Experian (LON:EXPN) Investor Returns Slow: What's Next?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Experian (LON:EXPN) Investor Returns Slow: What's Next?

Experian (LON:EXPN), a global leader in information services, has seen a slowdown in investor returns recently, prompting questions about the company's future trajectory. This article delves into the potential reasons behind this deceleration and explores what investors can expect moving forward. The recent performance raises concerns for some, while others maintain a long-term optimistic outlook. Understanding the nuances is crucial for informed investment decisions.

Declining Growth and Market Pressures:

Experian's recent financial reports reveal a slowing growth rate compared to previous years. Several factors contribute to this trend:

- Increased Competition: The information services sector is increasingly competitive, with both established players and new entrants vying for market share. This intensified competition puts pressure on pricing and profitability.

- Economic Uncertainty: Global economic headwinds, including inflation and potential recessionary pressures, impact consumer spending and business investment, directly affecting Experian's client base and revenue streams.

- Regulatory Scrutiny: The data privacy landscape is constantly evolving, with stricter regulations impacting how companies like Experian collect, use, and protect consumer data. Compliance costs and potential fines present ongoing challenges.

- Shifting Consumer Behavior: Changing consumer behavior and increasing awareness of data privacy concerns may affect the adoption of Experian's services and influence future growth projections.

Analyzing the Financial Performance:

A detailed analysis of Experian's recent financial statements, including revenue figures, earnings per share (EPS), and key performance indicators (KPIs), is essential to fully understand the current situation. Investors should consult official company reports and financial news sources for the most accurate data. [Link to Experian's Investor Relations page]. Looking at the stock's performance against competitors in the information services sector will also provide valuable context.

What the Future Holds for Experian Investors:

The slowdown in investor returns doesn't necessarily signal a long-term decline for Experian. The company has a strong brand reputation, a diverse client base, and a proven track record. However, investors need to consider the challenges discussed above.

Potential Strategies for Experian:

To regain momentum, Experian might consider the following strategic moves:

- Innovation and Technological Advancement: Investing in research and development to offer innovative data analytics solutions and enhance its existing product offerings is crucial. This could involve exploring new technologies such as AI and machine learning.

- Strategic Acquisitions: Acquiring smaller, specialized companies could broaden Experian's capabilities and market reach.

- Enhanced Customer Relationship Management (CRM): Focusing on customer retention and satisfaction through improved services and personalized solutions can boost long-term loyalty.

- Strengthening Data Security and Privacy Measures: Demonstrating a strong commitment to data security and privacy will build trust with customers and regulators.

Long-Term Outlook and Investment Considerations:

The long-term outlook for Experian remains a subject of debate among financial analysts. While the recent slowdown is concerning, the company's fundamental strengths and potential for strategic adaptation offer a degree of resilience. Investors should carefully weigh the risks and rewards before making any investment decisions, considering factors such as their risk tolerance and investment horizon. Diversification within their portfolio is also a key consideration.

Conclusion:

Experian's recent slowdown in investor returns is a complex issue with multiple contributing factors. While challenges exist, the company's established position and potential for strategic adaptation suggest it's not necessarily a cause for immediate alarm. However, thorough due diligence, careful analysis of financial data, and a long-term perspective are crucial for investors navigating this period of uncertainty. Stay informed by following financial news and Experian's official announcements for the latest developments.

Disclaimer: This article provides general information and commentary and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Experian (LON:EXPN) Investor Returns Slow: What's Next?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tigers Vs White Sox Game 120 Preview And Series Prediction

