Financial Crisis Looms For Major Australian Energy Storage Provider

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Crisis Looms for Major Australian Energy Storage Provider: Red Flag for the Renewable Energy Sector?

Australia's burgeoning renewable energy sector faces a potential setback as a major energy storage provider teeters on the brink of financial collapse. The situation highlights the inherent risks and challenges within the rapidly evolving landscape of clean energy infrastructure. While the transition to renewable sources is crucial for combating climate change, the financial stability of key players remains a critical concern. This article delves into the potential implications of this crisis and explores the wider ramifications for Australia's energy future.

The Impending Collapse of [Company Name]: A Case Study

[Company Name], a significant player in the Australian energy storage market, is reportedly facing severe financial difficulties. Speculation points towards a combination of factors contributing to their precarious position, including:

- High upfront capital costs: The construction and deployment of large-scale battery storage projects require substantial upfront investment. Securing sufficient funding, particularly in a volatile economic climate, poses a significant hurdle.

- Fluctuating energy prices: The profitability of energy storage projects is directly linked to the price of electricity. Unpredictable market fluctuations can severely impact revenue projections and financial viability.

- Regulatory uncertainty: The evolving regulatory landscape for energy storage in Australia introduces complexities and uncertainty, potentially delaying project approvals and impacting investor confidence.

- Supply chain disruptions: Global supply chain issues, particularly affecting critical components for battery storage systems, have contributed to increased costs and project delays.

These challenges are not unique to [Company Name]. Many energy storage companies face similar pressures, underscoring the need for robust financial planning and risk management strategies within the sector.

Wider Implications for the Renewable Energy Transition

The potential collapse of [Company Name] sends shockwaves through the Australian renewable energy sector. It raises critical questions about:

- Investor confidence: The situation could deter potential investors from committing capital to similar projects, hindering the expansion of crucial energy storage infrastructure.

- Energy security: Sufficient energy storage is vital for integrating intermittent renewable energy sources like solar and wind power into the national grid. The failure of key players could compromise energy security and reliability.

- Government policy: The crisis highlights the need for supportive government policies to mitigate risks and incentivize investment in renewable energy storage. This may include targeted funding, streamlined regulatory processes, and long-term price stability mechanisms.

What's Next? The Path Forward for Energy Storage in Australia

The Australian government and industry stakeholders must address the underlying challenges facing the energy storage sector to ensure a smooth transition to a cleaner energy future. This requires a multifaceted approach, including:

- Enhanced risk assessment and management frameworks: Companies need robust financial models that account for market volatility and potential disruptions.

- Improved collaboration between government and industry: Clearer regulatory frameworks and streamlined approvals processes are essential to reduce uncertainty and attract investment.

- Investment in research and development: Innovation in battery technology and energy storage solutions can help to reduce costs and improve efficiency.

- Diversification of funding sources: Exploring alternative funding models beyond traditional equity financing, such as government grants and green bonds, can reduce reliance on volatile market conditions.

The situation surrounding [Company Name] serves as a stark reminder that the transition to renewable energy is not without its challenges. Addressing these issues proactively is crucial to ensuring the long-term success of Australia's clean energy ambitions. Failure to act decisively could jeopardize the country's progress towards a sustainable energy future. We will continue to update this story as it develops.

Keywords: Australian energy storage, renewable energy, financial crisis, energy storage provider, battery storage, clean energy, energy security, government policy, investment, supply chain, renewable energy transition, [Company Name], Australian energy market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Crisis Looms For Major Australian Energy Storage Provider. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

