Experian's Share Repurchase Program: An Update After Latest Acquisition

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Experian's Share Repurchase Program: A Post-Acquisition Update

Experian plc, a global leader in information services, recently concluded its acquisition of the U.S.-based data analytics firm, certain parts of the data assets of the IHS Markit Limited. This significant move has naturally led to questions about the company's ongoing share repurchase program. This article will delve into the latest updates regarding Experian's share buyback initiative in light of this substantial acquisition.

The Acquisition's Impact on Share Repurchases

Experian's acquisition of IHS Markit assets represents a considerable investment. Such large-scale purchases often impact a company's financial strategy, including share repurchase programs. While the acquisition undoubtedly requires significant capital outlay, Experian has historically demonstrated a commitment to returning value to shareholders through share buybacks. The immediate impact of the acquisition on the existing repurchase program remains unclear, but several factors need to be considered:

-

Debt Financing: The acquisition may have been partly financed through debt, which could temporarily limit the funds available for share repurchases. Companies often prioritize debt reduction before significantly increasing share buyback activities.

-

Integration Costs: Integrating a newly acquired company requires significant resources and time. These integration costs can temporarily reduce available cash flow, influencing the pace of share repurchases.

-

Synergies and Future Growth: Experian anticipates significant synergies from this acquisition, leading to enhanced future revenue and profitability. These expected gains could, in the long term, positively impact the share repurchase program by freeing up more capital.

Analyzing Experian's Financial Statements

Investors should carefully analyze Experian's financial statements, specifically their cash flow statements and balance sheets, for insights into the impact of the acquisition on their share repurchase program. Look for key indicators such as:

- Free Cash Flow: A strong free cash flow indicates the company's ability to fund both its operations and share repurchases.

- Debt Levels: High debt levels may restrict the company's ability to repurchase shares aggressively.

- Shareholder Equity: Changes in shareholder equity can provide clues about the company's capital allocation strategies.

By reviewing these metrics, investors can gain a clearer understanding of Experian's financial health and the potential future of its share buyback program. Access to these reports can usually be found on Experian's official investor relations website.

Future Outlook and Investor Expectations

While the immediate effects of the acquisition on the share repurchase program may be uncertain, the long-term outlook remains positive. Experian’s commitment to shareholder returns and its projected growth following the integration of the IHS Markit assets suggest a continued, albeit perhaps modified, share repurchase program. Analysts and investors will be keenly watching Experian's upcoming financial reports and investor calls for more definitive guidance.

Conclusion:

The acquisition of IHS Markit assets presents a complex scenario for Experian's share repurchase program. While short-term impacts might involve adjustments, the long-term potential remains positive. Careful monitoring of Experian's financial performance and statements will be crucial for investors seeking to understand the future direction of their share repurchase strategy. Stay informed by following Experian's official announcements and industry news. This allows you to make well-informed decisions regarding your investment in Experian stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Experian's Share Repurchase Program: An Update After Latest Acquisition. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Milwaukee Brewers Vs Pittsburgh Pirates A Deep Dive Into The Upcoming Series