Aug 12, 2025

Tigers Vs White Sox Game 120 Preview And Series Prediction

Aug 12, 2025 -

10 Players With The Most Single Game Rushing Yards In Fbs History

Aug 12, 2025

10 Players With The Most Single Game Rushing Yards In Fbs History

Aug 12, 2025 -

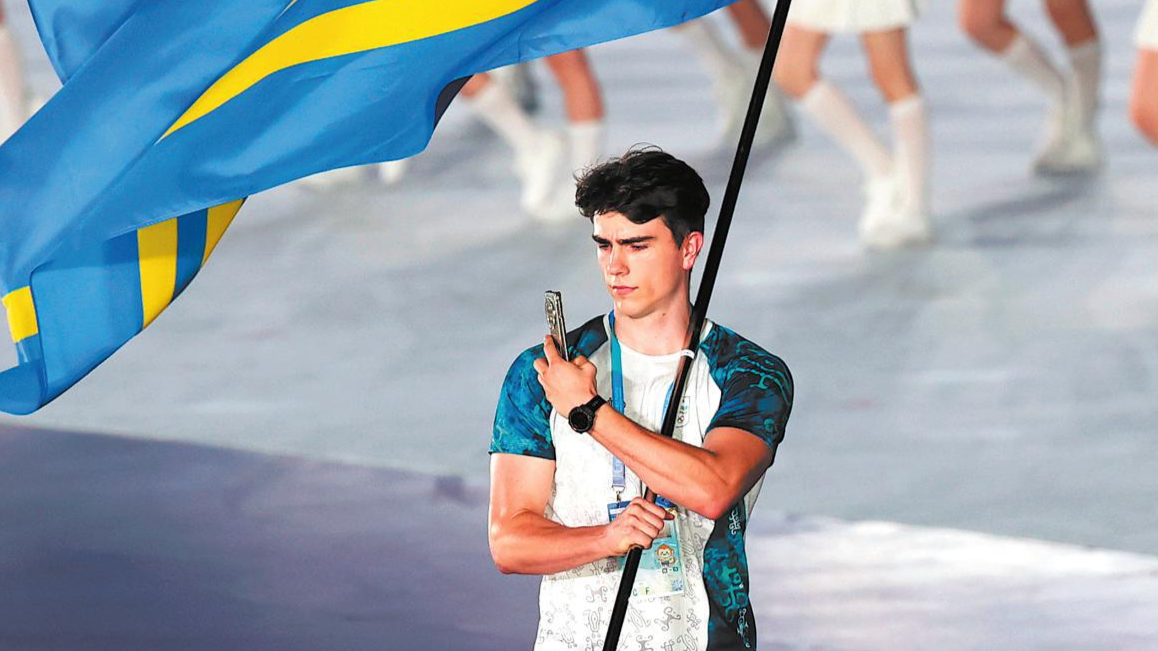

Arubas Karate Athlete Dominates Chengdu World Games

Aug 12, 2025

Arubas Karate Athlete Dominates Chengdu World Games

Aug 12, 2025 -

End Of Coding Jobs One Techies Experience Highlights Tech Industry Downturn

Aug 12, 2025

End Of Coding Jobs One Techies Experience Highlights Tech Industry Downturn

Aug 12, 2025 -

Record Breaking Runs The 10 Highest Single Game Rushing Totals In Fbs History

Aug 12, 2025

Record Breaking Runs The 10 Highest Single Game Rushing Totals In Fbs History

Aug 12, 2025

Latest Posts

-

49ers Facing Wide Receiver Crisis Aiyuks Potential Week 6 Comeback

Aug 13, 2025

49ers Facing Wide Receiver Crisis Aiyuks Potential Week 6 Comeback

Aug 13, 2025 -

Lluvia De Perseidas 2025 Mejor Momento Y Lugar Para Verlas En Espana

Aug 13, 2025

Lluvia De Perseidas 2025 Mejor Momento Y Lugar Para Verlas En Espana

Aug 13, 2025 -

Cleveland Browns Garrett Cited For Reckless Driving 100 Mph Speed

Aug 13, 2025

Cleveland Browns Garrett Cited For Reckless Driving 100 Mph Speed

Aug 13, 2025 -

2025 Nfl Preseason Week 2 Complete Guide To Betting Lines And Spreads

Aug 13, 2025

2025 Nfl Preseason Week 2 Complete Guide To Betting Lines And Spreads

Aug 13, 2025 -

Get Ready To Rumble Laila Ali Presents Chef Grudge Match A Culinary Throwdown

Aug 13, 2025

Get Ready To Rumble Laila Ali Presents Chef Grudge Match A Culinary Throwdown

Aug 13, 2025