Expert Weighs In: Unanswered Questions On Trump's Tip Tax Policy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expert Weighs In: Unanswered Questions on Trump's Proposed Tip Tax Policy

The lingering debate surrounding Donald Trump's proposed changes to how tips are taxed continues to generate confusion and concern among restaurant workers and tax professionals alike. While the specifics of the policy were never fully fleshed out, the implications remain a significant point of contention. This article delves into the unanswered questions surrounding this controversial proposal, offering expert insight to shed light on the potential ramifications.

The idea, floated during Trump's presidency, suggested altering the way tipped employees' income is taxed. Currently, employers are allowed to take a tip credit against their Social Security and Medicare tax liability for employees who receive tips. Trump's proposed changes, however, lacked clarity, leaving many wondering about their exact nature and potential impact. This ambiguity has created significant uncertainty within the food service industry, a sector already grappling with low wages and unpredictable income streams.

H2: The Core Unanswered Questions:

Several key questions remain unanswered about Trump's proposed tip tax policy. These include:

- What specific changes were proposed? The lack of concrete details makes it difficult to analyze the policy's true impact. Was it a complete elimination of the tip credit? A modification of the current system? The absence of clear documentation fuels ongoing speculation and debate.

- How would it affect tipped employees' net income? This is perhaps the most crucial unanswered question. Would the proposed changes lead to increased or decreased take-home pay for servers, bartenders, and other tipped employees? The answer depends heavily on the specifics of the proposed changes, which remain elusive.

- What impact would it have on small businesses? Many restaurants, particularly smaller establishments, rely heavily on the current tip credit system to manage their payroll taxes. Significant changes could impose considerable financial burdens, potentially leading to job losses or reduced wages for employees.

- What was the underlying rationale for the proposal? Understanding the policy's intended goals is crucial to assessing its potential effects. Was it designed to simplify the tax code, increase tax revenue, or achieve some other objective? Without a clear explanation of the rationale, it's difficult to evaluate its effectiveness.

H2: Expert Commentary: Professor Anya Sharma, Tax Law Specialist

We reached out to Professor Anya Sharma, a leading expert in tax law at the University of California, Berkeley, for her insights. Professor Sharma stated, "The ambiguity surrounding the proposed changes is deeply problematic. Without clear documentation and explanation, it's impossible to conduct a meaningful assessment of the potential economic and social impacts on tipped workers and the restaurant industry. The lack of transparency raises serious concerns about the fairness and efficacy of such a policy."

Professor Sharma further emphasized the need for policymakers to engage in open dialogue with stakeholders, including tipped employees, restaurant owners, and tax professionals, before implementing such significant changes to the tax code. She highlighted the importance of considering the potential unintended consequences and ensuring that any new policy protects the rights and livelihoods of vulnerable workers.

H2: The Ongoing Need for Clarity

The lack of clarity surrounding Trump's proposed tip tax policy highlights the importance of transparent and well-defined legislation. The uncertainty created by this proposal underscores the need for policymakers to engage in thorough research, consultation, and debate before enacting changes that could significantly impact millions of workers and businesses. This case serves as a reminder of the critical role of detailed policy proposals and public discourse in shaping effective and equitable legislation.

Call to Action: Stay informed about developments in tax legislation by following reputable news sources and engaging in informed discussions with your representatives. Understanding the complexities of tax policy is vital for advocating for fair and just economic policies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expert Weighs In: Unanswered Questions On Trump's Tip Tax Policy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

