Fiserv Stock Plunges: Q2 Organic Revenue Misses Expectations (FI:NYSE)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fiserv Stock Plunges After Q2 Earnings Miss Expectations

Fiserv (FI:NYSE) experienced a significant stock price drop following the release of its second-quarter 2024 earnings report, which revealed organic revenue falling short of analyst projections. The news sent shockwaves through the financial markets, raising concerns about the company's growth trajectory and prompting investors to reassess their positions. This article delves into the details of the disappointing Q2 performance, analyzes the potential causes, and explores the outlook for Fiserv stock.

Q2 Results Fall Short of Expectations:

Fiserv reported Q2 organic revenue growth that significantly trailed expectations. While the exact figures require careful scrutiny of the official earnings release, the shortfall triggered a sharp negative reaction from the market. This underperformance contrasts with previous quarters and raises questions about the company's ability to maintain its growth momentum in the current economic climate. The company's earnings per share (EPS) also likely contributed to the negative investor sentiment, though precise figures need confirmation from official sources. Investors are keenly focusing on the detailed breakdown of revenue streams within the report to pinpoint areas of weakness.

Why Did Fiserv Miss Expectations?

Several factors could have contributed to Fiserv's disappointing Q2 performance. These include:

-

Macroeconomic Headwinds: The broader economic environment, characterized by persistent inflation and potential recessionary concerns, may have impacted client spending and investment decisions, thus affecting Fiserv's revenue streams. The impact of rising interest rates on the financial sector also cannot be ignored.

-

Increased Competition: The payments processing industry is highly competitive, with established players and emerging fintech companies vying for market share. Intensified competition could have squeezed Fiserv's margins and slowed revenue growth.

-

Internal Challenges: While the company hasn't explicitly stated internal challenges, a closer look at the earnings call transcript and investor presentations may reveal internal operational issues or strategic missteps that contributed to the shortfall. Any delays in product launches or integration issues could also be contributing factors.

-

Shifting Client Preferences: Changes in client preferences and adoption of new technologies could also be impacting revenue. The need to adapt to evolving market demands might have presented challenges in Q2.

What Does This Mean for Fiserv Stock?

The market's reaction indicates a significant loss of investor confidence. The stock price plunge reflects anxieties about future performance and the company's ability to meet revised growth targets. Many analysts are likely revising their price targets and forecasts downward, impacting the overall outlook for Fiserv in the short-term.

Looking Ahead:

The coming weeks and months will be crucial for Fiserv. The company's response to the Q2 results and its strategies to address the underlying challenges will heavily influence investor sentiment. A detailed analysis of the Q2 earnings call transcript, coupled with close monitoring of industry trends, will be essential to understand the longer-term implications for the company and its stock price. Investors will be looking for clear evidence of a robust recovery plan and a renewed focus on achieving growth. Further announcements regarding strategic initiatives or restructuring could impact the stock's performance in the near future.

Disclaimer: This article provides general information and commentary based on publicly available data. It does not constitute financial advice. Investors should conduct their own thorough research and consult with a financial advisor before making any investment decisions. Always refer to official company announcements and financial reports for accurate and detailed information.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fiserv Stock Plunges: Q2 Organic Revenue Misses Expectations (FI:NYSE). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Shrinking Season 3 Release Date Update Hints At Earlier Arrival

