Experian (LON:EXPN): Analyzing The Unattractive Return Trends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Experian (LON:EXPN): Is the Credit Reporting Giant's Return Losing its Appeal?

Experian (LON:EXPN), a global leader in credit reporting and information services, has long been a staple in many investment portfolios. However, recent performance trends have some investors questioning whether the company's historically attractive returns are starting to fade. This article delves into the factors contributing to this perceived downturn and analyzes the future outlook for Experian shareholders.

Unattractive Return Trends: A Closer Look

Experian's share price has experienced volatility in recent months, underperforming compared to some of its industry peers and broader market indices. While the company continues to report strong revenues, driven by growth in its digital and data analytics segments, the return on investment for shareholders hasn't mirrored this positive financial performance. Several factors contribute to this disconnect:

1. Valuation Concerns: Some analysts argue that Experian's current valuation is stretched, considering its growth trajectory and prevailing market conditions. This high valuation leaves less room for significant future price appreciation, making the return less attractive for investors seeking substantial gains.

2. Macroeconomic Headwinds: Global economic uncertainty, rising interest rates, and inflationary pressures are impacting consumer spending and borrowing habits. These macroeconomic headwinds can negatively affect Experian's core business, influencing credit applications and impacting its revenue streams.

3. Increased Competition: The credit reporting and data analytics industry is becoming increasingly competitive. New entrants and established players are vying for market share, creating pressure on Experian's pricing power and profitability.

4. Regulatory Scrutiny: Experian, like other credit reporting agencies, operates under a strict regulatory framework. Increased regulatory scrutiny and potential changes in data privacy regulations could impact its operational costs and profitability.

H2: Analyzing the Positives: Experian's Strengths Remain

Despite these challenges, Experian possesses several inherent strengths that warrant consideration:

- Strong Brand Recognition and Market Leadership: Experian enjoys a strong global brand presence and holds a dominant position in the credit reporting market. This provides a significant competitive advantage.

- Diversified Revenue Streams: Experian’s revenue is diversified across multiple segments, reducing reliance on any single market or product. This diversification offers resilience against economic downturns.

- Focus on Digital Transformation: The company is actively investing in digital technologies and data analytics, positioning itself for future growth opportunities.

H2: The Future Outlook: Navigating Uncertainty

Predicting the future performance of any stock is inherently challenging. However, by carefully analyzing the factors discussed above, investors can form a more informed opinion. While concerns regarding valuation and macroeconomic conditions are valid, Experian's strong market position, diversified revenue streams, and commitment to digital innovation suggest a degree of resilience.

H3: What should investors do?

Investors should consider the following:

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes and sectors to mitigate risk.

- Long-Term Perspective: Investing in Experian should be considered a long-term strategy, acknowledging short-term market fluctuations.

- Due Diligence: Conduct thorough research and consider seeking professional financial advice before making investment decisions.

Conclusion:

Experian's recent performance has raised questions regarding its return trends. While challenges exist, the company retains several key strengths. Investors need to carefully weigh these factors alongside their personal risk tolerance and investment objectives before making any decisions regarding their holdings in Experian (LON:EXPN). Remember, this analysis is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Experian (LON:EXPN): Analyzing The Unattractive Return Trends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Van Gisbergen Victorious Watkins Glen Win Solidifies Nascar Dominance

