Experian (LON:EXPN): Analyzing Current Return Trends And Future Prospects

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Experian (LON:EXPN): Analyzing Current Return Trends and Future Prospects

Experian plc (LON:EXPN), a global leader in information services, has consistently delivered strong returns for investors, but what does the future hold? This in-depth analysis explores Experian's current performance, examining its return trends and offering insights into potential future prospects. Understanding these factors is crucial for anyone considering investing in or currently holding shares in this FTSE 100 company.

Current Return Trends: A Positive Outlook

Experian has demonstrated a remarkable track record of delivering shareholder value. Recent financial reports showcase sustained revenue growth, driven by increasing demand for its data analytics and credit reporting services across diverse sectors. This growth translates into attractive returns for investors, both in terms of capital appreciation and dividends.

- Strong Revenue Growth: Experian's consistent revenue growth stems from a diversified business model, catering to businesses and consumers globally. Their ability to leverage data to provide valuable insights into credit risk, marketing effectiveness, and fraud prevention fuels this expansion.

- Robust Dividend Policy: The company maintains a healthy dividend payout ratio, providing investors with a steady stream of income. This stable dividend policy further enhances the attractiveness of Experian as an investment.

- Strategic Acquisitions: Experian's strategic acquisitions have played a crucial role in expanding its market reach and service offerings. These acquisitions often integrate seamlessly, contributing positively to overall return trends.

However, it's important to acknowledge external factors impacting returns. Global economic uncertainties, regulatory changes, and competition within the information services sector all present potential challenges.

Future Prospects: Navigating Challenges and Opportunities

While challenges exist, Experian's future prospects remain promising. Several key factors contribute to this optimistic outlook:

- Growing Demand for Data Analytics: The increasing reliance on data analytics across various industries ensures sustained demand for Experian's services. As businesses become more data-driven, the need for reliable, insightful data solutions will only intensify.

- Expansion into Emerging Markets: Experian's continued expansion into rapidly growing emerging markets presents significant growth opportunities. These markets offer substantial untapped potential for their services.

- Technological Innovation: Experian’s commitment to technological innovation allows them to stay ahead of the curve. Investments in advanced analytics, artificial intelligence (AI), and machine learning (ML) enhance their service offerings and provide a competitive edge.

- Focus on Cybersecurity: With increasing cybersecurity threats, businesses are investing heavily in robust security solutions. Experian's capabilities in this area position them to capitalize on this growing demand.

Risks to Consider: It’s crucial to note that investing in any company carries inherent risks. For Experian, potential risks include increased competition, regulatory scrutiny, data privacy concerns, and the impact of global economic downturns. Thorough due diligence is essential before making any investment decisions.

Conclusion: A Solid Investment Opportunity?

Experian's current return trends paint a largely positive picture, underpinned by strong revenue growth, a robust dividend policy, and strategic acquisitions. While external factors and inherent risks must be considered, the company's future prospects appear bright, driven by the growing demand for data analytics and its commitment to technological innovation. This makes Experian a potentially attractive investment for those with a long-term perspective and a tolerance for moderate risk. However, conducting thorough research and consulting with a financial advisor are strongly recommended before making any investment decisions regarding Experian (LON:EXPN).

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The information provided is based on publicly available data and should not be considered a recommendation to buy or sell any securities.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Experian (LON:EXPN): Analyzing Current Return Trends And Future Prospects. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

