Facing Life's Curveballs: A Comprehensive Guide To Retirement Plan Stress Testing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Facing Life's Curveballs: A Comprehensive Guide to Retirement Plan Stress Testing

Retirement planning is a marathon, not a sprint. While diligently saving for your golden years is crucial, unforeseen circumstances can easily derail even the most meticulously crafted plan. That's where retirement plan stress testing comes in. This crucial process helps you anticipate potential financial hurdles and adjust your strategy accordingly, ensuring a smoother and more secure retirement. This guide will equip you with the knowledge and tools to navigate the complexities of stress testing your retirement plan.

What is Retirement Plan Stress Testing?

Retirement plan stress testing involves simulating various negative scenarios that could impact your retirement savings. This isn't about fear-mongering; it's about proactive risk management. By running these simulations, you gain a realistic understanding of your plan's resilience and identify potential weaknesses before they become critical problems. These scenarios could include:

- Market downturns: A significant market correction could severely impact your portfolio's value. Stress testing allows you to see how your plan would withstand a substantial drop in stock prices.

- Unexpected medical expenses: Major illnesses or long-term care needs can quickly deplete your savings. Stress testing helps you determine if your plan can handle these unforeseen costs.

- Inflation: The rising cost of living can erode the purchasing power of your savings over time. Stress testing considers the impact of inflation on your projected retirement income.

- Increased longevity: Living longer than anticipated means needing more savings to cover your expenses. This scenario is crucial for stress testing.

- Unexpected job loss: Losing your job before retirement can significantly impact your savings and your ability to contribute further.

How to Conduct a Retirement Plan Stress Test:

While you can use sophisticated financial software, a basic stress test can be performed using a simple spreadsheet or online retirement calculator. Here's a simplified approach:

- Determine your current retirement savings: Include all retirement accounts (401(k), IRA, etc.).

- Estimate your annual retirement expenses: Consider housing, healthcare, travel, and other costs. Remember to account for inflation.

- Project your retirement income: Include Social Security benefits, pensions, and any other sources of income.

- Model negative scenarios: Reduce your investment returns by a significant percentage (e.g., 20%, 30%, or even more, depending on your risk tolerance) to simulate a market downturn. Increase your healthcare expenses by a substantial amount to account for potential medical emergencies. Extend your lifespan to account for increased longevity.

- Analyze the results: Determine if your projected savings will cover your expenses under these adverse conditions. If not, you'll need to adjust your plan.

Adjusting Your Retirement Plan:

If your stress test reveals vulnerabilities, several adjustments can strengthen your plan:

- Increase savings: Contribute more to your retirement accounts if possible.

- Reduce expenses: Identify areas where you can cut back on spending.

- Adjust your investment strategy: Consider a more conservative investment approach to reduce risk.

- Delay retirement: Working a few extra years can significantly boost your savings.

- Explore long-term care insurance: This can help protect your assets from the high cost of long-term care.

Seeking Professional Advice:

While this guide provides a framework, consulting a qualified financial advisor is strongly recommended. A financial advisor can provide personalized guidance based on your specific circumstances and help you develop a robust retirement plan that can withstand life's curveballs. They can also utilize more sophisticated stress testing models and offer tailored solutions.

Conclusion:

Retirement plan stress testing is not just a good idea; it's a vital step in securing your financial future. By proactively identifying and mitigating potential risks, you can significantly reduce stress and increase your confidence in your retirement plans. Don't wait until it's too late – start stress testing your retirement plan today!

(CTA: Schedule a consultation with a financial advisor to discuss your retirement plan and perform a comprehensive stress test.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Facing Life's Curveballs: A Comprehensive Guide To Retirement Plan Stress Testing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

