Fiserv (FI) Stock Falls Amidst Concerns Of Shrinking Payment Volumes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fiserv (FI) Stock Takes a Dive Amidst Payment Volume Concerns

Fiserv (FI), a leading provider of financial services technology, experienced a significant stock price decline this week amidst growing concerns regarding shrinking payment volumes. The drop underscores investor anxieties about the potential impact of a slowing economy and shifting consumer spending habits on the company's future performance. This article delves into the specifics of the stock fall, exploring the underlying factors contributing to investor unease and examining the potential implications for Fiserv and the broader fintech sector.

Concerns Fueling the Decline:

The recent dip in Fiserv's stock price can be largely attributed to a confluence of factors:

-

Slowing Payment Growth: Analysts point to a noticeable slowdown in payment processing volumes as a primary driver of investor concern. While Fiserv remains a dominant player in the industry, a decrease in transaction activity directly impacts its revenue streams. This deceleration is particularly worrying given the company's reliance on transaction fees for a significant portion of its earnings.

-

Economic Uncertainty: The current economic climate, characterized by high inflation and rising interest rates, is casting a shadow over consumer spending. Reduced consumer spending inevitably leads to fewer transactions, placing pressure on companies like Fiserv that profit from the volume of these transactions. This macroeconomic uncertainty is a major headwind for the entire fintech sector.

-

Increased Competition: The fintech landscape is increasingly competitive, with new players constantly emerging and vying for market share. Fiserv faces pressure to innovate and adapt to maintain its competitive edge, a challenge that can strain profitability and impact investor confidence. This competition extends to both traditional financial institutions and newer, more agile technology firms.

-

Investor Sentiment: Negative news and analyst downgrades often create a self-reinforcing cycle of negative investor sentiment. This can lead to increased selling pressure, further driving down the stock price. The combination of the factors listed above has clearly contributed to a less optimistic outlook among investors.

What This Means for Fiserv and Investors:

The recent stock price decline presents both challenges and opportunities for Fiserv. The company will need to demonstrate its ability to navigate the current economic headwinds and maintain its growth trajectory. This may involve focusing on strategic initiatives such as:

-

Diversification of Revenue Streams: Reducing reliance on transaction fees by exploring new revenue streams through expanded product offerings and strategic partnerships.

-

Technological Innovation: Investing in advanced technologies like AI and machine learning to improve efficiency and enhance customer offerings.

-

Strategic Acquisitions: Acquiring smaller fintech companies to expand its capabilities and market reach.

Looking Ahead:

While the short-term outlook for Fiserv may appear uncertain, the long-term prospects of the company remain relatively strong. The continued growth of digital payments and the increasing reliance on financial technology suggest that Fiserv is well-positioned to capitalize on long-term market trends. However, investors should closely monitor the company's performance in the coming quarters to gauge its ability to overcome the current challenges. The key to understanding the future trajectory of FI stock will be its ability to adapt and innovate in a rapidly evolving market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and it's crucial to conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fiserv (FI) Stock Falls Amidst Concerns Of Shrinking Payment Volumes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Vote Now Gmas Beyond 75 75th Anniversary Special Voting Ends July 26