Jul 24, 2025

Shrinking Season 3 Release Date Update Hints At Earlier Arrival

Jul 24, 2025 -

Veteran Pitcher Rich Hill Gets Royals Start Tuesday

Jul 24, 2025

Veteran Pitcher Rich Hill Gets Royals Start Tuesday

Jul 24, 2025 -

Beyond 75 Gma Anniversary Special Cast Your Vote Before July 26th

Jul 24, 2025

Beyond 75 Gma Anniversary Special Cast Your Vote Before July 26th

Jul 24, 2025 -

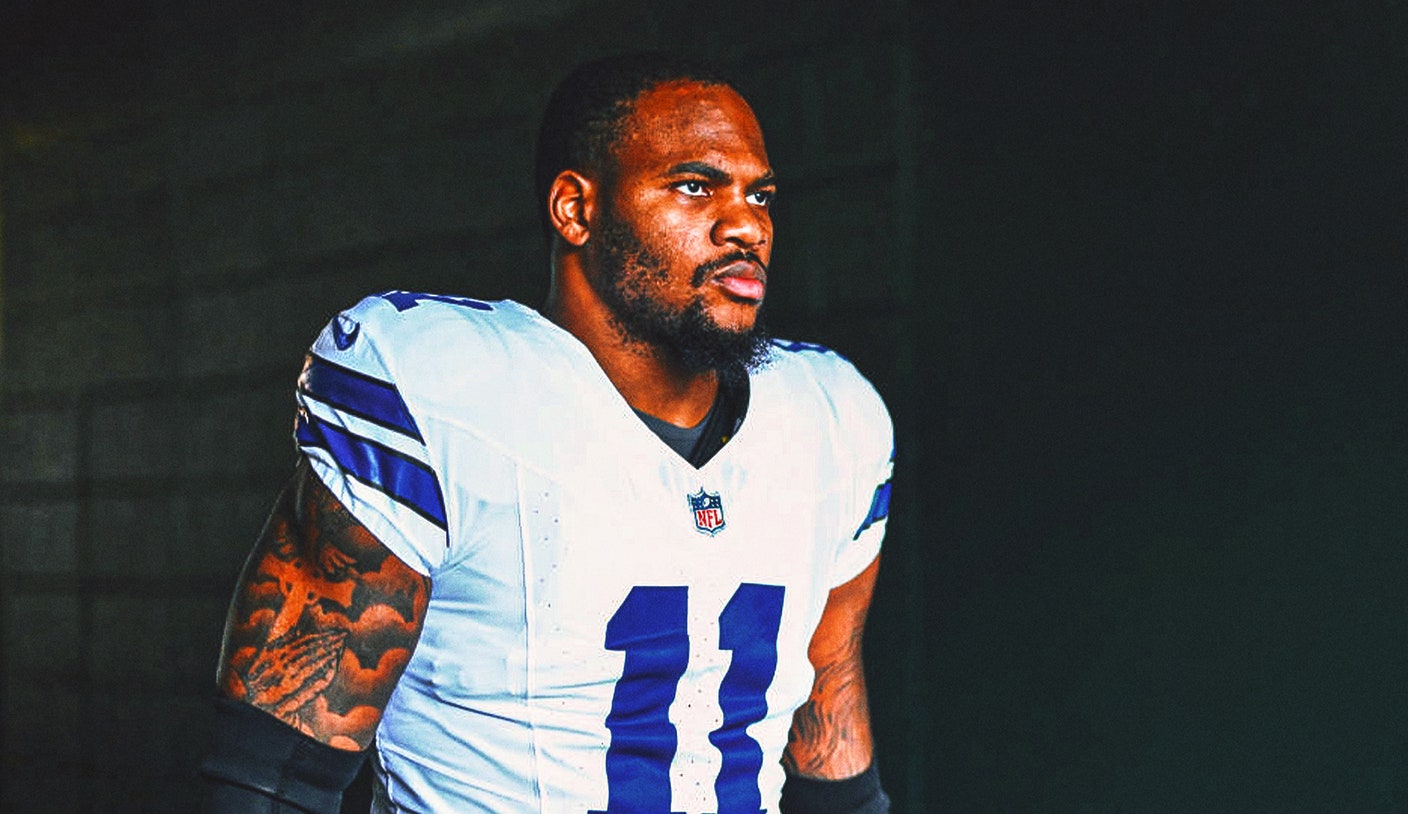

Jerry Jones And Micah Parsons Contract Standoff Dominates Cowboys Camp News

Jul 24, 2025

Jerry Jones And Micah Parsons Contract Standoff Dominates Cowboys Camp News

Jul 24, 2025 -

The Doj Antitrust Divisions Impact On Competition In 2025

Jul 24, 2025

The Doj Antitrust Divisions Impact On Competition In 2025

Jul 24, 2025