Aug 12, 2025

Milwaukee Brewers Vs Pittsburgh Pirates A Deep Dive Into The Upcoming Series

Aug 12, 2025 -

Tennessee Titans Rookie Rb Tyjae Spears Suffers Season Ending Injury

Aug 12, 2025

Tennessee Titans Rookie Rb Tyjae Spears Suffers Season Ending Injury

Aug 12, 2025 -

Weak Return Trends Raise Concerns For Experian Lon Expn Investors

Aug 12, 2025

Weak Return Trends Raise Concerns For Experian Lon Expn Investors

Aug 12, 2025 -

Mlb Preview Detroit Tigers Begin 3 Game Set Against Chicago White Sox

Aug 12, 2025

Mlb Preview Detroit Tigers Begin 3 Game Set Against Chicago White Sox

Aug 12, 2025 -

Routes And Networks Daily Updates For The Week Of August 11 2025

Aug 12, 2025

Routes And Networks Daily Updates For The Week Of August 11 2025

Aug 12, 2025

Latest Posts

-

August 13 2025 Powerball Lottery Results Check The Winning Numbers

Aug 14, 2025

August 13 2025 Powerball Lottery Results Check The Winning Numbers

Aug 14, 2025 -

Allisha Gray Dominates Named Eastern Conference Player Of The Week

Aug 14, 2025

Allisha Gray Dominates Named Eastern Conference Player Of The Week

Aug 14, 2025 -

Recurring Knee Injury Forces Rondale Moore To Miss Entire 2024 Nfl Season

Aug 14, 2025

Recurring Knee Injury Forces Rondale Moore To Miss Entire 2024 Nfl Season

Aug 14, 2025 -

Wnba Mvp Race Allisha Grays Case For The Atlanta Dream

Aug 14, 2025

Wnba Mvp Race Allisha Grays Case For The Atlanta Dream

Aug 14, 2025 -

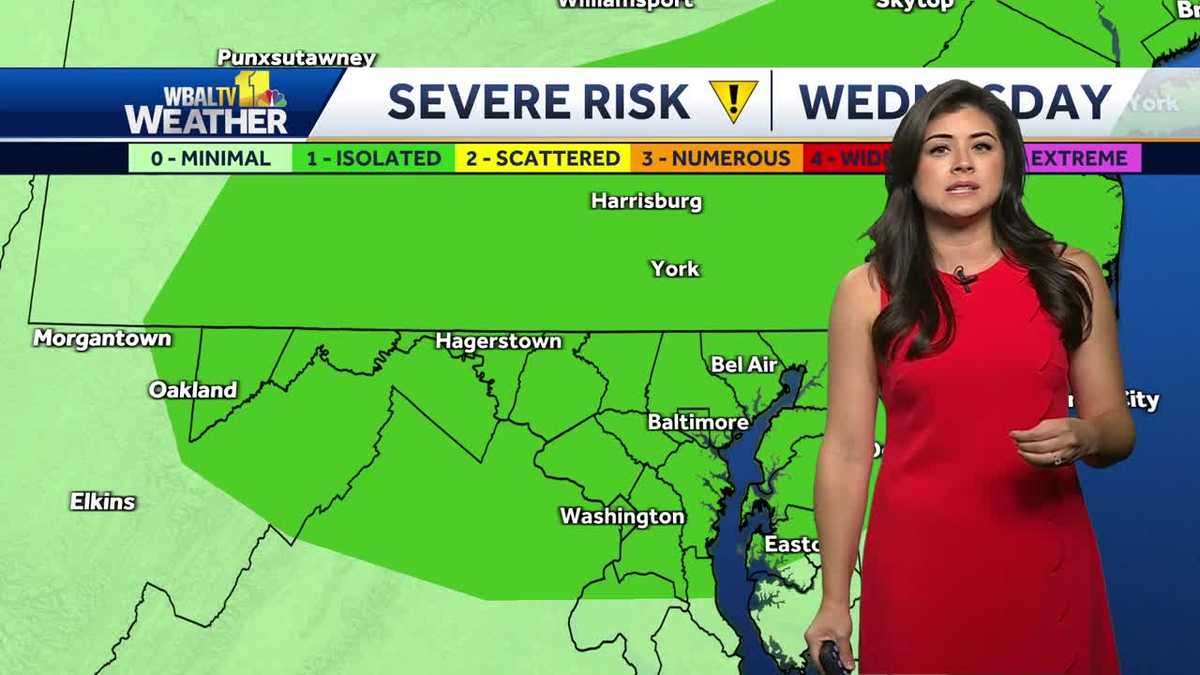

Rain Or Shine Thunderstorm Outlook For Tonights Orioles Mariners Game

Aug 14, 2025

Rain Or Shine Thunderstorm Outlook For Tonights Orioles Mariners Game

Aug 14, 2025