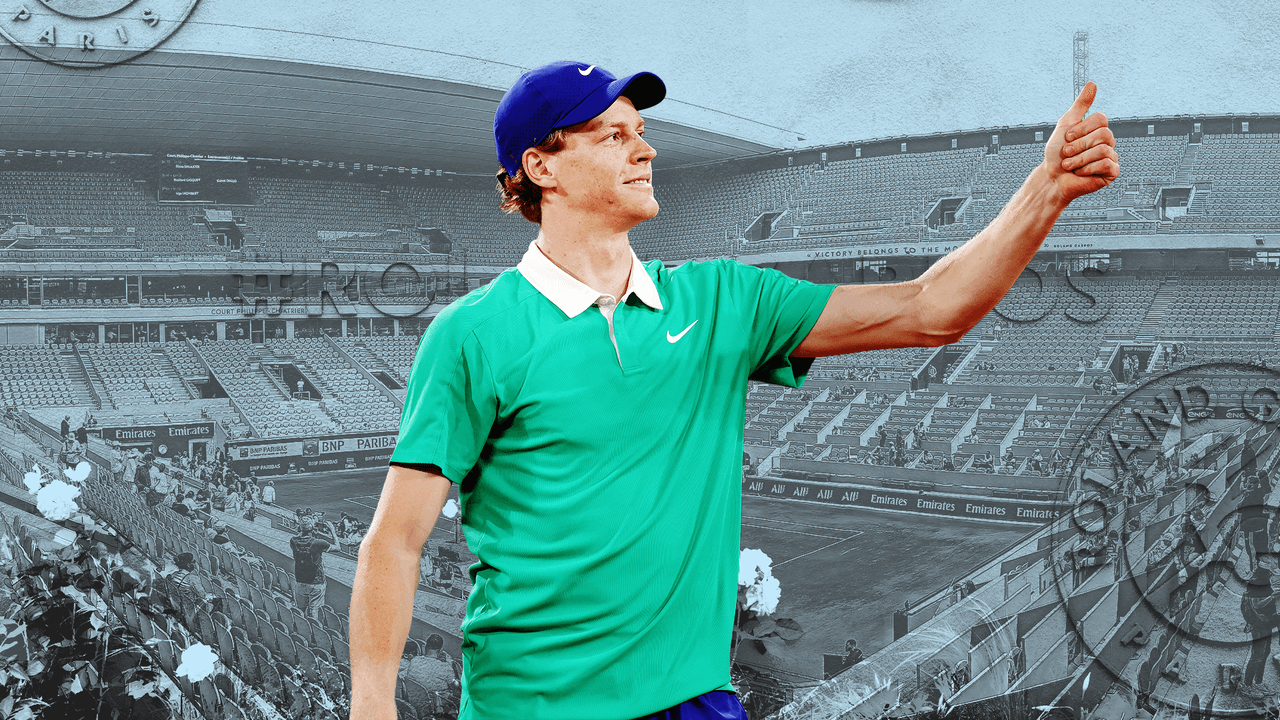

Roland Garros 2025 Guida Completa Allo Streaming Delle Partite Di Jannik Sinner

May 29, 2025

Roland Garros 2025 Guida Completa Allo Streaming Delle Partite Di Jannik Sinner

May 29, 2025 -

Animal Cruelty Charges Filed Against R And B Singer Jaheim In Atlanta

May 29, 2025

Animal Cruelty Charges Filed Against R And B Singer Jaheim In Atlanta

May 29, 2025 -

Sinner Oggi A Roland Garros 2025 A Che Ora Gioca

May 29, 2025

Sinner Oggi A Roland Garros 2025 A Che Ora Gioca

May 29, 2025