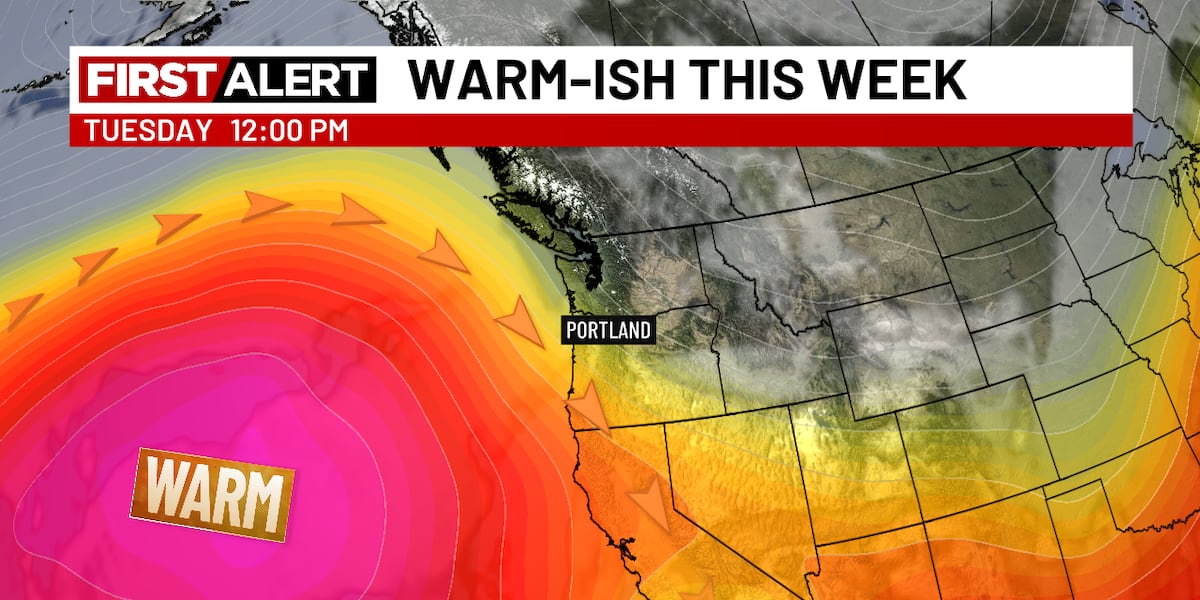

Fair Weather Forecast June Begins Sunny And Dry

Jun 05, 2025

Fair Weather Forecast June Begins Sunny And Dry

Jun 05, 2025 -

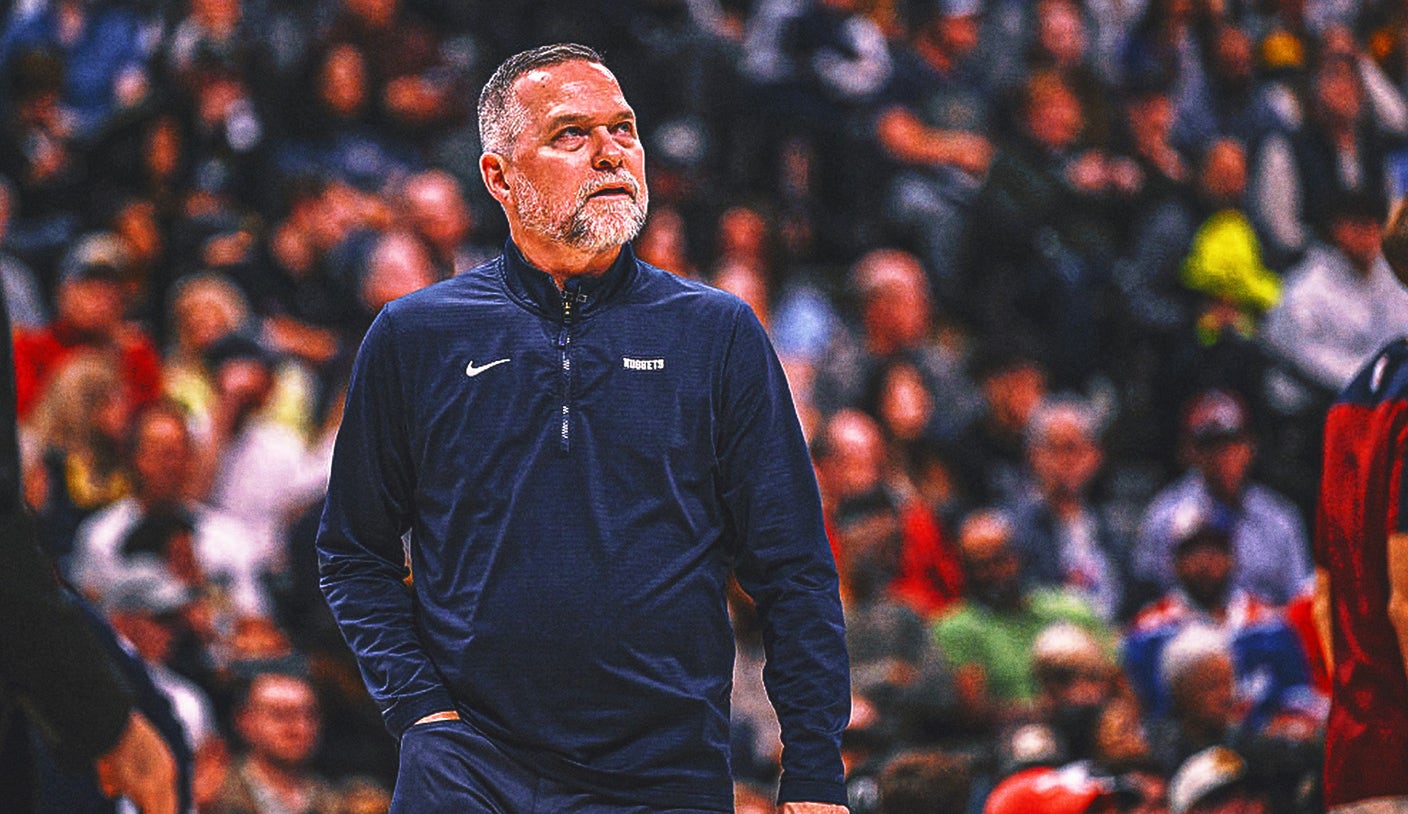

Whos Next For The Knicks Analyzing The Odds For The Head Coaching Job

Jun 05, 2025

Whos Next For The Knicks Analyzing The Odds For The Head Coaching Job

Jun 05, 2025 -

Nba Trade Rumors Potential Deals For Top Draft Pick Cooper Flagg

Jun 05, 2025

Nba Trade Rumors Potential Deals For Top Draft Pick Cooper Flagg

Jun 05, 2025 -

Amanda Seyfried Dazzles In Fringe Dress At I Dont Understand You Film Premiere

Jun 05, 2025

Amanda Seyfried Dazzles In Fringe Dress At I Dont Understand You Film Premiere

Jun 05, 2025 -

Buffetts Investment Shift Implications Of Selling Us Based Holdings

Jun 05, 2025

Buffetts Investment Shift Implications Of Selling Us Based Holdings

Jun 05, 2025