Aug 12, 2025

Van Gisbergen Victorious Watkins Glen Win Solidifies Nascar Dominance

Aug 12, 2025 -

Liverpool Captain Van Dijk Expresses Disappointment After Community Shield Loss

Aug 12, 2025

Liverpool Captain Van Dijk Expresses Disappointment After Community Shield Loss

Aug 12, 2025 -

Tonights Brewers Pirates Mlb Game Best Options For A Free Live Stream

Aug 12, 2025

Tonights Brewers Pirates Mlb Game Best Options For A Free Live Stream

Aug 12, 2025 -

University Of Tennessee Athletics Whitehorns Legal Troubles

Aug 12, 2025

University Of Tennessee Athletics Whitehorns Legal Troubles

Aug 12, 2025 -

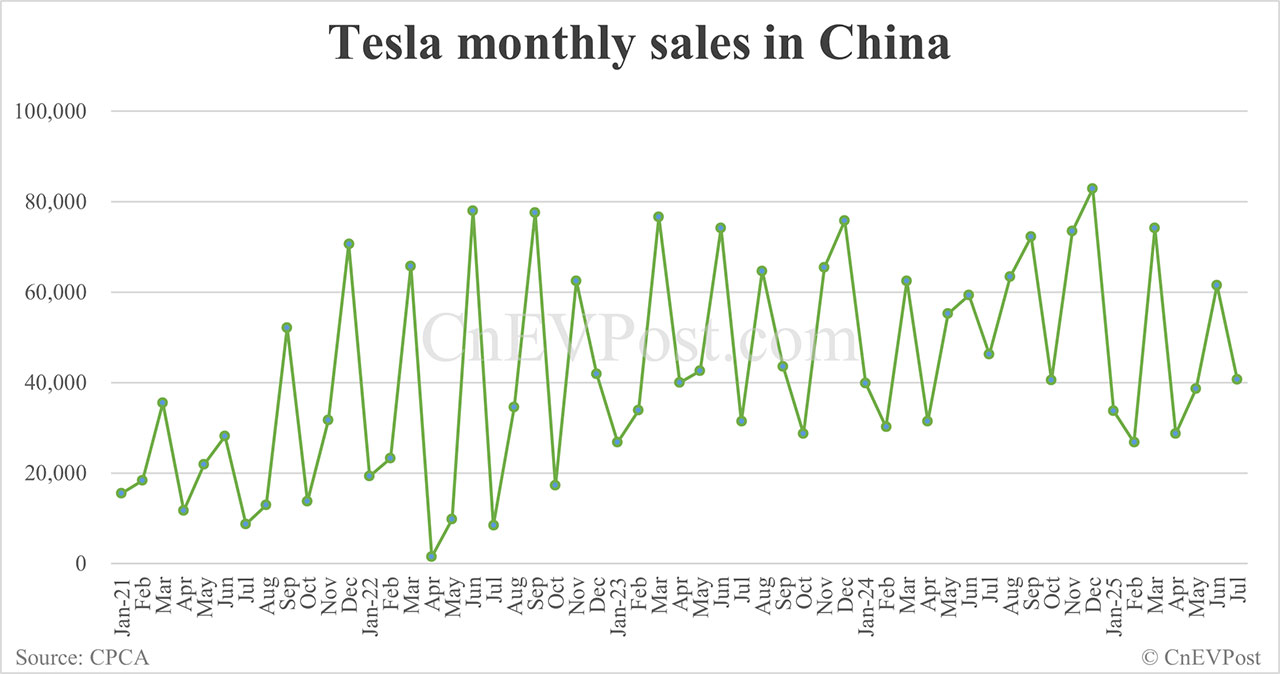

Teslas July China Sales Fall 12 To 40 617 Vehicles

Aug 12, 2025

Teslas July China Sales Fall 12 To 40 617 Vehicles

Aug 12, 2025

Latest Posts

-

Georgina Rodriguez Officially Engaged To Cristiano Ronaldo

Aug 13, 2025

Georgina Rodriguez Officially Engaged To Cristiano Ronaldo

Aug 13, 2025 -

Grudens Lawsuit Against Nfl Nevada Supreme Court Delivers Verdict

Aug 13, 2025

Grudens Lawsuit Against Nfl Nevada Supreme Court Delivers Verdict

Aug 13, 2025 -

Van Dijk Expresses Disappointment After Liverpools Community Shield Defeat

Aug 13, 2025

Van Dijk Expresses Disappointment After Liverpools Community Shield Defeat

Aug 13, 2025 -

Portland Indy Car Race Live Updates Leaderboard And Key Highlights

Aug 13, 2025

Portland Indy Car Race Live Updates Leaderboard And Key Highlights

Aug 13, 2025 -

Family Emergency Forces Ted Scott To Leave Scottie Schefflers Golf Team

Aug 13, 2025

Family Emergency Forces Ted Scott To Leave Scottie Schefflers Golf Team

Aug 13, 2025