Financial Regulator's Decision: Sub-£950 Compensation For Car Finance Mis-selling

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Regulator's Decision: Sub-£950 Compensation for Car Finance Mis-selling Sparks Outrage

Thousands of consumers face disappointment after the Financial Conduct Authority (FCA) ruled that compensation for car finance mis-selling will be capped at under £950. This decision has ignited a firestorm of criticism, leaving many feeling cheated and undervalued by the regulatory body. The announcement follows years of complaints about aggressive sales tactics and unfair lending practices within the car finance sector.

The FCA’s ruling, released late last week, states that compensation will be calculated based on a formula taking into account individual circumstances. However, the maximum payout will rarely exceed £950, a figure many argue is woefully inadequate considering the significant financial burdens some consumers have faced. This includes those trapped in unaffordable loans, facing repossession, or suffering from severe financial hardship as a direct result of mis-selling.

What constitutes car finance mis-selling?

Car finance mis-selling can encompass a range of practices, including:

- Unaffordable loans: Lenders pushing loans onto consumers who demonstrably couldn't afford the repayments.

- Misrepresentation of terms: Providing inaccurate or misleading information about interest rates, APR, or other crucial loan details.

- Aggressive sales tactics: Employing high-pressure sales techniques to persuade customers into loans they didn't want or need.

- Failure to conduct proper affordability assessments: Not adequately checking a borrower's financial situation before approving a loan.

Consumers who believe they were victims of such practices are encouraged to check their finance agreements carefully. Look out for discrepancies in the information provided, unusual fees, or repayment terms that seem disproportionate to the loan amount.

The FCA's Justification and Public Backlash

The FCA maintains that its compensation scheme is designed to be fair and efficient, balancing the needs of consumers with the stability of the financial sector. However, this explanation has fallen flat with many consumer advocacy groups and affected individuals.

The decision has been widely criticized for:

- Insufficient compensation: The low cap on compensation is seen as inadequate to address the significant financial harm suffered by many victims.

- Lack of transparency: The complexity of the compensation calculation process has left many feeling confused and frustrated.

- Perceived bias towards lenders: Critics argue the ruling favors lenders over consumers, potentially shielding them from substantial financial penalties.

"This decision is a slap in the face to those who have suffered financially due to the reckless actions of car finance companies," stated Sarah Jones, spokesperson for the Consumer Rights Group. "The FCA’s actions demonstrate a worrying lack of concern for the welfare of vulnerable consumers."

What can consumers do now?

While the FCA's decision is disappointing, consumers are not powerless. They can:

- Contact the Financial Ombudsman Service (FOS): If dissatisfied with the FCA's ruling, consumers can escalate their complaint to the FOS, an independent body that can review decisions made by financial institutions. [Link to FOS website]

- Seek legal advice: Consulting a solicitor specializing in consumer finance law may be beneficial for individuals seeking further redress.

- Join a consumer action group: Collective action can often be more effective in putting pressure on regulatory bodies and lenders.

This situation highlights the ongoing need for stronger consumer protection in the car finance industry. The FCA's decision underscores the importance of careful scrutiny of all loan agreements and the need for robust regulations to prevent future mis-selling. The fight for fair compensation is far from over.

Keywords: Car finance mis-selling, FCA, Financial Conduct Authority, compensation, consumer rights, unfair lending, affordability assessment, Financial Ombudsman Service, FOS, consumer protection, legal advice, car loan, auto loan, misrepresentation, aggressive sales tactics.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Regulator's Decision: Sub-£950 Compensation For Car Finance Mis-selling. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cyclist Seriously Injured In North Highlands Collision Watt Avenue And Palomino Lane

Aug 05, 2025

Cyclist Seriously Injured In North Highlands Collision Watt Avenue And Palomino Lane

Aug 05, 2025 -

Npb You Tube

Aug 05, 2025

Npb You Tube

Aug 05, 2025 -

Mariners Julio Rodriguez Achieves Rare 20 20 Milestone For Fourth Straight Year

Aug 05, 2025

Mariners Julio Rodriguez Achieves Rare 20 20 Milestone For Fourth Straight Year

Aug 05, 2025 -

North Carolina Motorcycle Crash Your Guide To Finding The Right Legal Representation

Aug 05, 2025

North Carolina Motorcycle Crash Your Guide To Finding The Right Legal Representation

