From Peak To Valley: Snap Stock's 90% Decline And Potential 2025 Reversal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

From Peak to Valley: Snap Stock's 90% Decline and Potential 2025 Reversal

Snap Inc. (SNAP), the parent company of the popular social media app Snapchat, has experienced a dramatic rollercoaster ride in its stock price. Since its peak in 2021, SNAP stock has plummeted by a staggering 90%, leaving investors reeling and questioning the future of the company. But could a reversal be on the horizon by 2025? This article delves into the factors contributing to Snap's decline and explores the potential for a comeback.

The Fall from Grace: Understanding Snap's Stock Decline

Several key factors contributed to Snap's dramatic stock price drop. The initial euphoria surrounding the IPO quickly faded as the company struggled to maintain its growth trajectory. Here are some of the major challenges:

-

Increased Competition: The social media landscape is fiercely competitive. TikTok's explosive growth, particularly among younger demographics, significantly impacted Snapchat's user engagement and advertising revenue. Facebook and Instagram also continue to be formidable competitors.

-

Advertising Revenue Slowdown: Snap is heavily reliant on advertising revenue. The economic downturn, coupled with increased competition, led to a slowdown in advertising spending, directly impacting Snap's bottom line. This is a significant challenge for many tech companies reliant on advertising.

-

Privacy Concerns: Growing concerns around data privacy and user data security have impacted the entire tech sector. Snap, like other social media platforms, faces increasing regulatory scrutiny and pressure to address these concerns, impacting its operations and user trust.

-

Management Challenges: While Snap has made efforts to diversify its revenue streams, it has faced criticism for its execution and strategic decision-making. This has further eroded investor confidence.

Signs of Potential Reversal: Looking Ahead to 2025

While the outlook may seem bleak, several factors suggest a potential for a turnaround by 2025:

-

Focus on AR & Innovation: Snap is heavily investing in augmented reality (AR) technology, a sector with significant long-term potential. Success in this area could significantly boost its revenue streams and attract new users.

-

Improved Monetization Strategies: The company has been working on improving its advertising platform and exploring new monetization strategies, including in-app purchases and subscriptions. Success in this area is crucial for future growth.

-

Cost-Cutting Measures: Snap has implemented cost-cutting measures to improve its financial health and efficiency. This strategic move could pave the way for future profitability.

-

Potential Market Recovery: A broader economic recovery could lead to increased advertising spending, benefiting Snap and other companies in the sector.

Is 2025 Realistic? The Verdict

Predicting the future of any stock is inherently speculative. While the potential for a Snap stock reversal by 2025 exists, it's far from guaranteed. The company needs to execute its strategy effectively, navigate the competitive landscape successfully, and capitalize on emerging opportunities in AR and other areas. Investors should carefully consider the inherent risks before making any investment decisions.

Further Research:

For more in-depth analysis of Snap's financial performance, visit the company's investor relations website. You can also find insightful commentary from financial analysts on major financial news websites like [link to reputable financial news source].

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on From Peak To Valley: Snap Stock's 90% Decline And Potential 2025 Reversal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

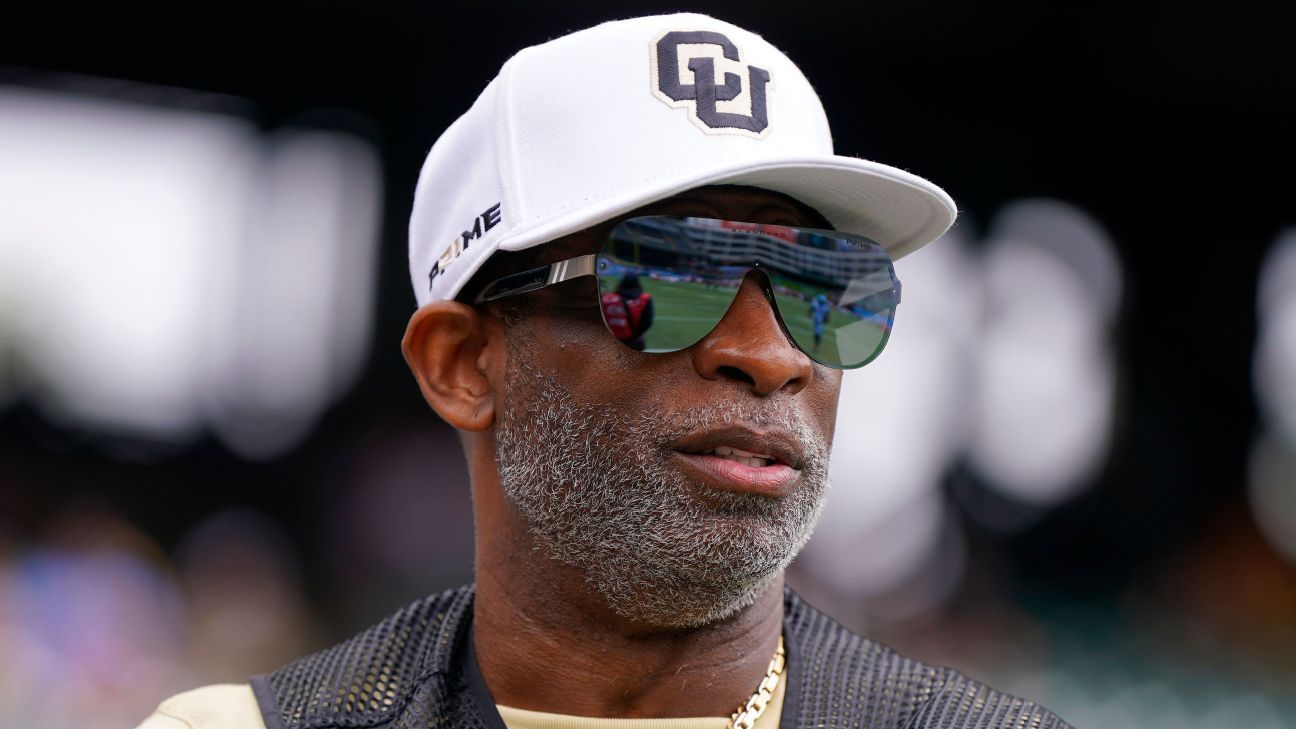

Illness Sidelines Colorados Deion Sanders Latest On His Health And Recovery

Jun 11, 2025

Illness Sidelines Colorados Deion Sanders Latest On His Health And Recovery

Jun 11, 2025 -

Exclusive 3 000 Point Club Shai Gilgeous Alexanders Remarkable Feat

Jun 11, 2025

Exclusive 3 000 Point Club Shai Gilgeous Alexanders Remarkable Feat

Jun 11, 2025 -

Discover 6 Tailored Android Features In The New Update

Jun 11, 2025

Discover 6 Tailored Android Features In The New Update

Jun 11, 2025 -

World Cup Qualifier Betting Value In Card Prices Tuesdays Tips

Jun 11, 2025

World Cup Qualifier Betting Value In Card Prices Tuesdays Tips

Jun 11, 2025 -

Can Shai Gilgeous Alexander Win The 2025 Nba Finals Mvp Odds And Analysis

Jun 11, 2025

Can Shai Gilgeous Alexander Win The 2025 Nba Finals Mvp Odds And Analysis

Jun 11, 2025