Factors Affecting IBM Stock Price: Market Analysis And Investor Sentiment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Factors Affecting IBM Stock Price: Market Analysis and Investor Sentiment

IBM, a technology giant with a storied history, continues to navigate a complex and evolving market landscape. Its stock price, therefore, is influenced by a multitude of interconnected factors, ranging from macroeconomic trends to investor sentiment and company-specific performance. Understanding these factors is crucial for investors looking to analyze IBM's potential and make informed decisions.

Macroeconomic Headwinds and Tailwinds:

The global economy significantly impacts IBM's performance, as it does with most large-cap companies. A strong economy generally boosts demand for IBM's services, particularly in sectors like finance and healthcare. Conversely, economic downturns often lead to reduced IT spending, impacting IBM's revenue and profitability. Factors like interest rate hikes, inflation, and geopolitical instability all play a crucial role. For instance, rising interest rates can increase borrowing costs for IBM and its clients, potentially slowing down growth. [Link to relevant macroeconomic news source]

Competition in the Tech Landscape:

IBM faces stiff competition from a plethora of tech companies, including cloud giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. The highly competitive cloud computing market is a significant factor in IBM's stock valuation. The company's ability to innovate and maintain its market share in this crucial area directly impacts investor confidence. Furthermore, competition in other areas like artificial intelligence (AI), cybersecurity, and hybrid cloud solutions also plays a role. [Link to article comparing cloud providers]

IBM's Strategic Initiatives and Performance:

IBM's own strategic decisions and financial performance are paramount in determining its stock price. Key performance indicators (KPIs) like revenue growth, earnings per share (EPS), and free cash flow are closely scrutinized by investors. Recent strategic shifts, such as IBM's focus on hybrid cloud and AI, influence investor sentiment. Successful execution of these strategies can boost the stock price, while setbacks can lead to negative market reactions. Analyzing IBM's quarterly earnings reports and investor presentations is essential for understanding its performance trajectory. [Link to IBM Investor Relations]

Investor Sentiment and Market Volatility:

Market sentiment towards IBM is another significant driver of its stock price. Positive news, such as strong earnings reports, successful product launches, or strategic partnerships, can lead to increased demand and a higher stock price. Conversely, negative news, such as disappointing financial results, cybersecurity breaches, or regulatory issues, can trigger sell-offs and lower the stock price. Market volatility, often influenced by broader economic conditions and geopolitical events, also impacts IBM's stock price, leading to significant fluctuations in the short term.

Technological Innovation and Future Outlook:

IBM's ability to innovate and adapt to the rapidly changing technological landscape is crucial for its long-term success. Investors are keenly interested in IBM's research and development efforts, particularly in emerging technologies like quantum computing and AI. The company's vision for the future and its potential to capitalize on future technological trends significantly influence investor sentiment and long-term stock valuation.

Analyzing IBM Stock: Key Considerations:

- Long-term vs. Short-term Perspective: Investors should consider their investment horizon when analyzing IBM's stock. Short-term price fluctuations can be significant, while long-term trends might offer a more stable outlook.

- Diversification: It's crucial to diversify your investment portfolio to mitigate risk associated with any single stock, including IBM.

- Fundamental Analysis: Thoroughly analyze IBM's financial statements, strategic plans, and competitive landscape to assess its intrinsic value.

- Technical Analysis: Consider using technical analysis tools to identify potential entry and exit points, but remember that technical analysis alone shouldn't be the sole basis for investment decisions.

Conclusion:

The IBM stock price is a dynamic reflection of numerous interconnected factors. By carefully analyzing macroeconomic trends, competitive pressures, IBM's performance, and investor sentiment, investors can gain a clearer understanding of the forces driving its valuation and make better-informed investment decisions. Remember to conduct thorough research and consider seeking professional financial advice before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Factors Affecting IBM Stock Price: Market Analysis And Investor Sentiment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Three Year 36 75 M Extension For Ravens Wideout Rashod Bateman