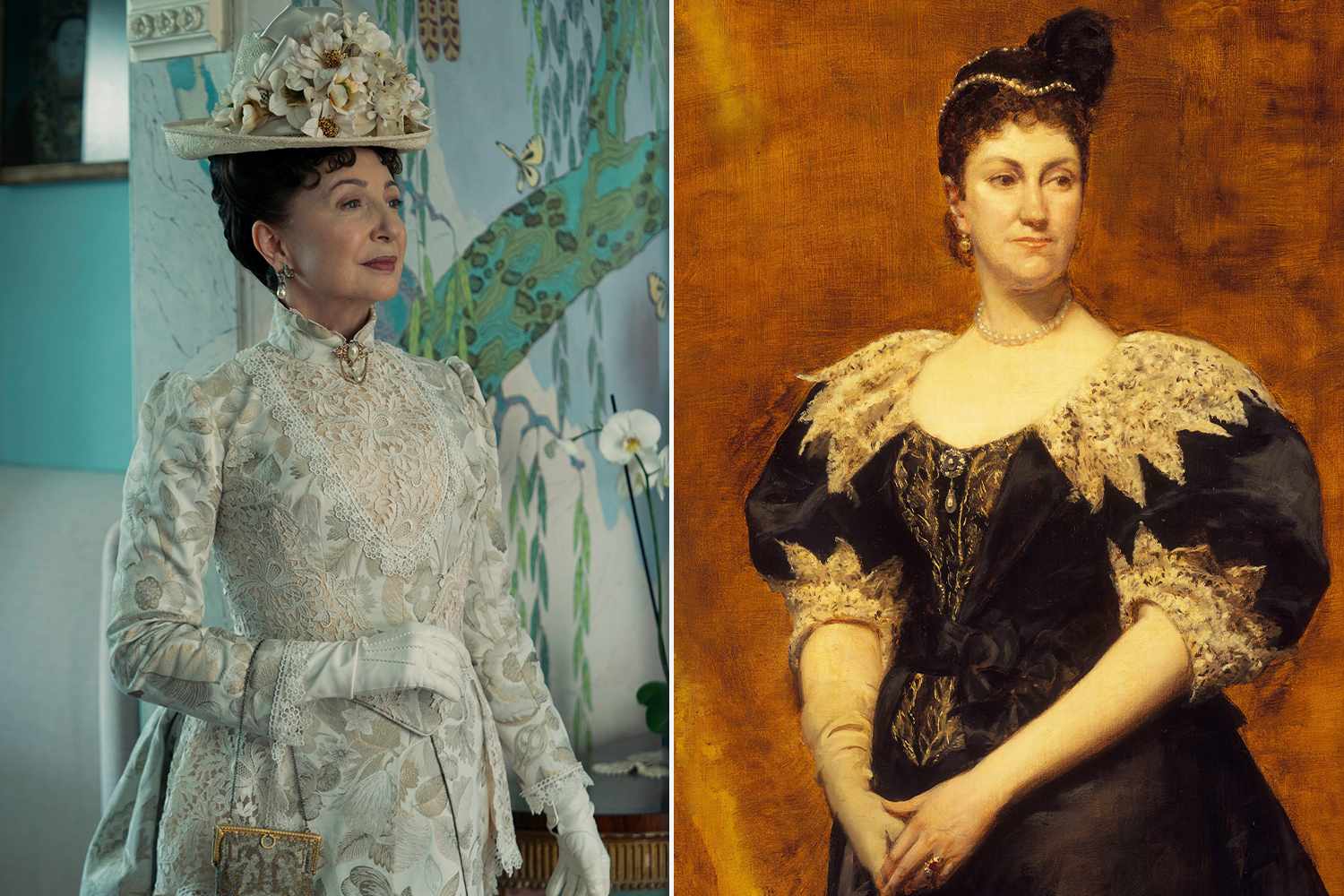

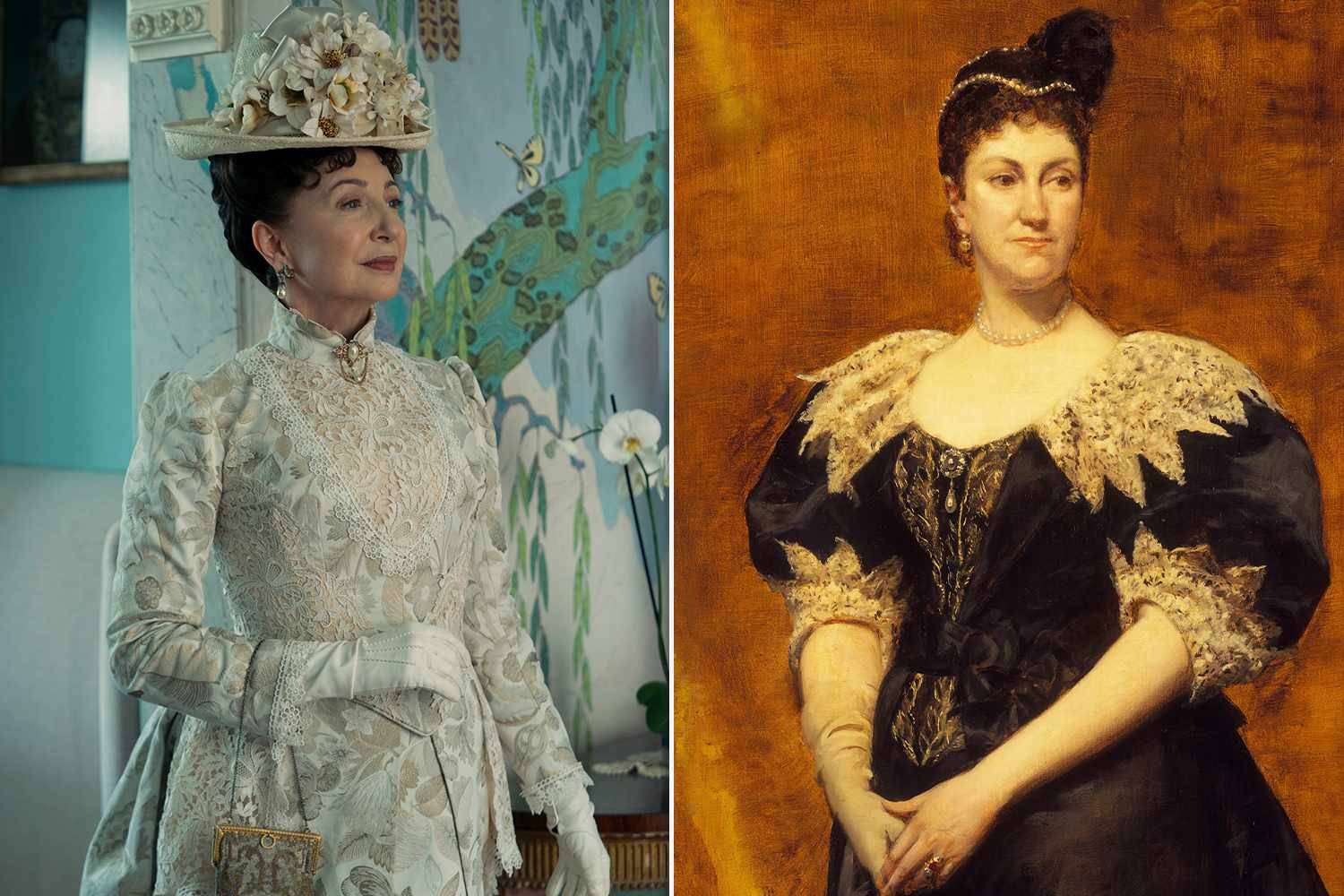

Meet The Real New York Socialites Who Inspired The Gilded Age

Jul 22, 2025

Meet The Real New York Socialites Who Inspired The Gilded Age

Jul 22, 2025 -

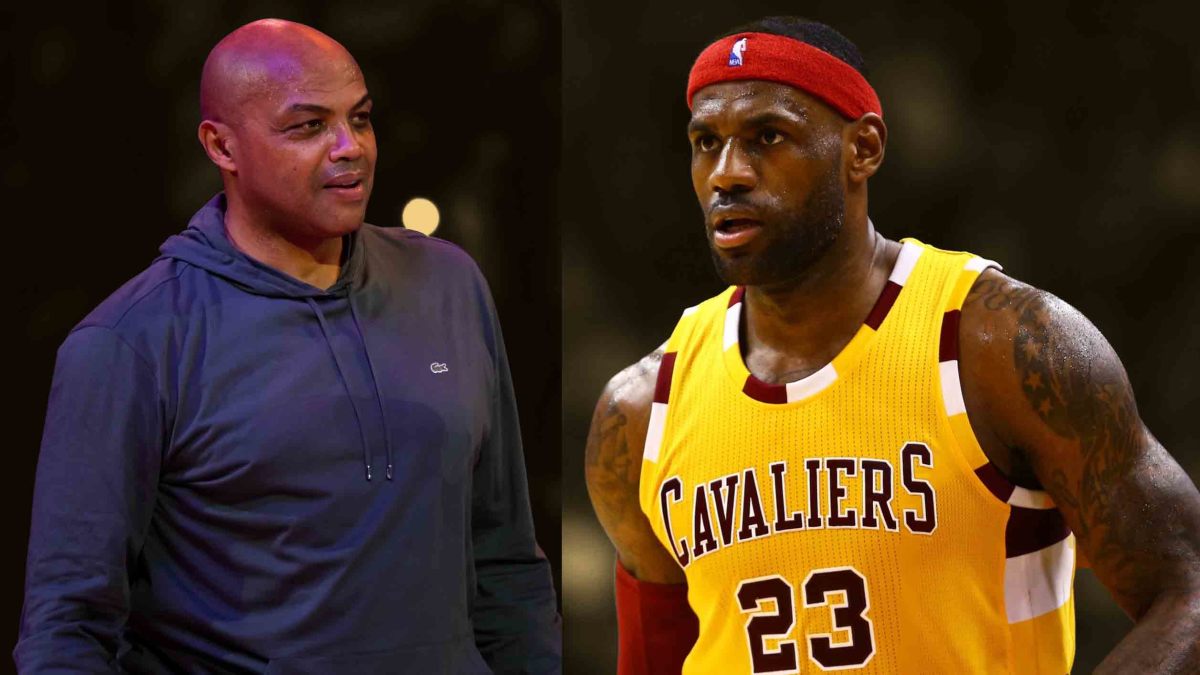

The 2017 Goat Debate Remembering Charles Barkleys I M Gonna Slap You Moment

Jul 22, 2025

The 2017 Goat Debate Remembering Charles Barkleys I M Gonna Slap You Moment

Jul 22, 2025 -

O Ward Vs Palou A Championship Battle For The Ages

Jul 22, 2025

O Ward Vs Palou A Championship Battle For The Ages

Jul 22, 2025 -