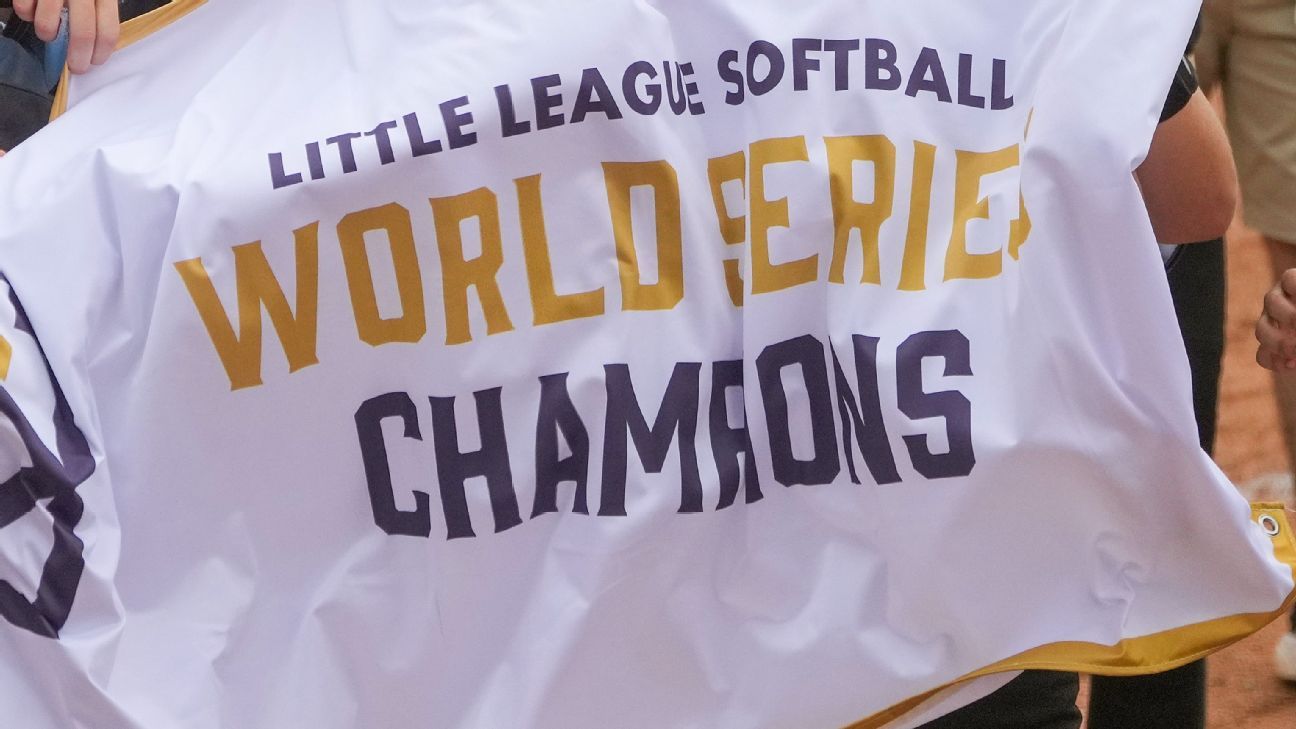

Pennsylvanias Little League World Series Victory Reagan Bills Historic Performance

Aug 12, 2025

Pennsylvanias Little League World Series Victory Reagan Bills Historic Performance

Aug 12, 2025 -

Your Edge In Fantasy Football Picks Rankings And Draft Prep

Aug 12, 2025

Your Edge In Fantasy Football Picks Rankings And Draft Prep

Aug 12, 2025 -

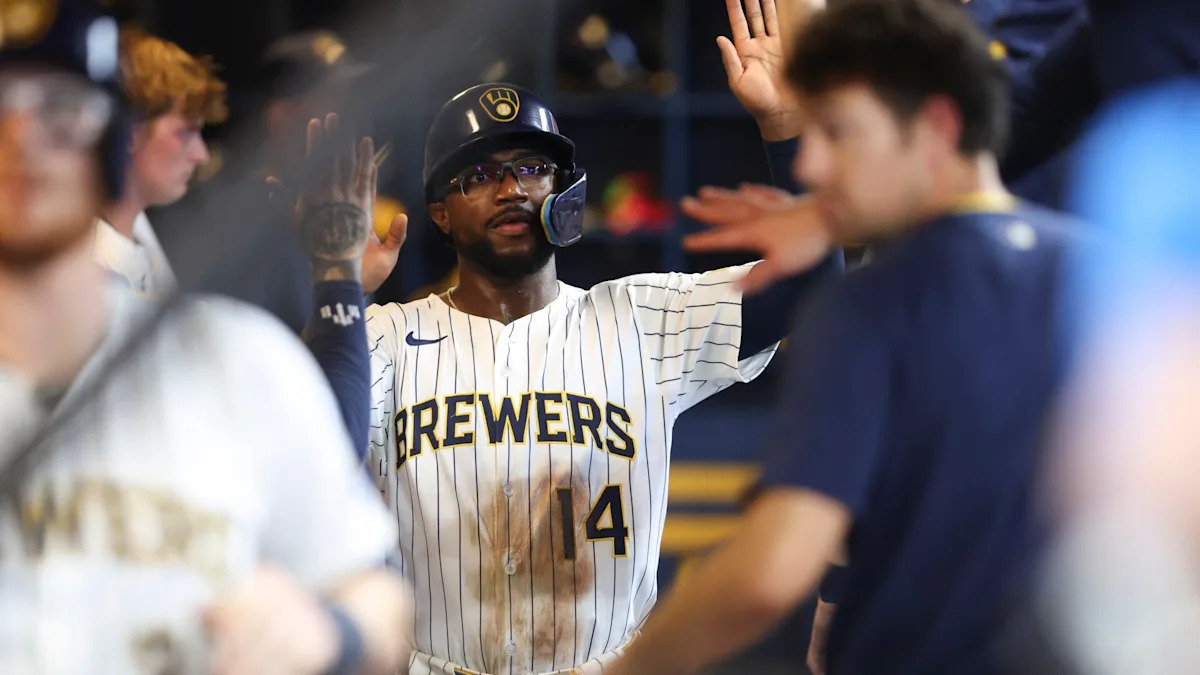

Mlb Odds And Prediction Pittsburgh Pirates At Milwaukee Brewers August 11th

Aug 12, 2025

Mlb Odds And Prediction Pittsburgh Pirates At Milwaukee Brewers August 11th

Aug 12, 2025 -

Family Emergency Forces Caddie Ted Scott To Leave Scottie Scheffler

Aug 12, 2025

Family Emergency Forces Caddie Ted Scott To Leave Scottie Scheffler

Aug 12, 2025 -

Saying Goodbye To Techs Easy Route Hard Work Ahead

Aug 12, 2025

Saying Goodbye To Techs Easy Route Hard Work Ahead

Aug 12, 2025

Latest Posts

-

Van Dijk Expresses Disappointment After Liverpools Community Shield Defeat

Aug 13, 2025

Van Dijk Expresses Disappointment After Liverpools Community Shield Defeat

Aug 13, 2025 -

Portland Indy Car Race Live Updates Leaderboard And Key Highlights

Aug 13, 2025

Portland Indy Car Race Live Updates Leaderboard And Key Highlights

Aug 13, 2025 -

Family Emergency Forces Ted Scott To Leave Scottie Schefflers Golf Team

Aug 13, 2025

Family Emergency Forces Ted Scott To Leave Scottie Schefflers Golf Team

Aug 13, 2025 -

Mlb Betting Tigers Vs White Sox Expert Predictions Starting Lineups And Key Stats August 11

Aug 13, 2025

Mlb Betting Tigers Vs White Sox Expert Predictions Starting Lineups And Key Stats August 11

Aug 13, 2025 -

Espn Reports Ruby Whitehorn Of Lady Volunteers Indicted On Multiple Charges

Aug 13, 2025

Espn Reports Ruby Whitehorn Of Lady Volunteers Indicted On Multiple Charges

Aug 13, 2025