Jun 07, 2025

Three Year 36 75 M Extension For Ravens Wideout Rashod Bateman

Jun 07, 2025 -

Crimeas Status Why Us Recognition Would Empower Putin

Jun 07, 2025

Crimeas Status Why Us Recognition Would Empower Putin

Jun 07, 2025 -

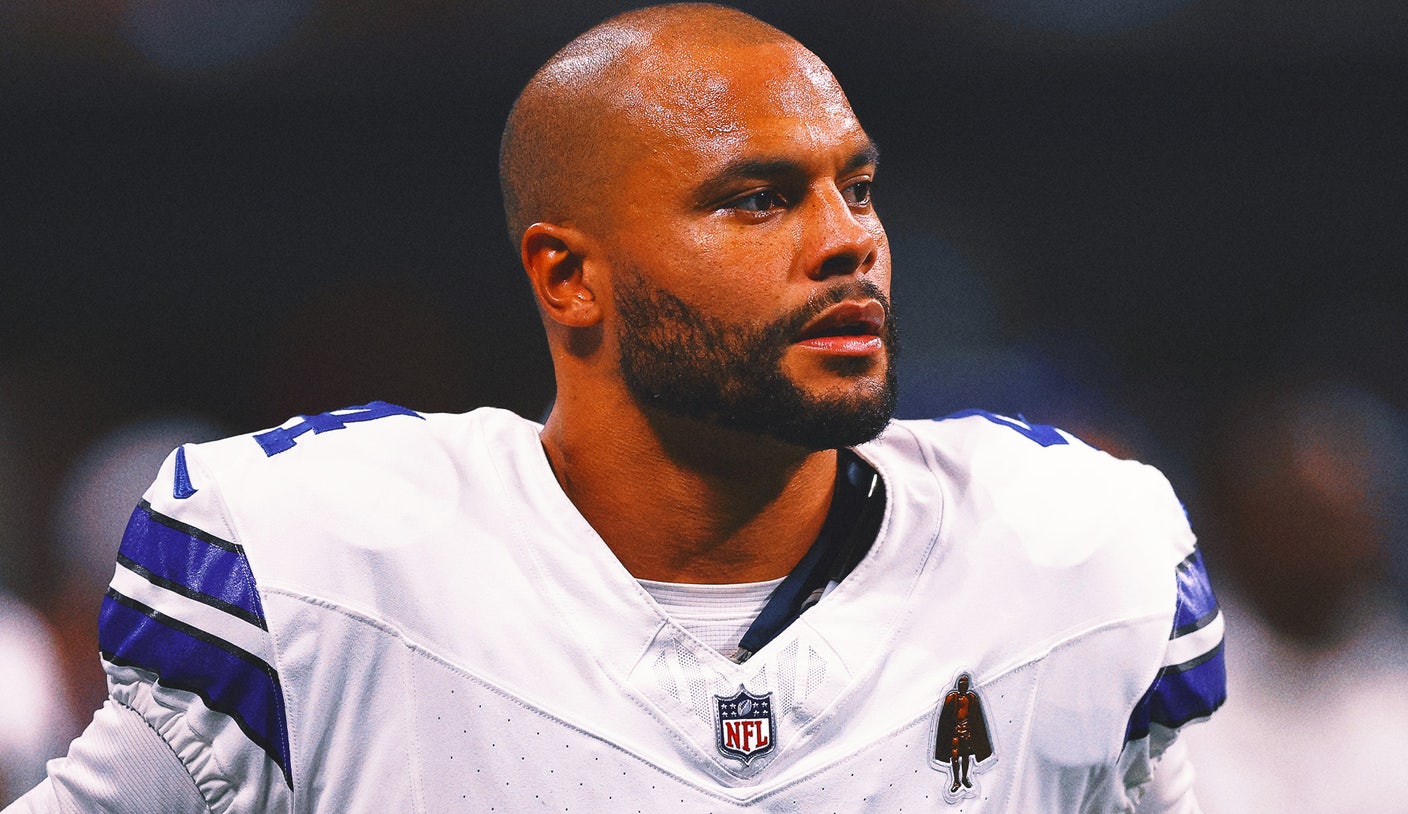

Dallas Cowboys 2025 Playoff Probability And Potential Depth Of Run

Jun 07, 2025

Dallas Cowboys 2025 Playoff Probability And Potential Depth Of Run

Jun 07, 2025 -

Mlb News Pablo Lopezs Shoulder Injury Sidelines Twins Star For Extended Period

Jun 07, 2025

Mlb News Pablo Lopezs Shoulder Injury Sidelines Twins Star For Extended Period

Jun 07, 2025 -

Texas Takes Game 1 Of Wcws Against Texas Tech Behind Atwoods Strong Arm

Jun 07, 2025

Texas Takes Game 1 Of Wcws Against Texas Tech Behind Atwoods Strong Arm

Jun 07, 2025