Aug 05, 2025 -

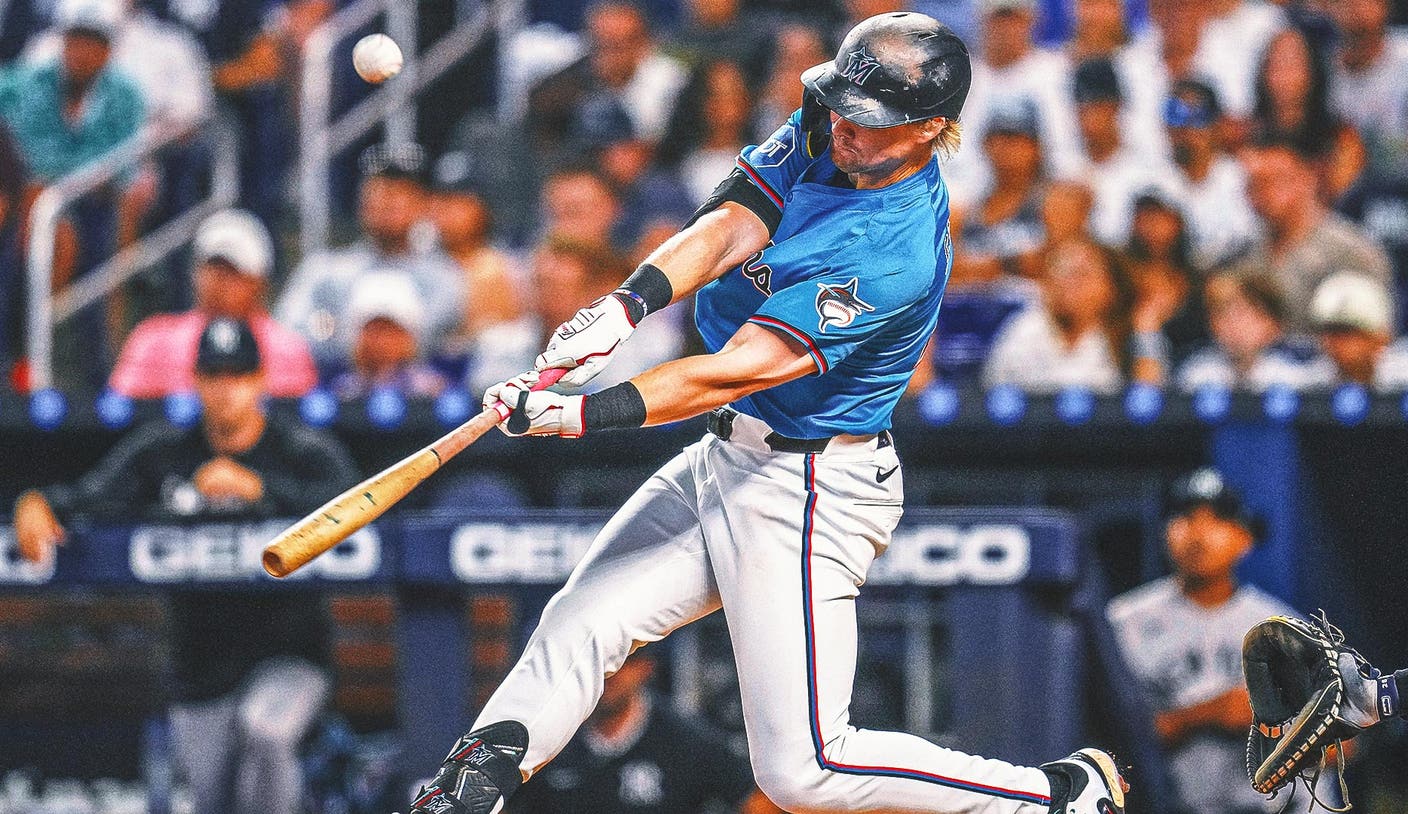

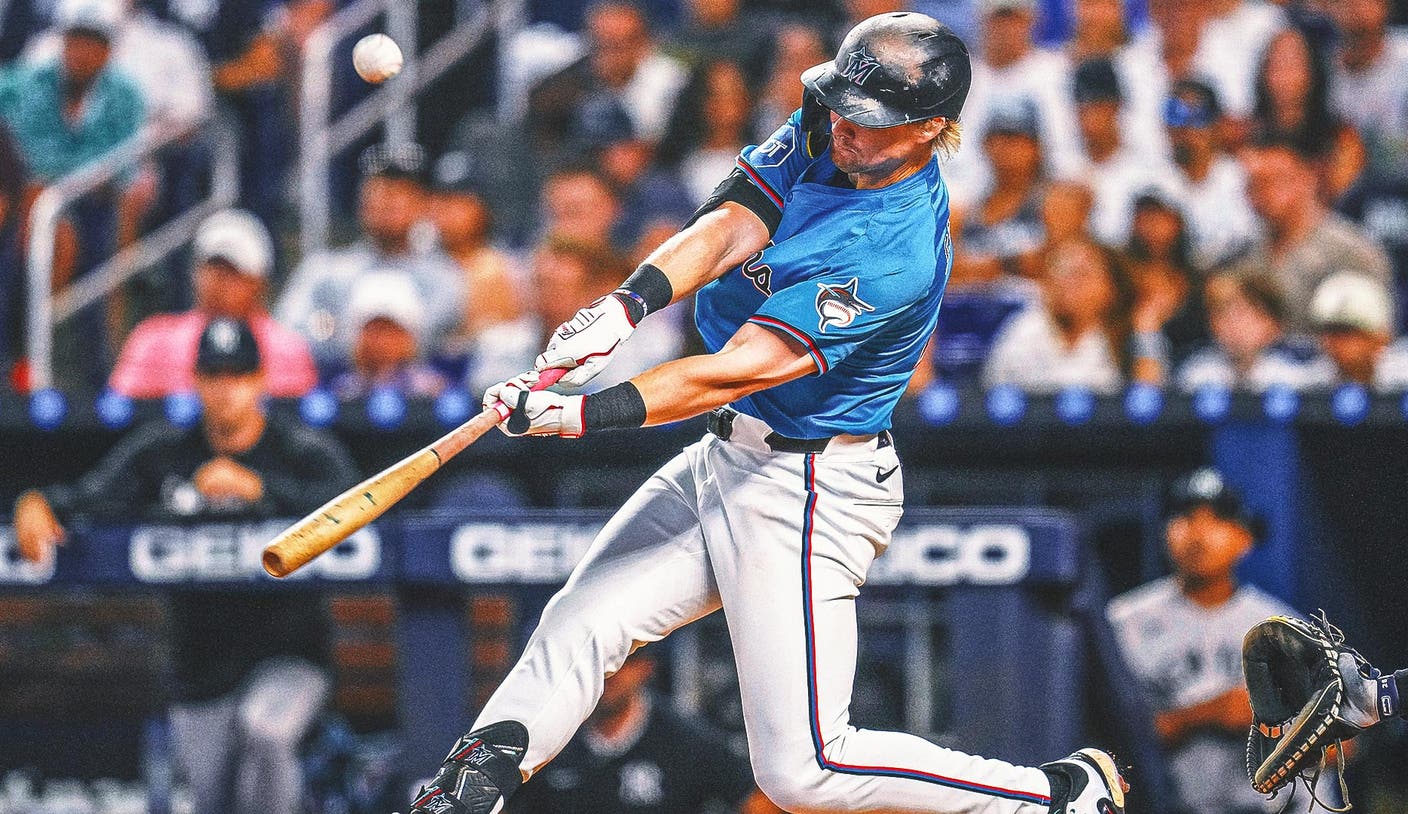

Historic Win Marlins Defeat Yankees 7 3 Clinch First Ever Series Sweep

Aug 05, 2025

Historic Win Marlins Defeat Yankees 7 3 Clinch First Ever Series Sweep

Aug 05, 2025

Latest Posts

-

Historic Achievement Julio Rodriguezs Fourth Straight 20 20 Season In Mlb

Aug 06, 2025

Historic Achievement Julio Rodriguezs Fourth Straight 20 20 Season In Mlb

Aug 06, 2025 -

Mariners Julio Rodriguez Makes History With Fourth Straight 20 20 Campaign

Aug 06, 2025

Mariners Julio Rodriguez Makes History With Fourth Straight 20 20 Campaign

Aug 06, 2025 -

Commanders Face Crucial Decision Meet Terry Mc Laurins Contract Demands

Aug 06, 2025

Commanders Face Crucial Decision Meet Terry Mc Laurins Contract Demands

Aug 06, 2025 -

Marlins Make History 7 3 Win Over Yankees Completes First Ever Series Sweep

Aug 06, 2025

Marlins Make History 7 3 Win Over Yankees Completes First Ever Series Sweep

Aug 06, 2025 -

Espn Khabibs Concerns For Mc Gregors Well Being And Future

Aug 06, 2025

Espn Khabibs Concerns For Mc Gregors Well Being And Future

Aug 06, 2025