Fact Vs Fiction The Real People Behind Hbos The Gilded Age

Jul 22, 2025

Fact Vs Fiction The Real People Behind Hbos The Gilded Age

Jul 22, 2025 -

Osus James Cancer Hospital Welcomes New Ceo With Extensive Cancer Research Background

Jul 22, 2025

Osus James Cancer Hospital Welcomes New Ceo With Extensive Cancer Research Background

Jul 22, 2025

Latest Posts

-

Open Championship 2024 Scottie Schefflers Road To The Grand Slam

Jul 23, 2025

Open Championship 2024 Scottie Schefflers Road To The Grand Slam

Jul 23, 2025 -

Wwe Premium Live Events Go Nationwide Summer Slams Two Night Event In Theaters

Jul 23, 2025

Wwe Premium Live Events Go Nationwide Summer Slams Two Night Event In Theaters

Jul 23, 2025 -

Nyt Sunday Crossword Connections July 20th Puzzle 770 Explained

Jul 23, 2025

Nyt Sunday Crossword Connections July 20th Puzzle 770 Explained

Jul 23, 2025 -

Plane Catches Fire On Takeoff Dramatic Video Emerges

Jul 23, 2025

Plane Catches Fire On Takeoff Dramatic Video Emerges

Jul 23, 2025 -

Scottie Scheffler Completes Open Victory Closing In On Grand Slam

Jul 23, 2025

Scottie Scheffler Completes Open Victory Closing In On Grand Slam

Jul 23, 2025