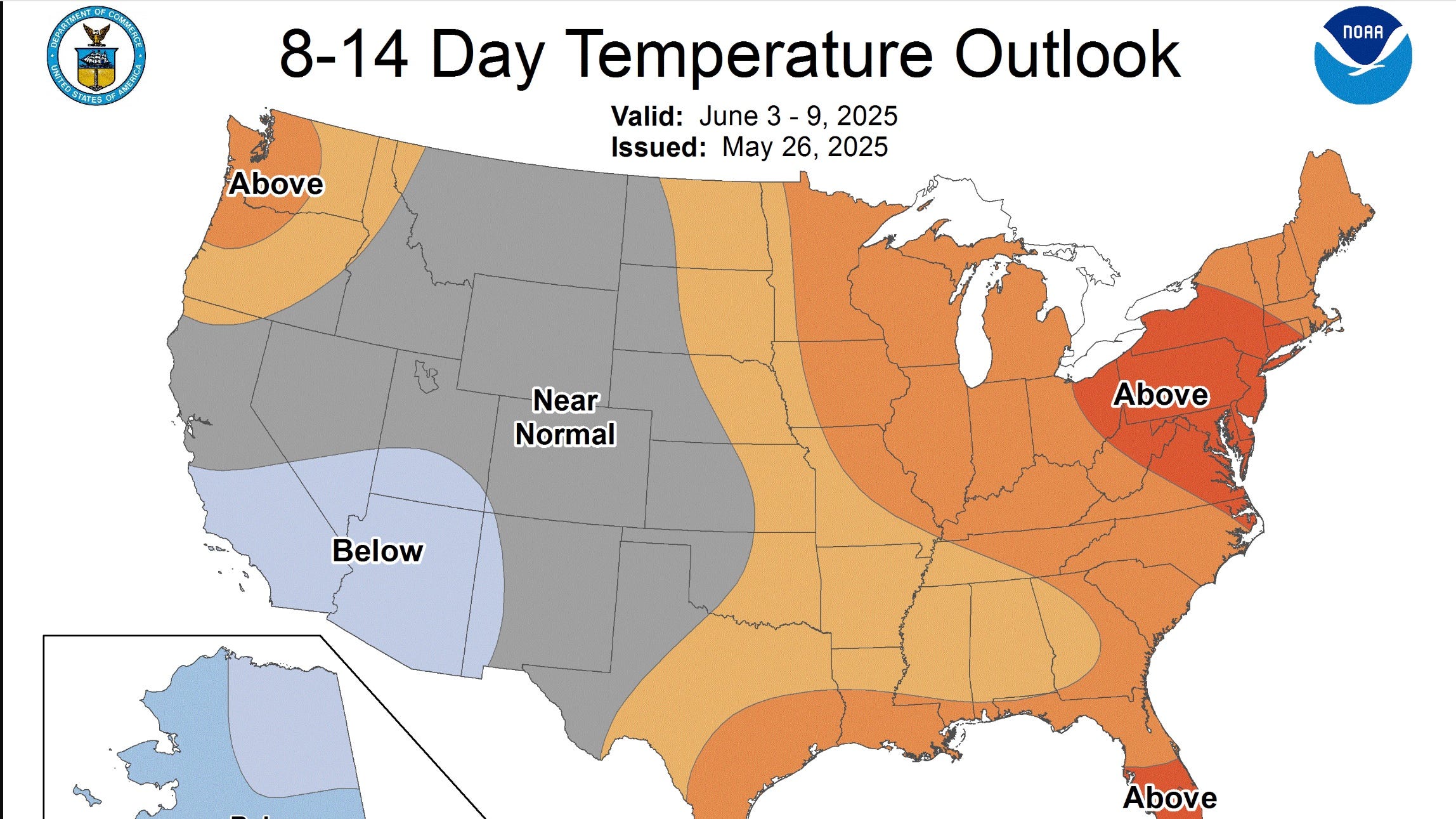

Extreme Heat Warning Willamette Valley Oregon Braces For Scorching Temperatures

Jun 04, 2025

Extreme Heat Warning Willamette Valley Oregon Braces For Scorching Temperatures

Jun 04, 2025 -

Memorial Tournament History Scheffler Achieves Rare Repeat Win

Jun 04, 2025

Memorial Tournament History Scheffler Achieves Rare Repeat Win

Jun 04, 2025 -

Financial Troubles Force Another Portland Energy Company Towards Shutdown

Jun 04, 2025

Financial Troubles Force Another Portland Energy Company Towards Shutdown

Jun 04, 2025 -

Video Controversy Wont Cost Diggs His Spot On The Patriots

Jun 04, 2025

Video Controversy Wont Cost Diggs His Spot On The Patriots

Jun 04, 2025 -

U S Open Qualifier Max Homa Goes Solo After Caddie Departure

Jun 04, 2025

U S Open Qualifier Max Homa Goes Solo After Caddie Departure

Jun 04, 2025