Jul 24, 2025

Vote Now Gmas Beyond 75 75th Anniversary Special Voting Ends July 26

Jul 24, 2025 -

Gma 75th Anniversary Voting For Beyond 75 Special Ends July 26

Jul 24, 2025

Gma 75th Anniversary Voting For Beyond 75 Special Ends July 26

Jul 24, 2025 -

Local Community Supports Restaurant Owner After Ice Detention

Jul 24, 2025

Local Community Supports Restaurant Owner After Ice Detention

Jul 24, 2025 -

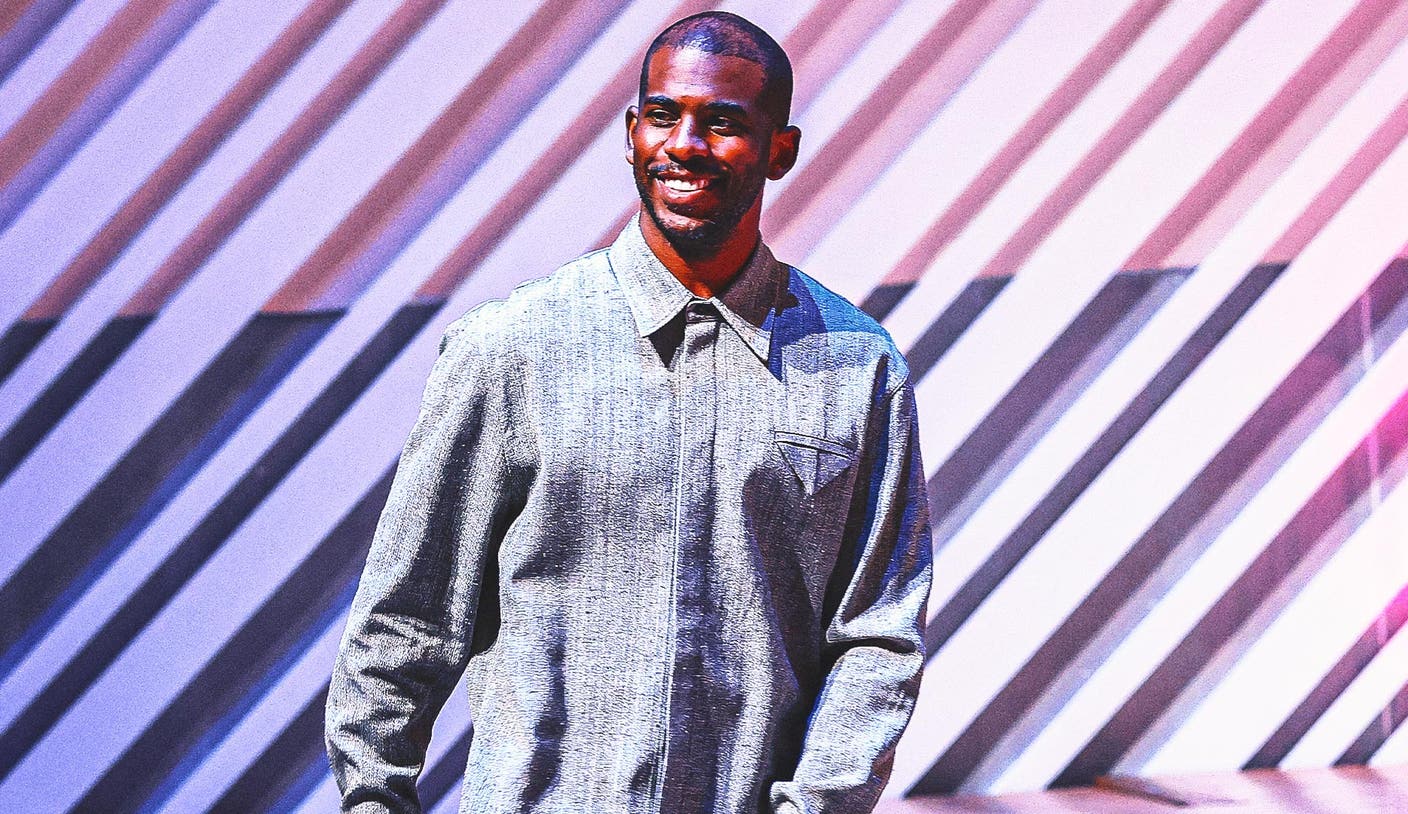

Is This Chris Pauls Farewell Tour Point Guard Returns To La Clippers

Jul 24, 2025

Is This Chris Pauls Farewell Tour Point Guard Returns To La Clippers

Jul 24, 2025 -

Phillies Win In Walk Off Fashion Thanks To Catchers Interference

Jul 24, 2025

Phillies Win In Walk Off Fashion Thanks To Catchers Interference

Jul 24, 2025

Latest Posts

-

On The Bubble Which Nfl Teams Are Most Likely To Secure A 2023 Postseason Spot

Jul 26, 2025

On The Bubble Which Nfl Teams Are Most Likely To Secure A 2023 Postseason Spot

Jul 26, 2025 -

Espn Report Jonathan Kuminga In No Hurry To Sign With Golden State

Jul 26, 2025

Espn Report Jonathan Kuminga In No Hurry To Sign With Golden State

Jul 26, 2025 -

Detroit Lions O Line A Year Of Regression From Elite To Work In Progress

Jul 26, 2025

Detroit Lions O Line A Year Of Regression From Elite To Work In Progress

Jul 26, 2025 -

Mookie Betts Injury Update Dodgers Stars Status Uncertain For Boston Series

Jul 26, 2025

Mookie Betts Injury Update Dodgers Stars Status Uncertain For Boston Series

Jul 26, 2025 -

Dolphins Matos Recovering Well From Training Camp Setback

Jul 26, 2025

Dolphins Matos Recovering Well From Training Camp Setback

Jul 26, 2025